Relief for energy markets won’t last long

Natural gas prices came under significant pressure in October due to milder weather and growing European storage. Oil prices have been relatively stable following the recently announced OPEC+ supply cuts. Despite the recent weakness, the 2023 outlook remains bullish

European natural gas prices collapse

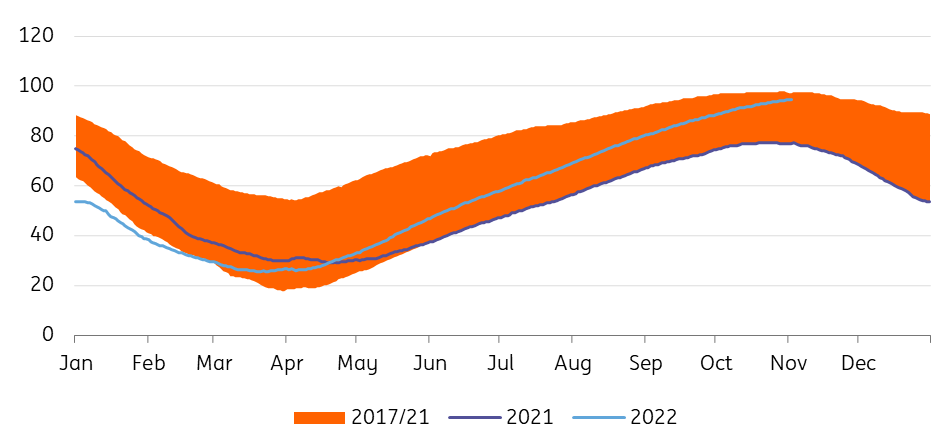

The scale and pace of the collapse in European natural gas prices have been extraordinary; day-ahead TTF prices fell by 79% over October, trading to their lowest levels since June 2021. Meanwhile, TTF next-hour prices briefly traded in negative territory towards the end of the month. This may be an odd move during an ongoing energy crisis, which is being felt most acutely in Europe. However, milder-than-usual weather across large parts of Europe has meant that heating demand has been lower than usual while EU gas storage continues to grow. The latest numbers from Gas Infrastructure Europe show that European inventories are almost 95% full right now, well above the European Commission’s initial target of having storage 80% full by 1 November. It's also above the 5-year average of around 89%.

Essentially, EU storage is full

Clearly, through much of 2022 strong LNG shipments and demand destruction helped the European Union build inventories at a good pace despite the significant fall in Russian pipeline gas flows - YTD Russian flows to the EU have fallen by around 50% Year-on-Year.

While weakness in prices provides some relief to consumers, the concern is whether those lower prices will stimulate demand once again. European fertiliser producers have already started to bring back curtailed capacity following the recent weakness in prices. If we see this happening on a larger scale, Europe’s efforts to refill storage next year will be more difficult.

There are still concerns for Europe over the longer term, particularly through 2023 and into 2024. The front end of the TTF forward curve is in significant contango with Feb-23 TTF futures trading in excess of EUR130/MWh (vs. day-ahead at around EUR34/MWh). The forward curve through 2023 until early 2024 remains fairly flat at these elevated levels.

EU gas storage

Chart shows total capacity as a percentage

Europe's temperature anomaly

The darker red colours show the higher-than-normal temperatures in the week beginning 23 October

2023 will be tight for European gas

The pace of inventory builds during the 2023 injection season will be much more modest compared to what we have seen this year, given the reductions in Russian supply. If Russian gas flows remain as they are currently, annual flows next year will still be down 60% YoY. And clearly, there is the risk that these remaining flows still come to a complete stop.

The ability of the EU to completely turn to other sources is just not possible. There are constraints to how much more LNG Europe can import. There are reports that LNG carriers are queuing for spots at regasification units. This highlights the lack of regas capacity in Europe at the moment. It could also be partly due to market players wanting to take advantage of the significant contango in the front end of the TTF curve.

The EU is seeing the start of a fair amount of regasification capacity in the form of Floating Storage Regasification Units (FSRUs) over the second half of this year and into early 2023. This will help with some of the infrastructure constraints Europe is facing, but the issue is also around global LNG supply and the limited capacity which is expected to start next year. Also, a key upside risk for Europe is if we see a recovery in Chinese LNG imports next year. The world’s largest importer has seen weaker demand so far this year due to the impact of Covid-related lockdowns and higher prices. Chinese LNG imports over the first nine months of 2022 were down 21% YoY.

Tight storage capacity will leave Europe vulnerable this time next year

As a result, Europe is likely to go into the winter with tight storage which will leave the region vulnerable this time next year. In order to get through this winter comfortably, we will have to see continued demand destruction. This will have to be either a result of market forces (prices needing to trade higher to reduce demand) or EU-mandated demand cuts. While Europe should be able to scrape through this winter if current Russian gas flows continue, it is much more challenging if the remaining Russian gas flows come to a full stop.

Therefore, we believe there to be upside to current 2023 forward values, particularly those towards the end of the year. Although much will depend on how much storage the EU drawdowns this winter, which obviously will depend on heating demand through the peak of winter.

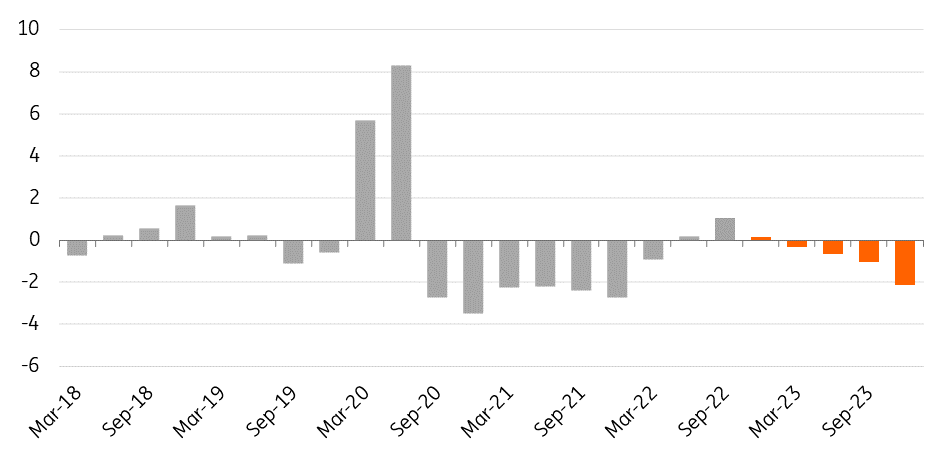

OPEC+ cuts change 2023 oil outlook

The outlook for the oil market has changed significantly since last month and this is a result of the OPEC+ supply cuts announced in early October. OPEC+ agreed to reduce their output targets by 2MMbbls/d from August production levels. These cuts will start in November and run through until the end of 2023. However, given that the bulk of OPEC+ members are producing well below their target levels, the actual cuts we see from the group will be much smaller. We estimate that output will fall by around 1.1MMbbls/d.

These OPEC+ cuts come at a time of plenty of uncertainty around Russian supply. The EU ban on Russian seaborne crude oil comes into effect on 5 December, followed by the ban on Russian refined products on 5 February. Up to now, Russian supply has held up well thanks largely to India, China and a handful of small buyers increasing their share of Russian oil purchases, but it is difficult to see them having room to increase these purchases significantly. Therefore, when these bans come into force, we would expect to see more significant declines in Russian supply. For now, we are assuming Russian supply to fall by a little more than 2MMbbls/d in the first quarter of next year.

Prior to the latest OPEC+ supply cut announcement; we were forecasting that the oil market would be in surplus through to mid-2023. However, with the market set to lose in the region of 1.1MMbbls/d of supply, it's now expected to be in deficit throughout the whole year. This is even after considering slower demand growth next year, given the macro headwinds (the IEA estimates demand growth of 1.7MMbbls/d for 2023 vs. a previous forecast of 2.1MMbbls/d). As a result, we see oil prices trading higher over 2023. We currently forecast ICE Brent to average US$104/bbl next year.

There are several risks to this view. These include a worse-than-expected macro environment, OPEC+ ending supply cuts early or members not adhering to their cuts, and obviously a de-escalation in the Russia-Ukraine war. For now, we believe it is unlikely that US sanctions against Iran will be lifted, so we see no change in Iranian supply through 2023.

Global quarterly oil balance (MMbbls/d)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 November 2022

ING’s November Monthly: The long wait for the pivot This bundle contains 14 Articles