Singapore’s economy is losing steam

Singapore has downgraded its second-quarter GDP and growth could slow further in the coming months

Second-quarter GDP revised lower

Singapore recently downgraded GDP estimates to show a contraction of 0.2% quarter-on-quarter, translating to 4.4% year-on-year growth compared to the 4.8% growth initially reported. Slower manufacturing activity was the main reason for the revision with the sector posting 5.3% growth versus 8% previously reported. Softer electronics demand was blamed for the weaker growth as China retained its zero-Covid policy. Meanwhile, construction activity was also slower than previously estimated although services growth was revised higher to 4.8% versus 4.7% previously.

The downward revision of 2Q GDP coupled with mounting headwinds forced Singapore’s Ministry of Trade and Industry (MTI) to trim growth projections for the year to 3-4% from 3-5%. Slowing global trade coupled with accelerating inflation onshore points to a likely deceleration of growth in the second half of 2022.

Singapore GDP likely to slow in coming months

Is the slowdown in manufacturing a cause of concern?

Manufacturing makes up 23% of Singapore’s economy and its recent deceleration may become a cause of concern in the coming months. Sliding manufacturing in 2Q was traced to softer production for electronic goods, the sector’s mainstay, however, we also note a slowdown in other key components of the sector as well.

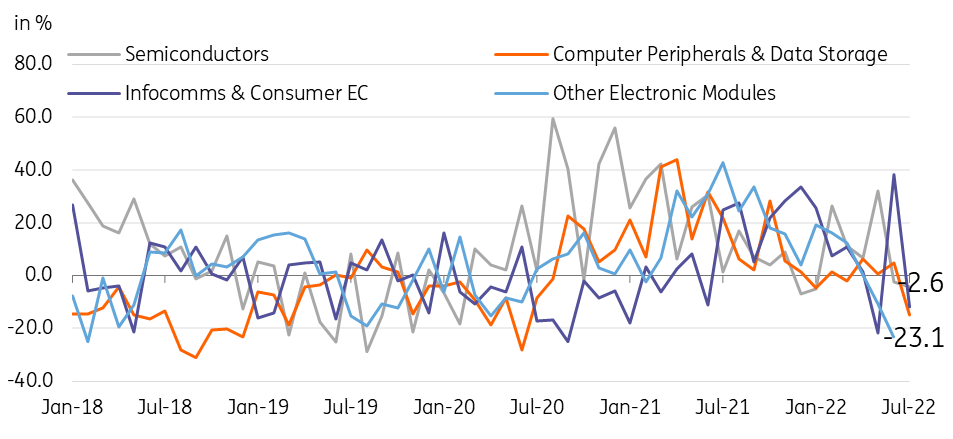

The electronic cluster, which accounts for the bulk of activity (40% of total), contracted across all four major subcomponents in July. The weakness in these two subsectors was enough to force the electronic cluster to fall 6.3%YoY from 22.3% previously.

In addition to the electronics downturn, the chemical and biomedical clusters posted negative growth in at least four out of the last six months. And although it may be too early to signal alarm bells just yet, slower manufacturing activity across these three main sectors may eventually become a cause of concern should the trend continue.

Electronics cluster weighed down by semiconductors and other modules

Softer trade activity from top export destinations impacting Singapore’s manufacturing

Singapore’s export sector has remained relatively resilient in 2022 (23% year-to-date growth) and we note a pickup in shipments to the US and EU as well as to regional partners like Indonesia and Malaysia. However, a slowdown in exports to Singapore’s top two partners (China and Hong Kong) could be one reason behind the recent dip in manufacturing activity as demand from China and Hong Kong slow. And although exports to other top trading partners appear to be on the uptick, weaker exports to Singapore’s top two partners are still expected to cap overall growth for the sector.

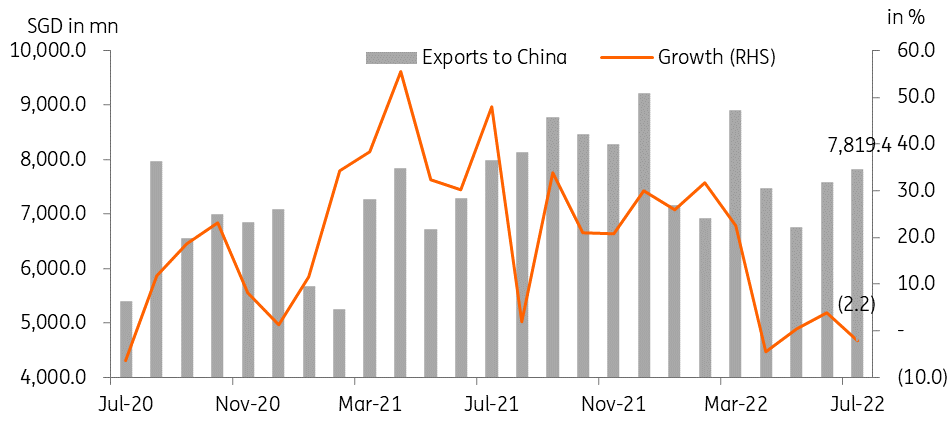

Slowing China to weigh on growth momentum

A string of disappointing data reports points to China expanding by only 4%YoY this year, down from the previous estimate of 4.4%. China’s projected slowdown will likely weigh on Singapore’s overall growth prospects in the near term. Exports to China have already contracted and softer demand from Singapore’s largest export destination has already translated to slowing manufacturing, particularly in the all-important electronics cluster of industrial production.

On top of the direct impact on Singapore’s export and manufacturing sectors, a weaker China could also translate to slower growth for the global economy, a situation that would impact Singapore’s trade with other major partners as well. Fading demand due to China’s lockdowns has impacted Taiwan and could eventually affect regional exporters in the coming months as well. Expectations of a recession in Europe and a similar downturn in the US later in the year will also likely weigh on demand for exports from the region.

Thus, slowing growth for China caps Singapore’s growth prospects in the coming months with the trend of slower exports and weaker industrial production for Singapore likely to continue.

Slowing exports to China presents a challenge for Singapore’s growth outlook

Accelerating inflation to eventually sap consumption?

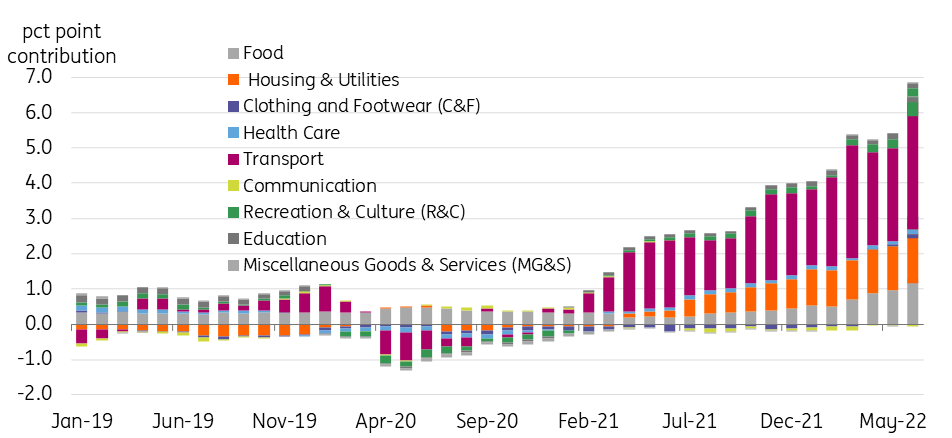

Slowing exports to major trading partners is just one of the challenges faced by Singapore as domestic price pressures have surged. Accelerating price pressures pushed headline inflation to 7.0%YoY while core inflation rose sharply to 4.7% as of July. Food inflation is one of the main reasons for the sharp uptick, powered by a pickup in basic food items (5.6%) as well as food servicing services (5.3%). Meanwhile, transport costs accounted for 3.2 percentage points of headline inflation with substantial price increases for both private (18.8%) and public transport costs (9.7%). This dynamic suggests that inflation in Singapore is turning increasingly broad-based as imported inflation tag teams with resurgent demand to drive inflation higher.

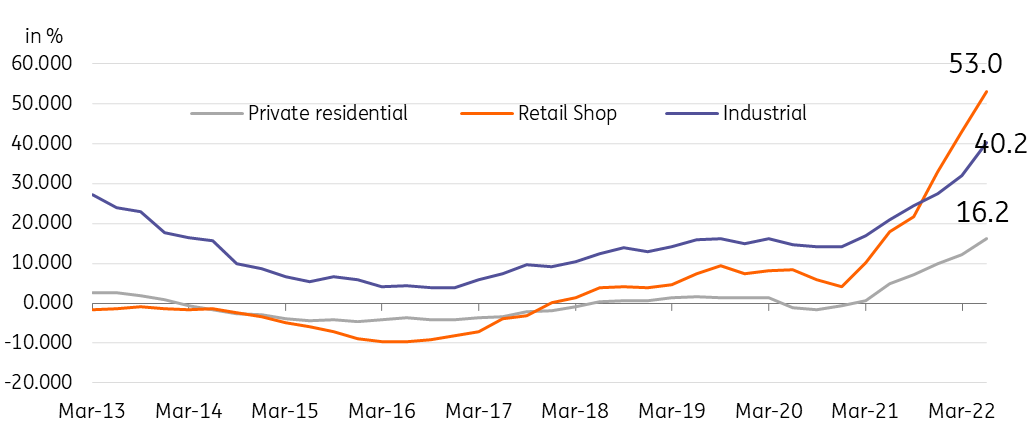

On top of surging consumer prices, elevated price pressures are also evident in rental costs. Rental costs have been charging higher for residential properties (16.2%) which will undoubtedly weigh on spending for goods and services now prices for food and utilities are likewise on the rise. Rental costs for retail shops and industrial areas are also surging, which should translate to an environment of higher prices as firms pass on costs to consumers.

Despite the pickup in prices, retail sales have managed to stay healthy for the first half of 2022. Retail sales were up 10.2%YoY in June although recent trends point to a shift in spending behaviour after the economy reopened. We note a sustained pullback in spending at supermarkets and convenience stores while sales at department stores have risen, mostly likely as budgets are reallocated away from basic items perhaps as households secure these items in anticipation of higher prices down the road. More telling was the uptrend in spending on recreational goods on top of apparel and footwear, which could ultimately be linked to the return of foreign tourists.

We could see an eventual dip in spending as inflation accelerates further and rental costs stay high especially since we believe price pressures will not dissipate anytime soon. So far, we haven’t seen a meaningful pullback in retail sales just yet, but even a slight decline in private consumption could cap overall GDP prospects given consumption’s 35% contribution to total economic output.

Rental costs accelerating sharply

Inflation becoming broad-based

Will tourist influx be enough to offset projected slowdown in household spending?

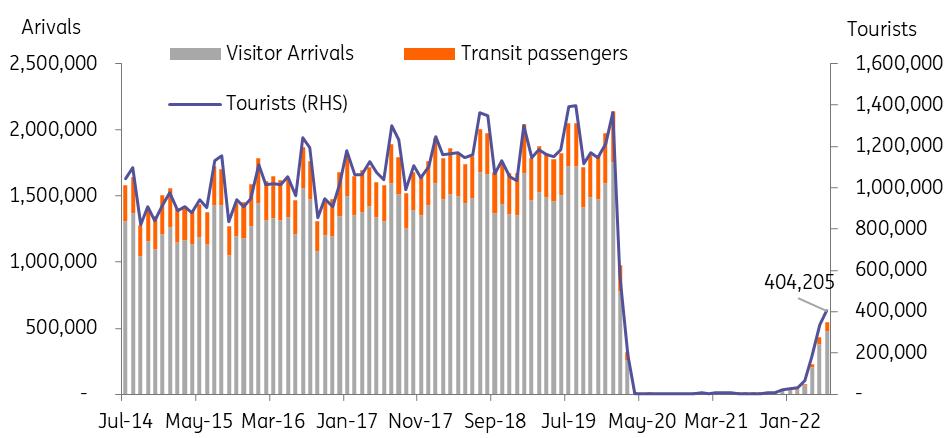

One development that could potentially partially offset the projected slowdown in household spending and the China slowdown could be the recovery of Singapore’s tourism industry. Tourist arrivals (visitor arrivals less transit passengers) have closed in on the half million mark as of June 2022, up sharply from almost zero during the pandemic. The influx of tourists after mobility curbs were relaxed pushed up hotel prices to pre-Covid levels pointing to healthy demand for the tourism industry.

The arrival of tourists and the spending that accompanies their visits may offset the likely pullback in local expenditure while also creating job opportunities in services related to recreation and tourism. Tourists spent a total of SGD68bn in Singapore back in 2019, spread across accommodation, food, shopping and sightseeing with tourists spending an average of SGD3,557 for their entire stay back then. So far, tourist receipts in 2022 hit SGD1.3bn as of 1Q2022 but we can expect this number to increase as more tourists arrive. However, despite the eye-catching growth rate posted for tourist arrivals, the current inflow of tourists is still well below the pre-Covid-19 norm.

Given the developments of 2022 however (the Russian invasion of Ukraine and China's zero-Covid policies), the return to pre-Covid levels of visitor arrivals may have to wait. Visitors from greater China (including Hong Kong and Macau) comprised roughly 20% of total pre-Covid arrivals. In 2022, the influx of Chinese tourists has not been as substantial with only 75,517 visitors recorded so far and down to only 13.8% of the total. Restrictions related to China’s zero-Covid policies (lockdowns and or restrictive requirements such as burdensome quarantine periods) are the likely factor behind the slowdown and we can expect slow visitor arrivals from China until such policies remain in place. Meanwhile, visitor arrivals from the Russian Federation have also, understandably, slowed. Russian tourists were a mere 0.4% of total arrivals in 2019 (80,259) but the ongoing conflict suggests that arrivals from this area will likely be limited.

Given these developments, we can assume that the usual tourism boost delivered by tourists from greater China, and to a lesser extent from Russia, may not be counted on fully just yet.

Tourists return but are still well-below pre-Covid levels

Market implications

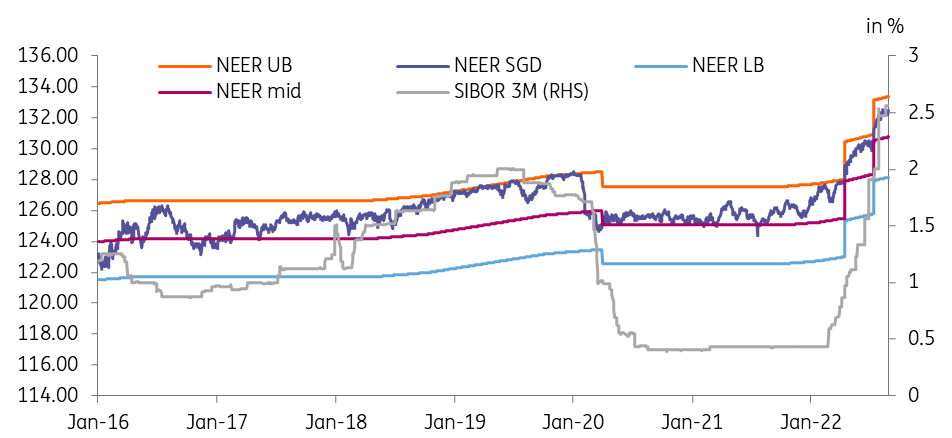

Given our expectations that inflation has become more entrenched, we expect the Monetary Authority of Singapore (MAS) to be on notice with core inflation well above 4%. Despite a string of tightening this year, we believe the MAS will likely still need to act in October as prices remain elevated. Aggressive tightening efforts, including the off-cycle move in July, have helped steady the SGD in early August but expectations of aggressive Fed rate hikes have renewed pressure on the currency. Three-month SIBOR rates are currently at the highest level since 2007 as the MAS hopes to steer the SGD Nominal Effective Exchange Rate (SGD NEER) stronger and could stay elevated until core inflation is clearly on a downtrend.

MAS tightening liquidity to steady SGD

Conclusion: Singapore likely to slow further although tourism lifeline could limit the downside

Singapore has managed to post positive year-on-year growth since 2021, supported by robust private consumption expenditure which was up 8.6%YoY in 1H. However, price pressures are just starting to heat up alongside rising rental costs which together could eventually cap consumption at a time when government spending (-2%) and capital formation (2.3%) are subdued.

The impending slowdown in China will likely be enough to ensure Singapore’s growth trajectory tilts to the downside for the rest of the year. Softer demand from China should translate to weaker exports for Singapore with our full-year GDP forecast now at 3.8%YoY.

The return of foreign tourists could potentially offset the slowing growth momentum to some extent but with visitor arrivals still well below pre-Covid levels. Furthermore, despite tourist arrivals improving, Singapore may be missing the usual influx of tourists from greater China and thus the upside may be limited.

Meanwhile, we expect core inflation to remain elevated for the rest of the year, suggesting that MAS will tighten further at the October meeting. Successive aggressive action from MAS could eventually help steady the currency but overall dollar strength could point to SGD settling at 1.39 by year-end.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article