Building costs go through the roof adding pressure on contractors’ margins

The price of building materials such as steel, timber and plastics is soaring putting contractors' margins under pressure, at least in the short term. While there's little room to adjust pricing for existing contracts, costs are being passed on for new projects

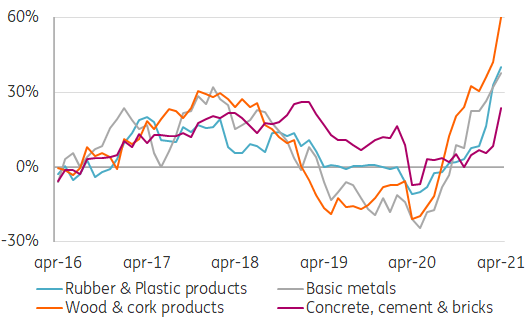

Prices of timber, plastics, steel and cement soar

Prices of building materials have soared over the last six months. Timber, plastics and steel prices are surging and many European manufactures are expecting to increase costs even more

In April, according to a European Commission survey, some 60% of wood and cork product manufacturers said they expected to raise their prices even further, as you can see in the chart below. That's the highest percentage increase the survey's ever seen in its 30-year history.

Timber manufacturers in particular expect to raise prices

Balance of manufactures in eurozone that expect to increase -/- decrease output prices (over next 3 months)

Numerous reasons for building cost inflation

There are several different reasons for these steep price hikes:

- World construction output was resilient during the Covid-crisis, which has resulted in continuous demand for building materials.

- Transport issues due to capacity constraints, delays and higher transportation costs.

- Many sawmills curtailed production during the lockdowns, particularly in North America. This limited the supply of timber.

- Steel prices have increased as the metal industry scaled down last year as well. China’s strong demand for steel and demand from the car industry picked up faster than expected this year.

Soaring prices for inputs building materials

Producer Price Index (PPI), (% development in The Netherlands year-on-year)

Margins under pressure due to long-term projects

In the short term, these sudden building materials' price hikes have put building companies' profit margins under pressure. Sales prices for building projects are often fixed. They are based on the expected development of procurement prices at the moment of closing the deal in the past. So if those procurement prices suddenly increase, contractors are often not able to pass on these higher prices to their clients for their current projects.

This can easily lead to loss-making projects as profit margins are thin in the construction sector, generally about 2%. The long lead times in the construction sector make matters worse; some projects can take several years to complete.

Building firms plan to increase output prices

In response, a growing number of construction companies in the eurozone are planning to increase their future sales prices. In April, on balance 10% (the difference between positive and negative answering options) of the construction firms expect to raise their prices. This is in sharp contrast to the beginning of this year when the majority of construction companies were still planning a sales price decrease.

Nevertheless, these planned sales price hikes could well be absorbed into the higher procurement prices for future projects. But this won't always compensate for the increased building material prices of current projects.

Percentage of building firms that expect to increase prices

Balance of construction companies in the eurozone which expect to increase or decrease output prices (over next 3 months)

Larger firms are more vulnerable

Not all construction firms are exposed to the procurement price risk at the same level. Large firms are in general more exposed than smaller ones as they quite often have larger projects with longer lead times. This makes the procurement price risk bigger for them. Smaller companies usually have shorter-term assignments and therefore have fewer closed deals in their order books. Consequently, they can adjust their sales prices sooner for new projects.

Most price increases expected in Austria and the Netherlands

Expected construction price increases differ from country to country. Most are expected in Austria and the Netherlands. Construction companies in these countries are the most optimistic about their business perspectives in the upcoming months. Therefore, they will probably be able to increase their sales prices and pass on the higher building material costs to their clients.

In France and Spain, construction firms are reluctant to raise prices because construction volumes lagged behind in 2020.

Most price increases expected in Austria and the Netherlands

Balance of construction companies that expect to increase or decrease output prices (over next 3 months) in April 2021

It is hard to predict the future development of building materials. Nevertheless, if the prices hikes are temporarily, only lasting a few months, it will limit the pressure on margins for current projects. However, should price levels remain high, this will lead to losses for current running projects, particularly for those larger firms which won't see their buildings or works completed for another few years. New projects will be able to pass on these higher procurement prices to their clients.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article