Russia: The curious case of FX interventions

Bank of Russia will have FX sales of more than US$2.6 bn for May, lowering the risks of a weaker ruble. The central bank's involvement on the FX market should downsize to the current requirements of the Finance Ministry, as the bank's additional FX sale obligations are close to purchase backlogs. This lowers the chances for a stronger ruble as well

| RUB193 bn |

to be sold by Minfin to CBR in Mayup from RUB78 bn sales in April |

| Lower than expected | |

Minfin's FX sales to CBR lower than expected in May, but market interventions can be higher

The Finance Ministry (MinFin) announced sales of FX (off-market transactions with the Bank of Russia) in the amount of RUB193 bn, or US$2.6 bn under current exchange rates, for the period of 13 May to 4 June. The sum is below our and consensus expectations of US$3.5-3.7 bn, and, more importantly, smaller than the Finance Ministry's own guidance. According to the latter, under average Urals of $16/bbl in April, the next month's fuel revenue undercollection for the budget would total around US$3.5 bn, or US$1.2-1.5 bn per each US$10 Urals price below the US$42.4 cut-off level.

The discrepancy in the actual data suggests that the fuel revenue collection in April may have still benefited from the long-term delivery contracts. Meanwhile, going forward some negative adjustments are possible depending on the Urals price environment and Russia's compliance with terms of the new OPEC+ deal, prescribing a decline in the physical output volumes. In practical terms, this means that despite some recovery in the Urals spot price to the US$20-25/bbl range in May, budget revenue undercollection in June may worsen.

Meanwhile, the experience of March-April suggests that the Minfin's FX announcements provide only limited guidance as to what amount of FX the Bank of Russia (CBR) will sell on the open market. If previously the CBR's FX interventions tightly correlated with the Minfin's operations, two major changes were introduced in March:

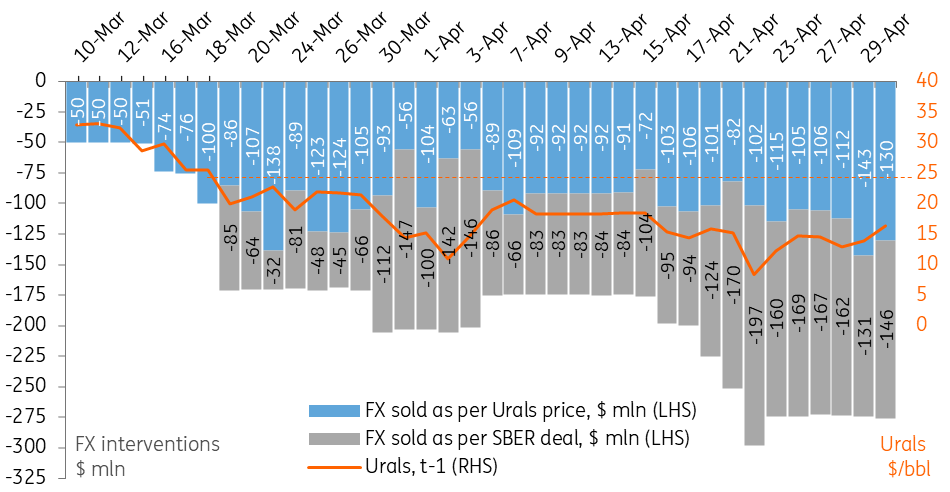

- Starting 10 March and responding to the sharp drop in the oil price below the US$42.4/bbl cut-off price, the CBR abandoned the Minfin's backward-looking intervenion guidance (based on last month's Urals price) and started front-running the interventions based on current Urals price. Based on the CBR's daily intervention data and public statements by the CBR governor, we estimate such sales at US$3.5 bn from 10 March to 30 April, translating into daily interventions of US$50 m per each US$10 Urals price below the US$42.4/bbl cut-off level.

- Starting 19 March and responding to the drop in the Urals price below US$25/bbl, the CBR initiated additional FX sales attributable to the handover of the CBR's 50% equity stake in Sberbank, Russia's largest lender, to the government. According to our estimates, in the period between 19 March and 30 April the CBR sold US$3.6 bn of FX attributable to the deal. This translates into average extra daily FX sales of US$140 m per each US$10 Urals price below the US$25/bbl threshold. It remains unclear whether the CBR will stop those additional interventions when the Urals price returns back above US$25/bbl. The intensity of the sales in March-April has been volatile from day to day, pointing to the CBR's flexible approach to interventions depending on the current market situation. We believe the CBR has yet to sell around US$24 bn of FX attributable to the SBER deal, and the recently CBR macro forecasts imply that the regulator intends to channel the entire sum into the market within this year.

Based on this analysis (also illustrated in Figures 1 and 2 below) we expect CBR to sell up to US$4.0 bn in May in case of Urals in the current US$20-25/bbl range.

Figure 1. Starting 10 March, CBR has been reacting to daily Urals moves, and since 19 March has been conducting extra sales related to SBER deal

Figure 2. CBR sells US$50 m per each US$10 Urals below US$42.4/bbl and extra US$140 m per each US$10 below US$25/bbl

CBR may lower its presence on FX market once it stabilizes

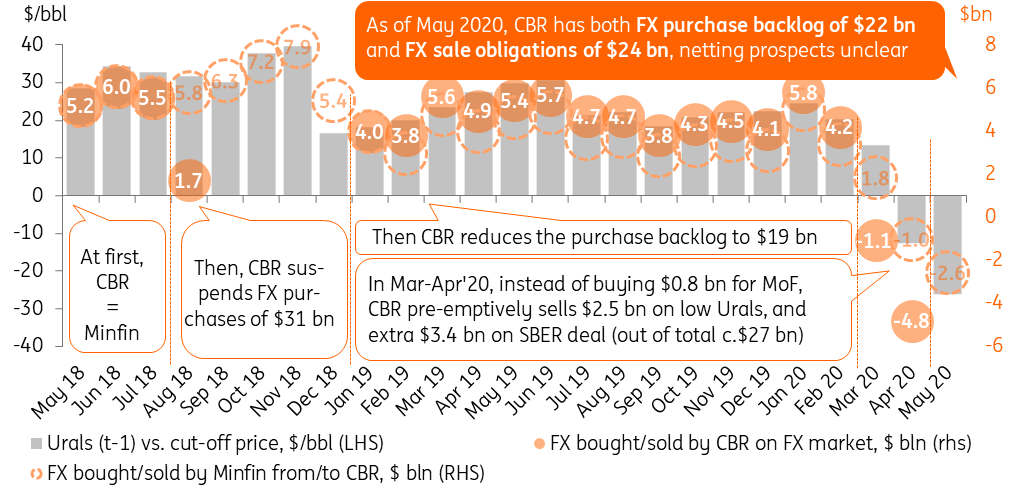

Looking beyond May, we expect the CBR to eventually scale back its presence on the FX market to the current requirements of the Minfin, ie, to re-align its FX interventions with the Minfin's monthly announcements. We base these expectations not only on the assumption the CBR remains committed to inflation targeting, ruble free-float, and liberalized capital account, but also on the arithmetics of the CBR's previous FX purchasing and spending obligaitons.

- On the one hand, indeed, as of May, the CBR has around US$24 bn of FX to spend due to the SBER handover. In addition, that sum might be increased by another US$4 bn if the previous plans by the Minfin to invest an addtional RUB300 bn from the National Wealth Fund in 2020 (discussed last year) remain intact.

- On the other hand, however, as of May, the CBR also has US$22 bn in the FX purchasing pipeline, comprising of US$19 bn interventions backlog from August-December 2018 (initially the CBR suspended US$31 bn in FX purchases during that period, but later on caught up with US$12 bn), as well as US$3 bn in front-running FX selling in March-April this year (the CBR sold US$2.5 bn of FX due to Urals below US$42.4/bbl instead of buying US$0.8 bn as prescribed by the Minfin).

As a result, an eventual netting between the two counter-balancing items cannot be excluded. At the sime time, we should note that it is not guaranteed, as the CBR has room for manoeuver in this regard. The initial deadline for the FX purchase backlog was 1 February 2022, while the initial timeframe for SBER-related FX sales was originally indicated at 3-7 years. For now we assume that the CBR will publicly clarify its FX operations schedule once the market conditions allow it.

Figure 3: Apart from current FX needs by the Minfin, the CBR has a pipeline of US$22 bn in FX purchases and US$24 bn in FX sales

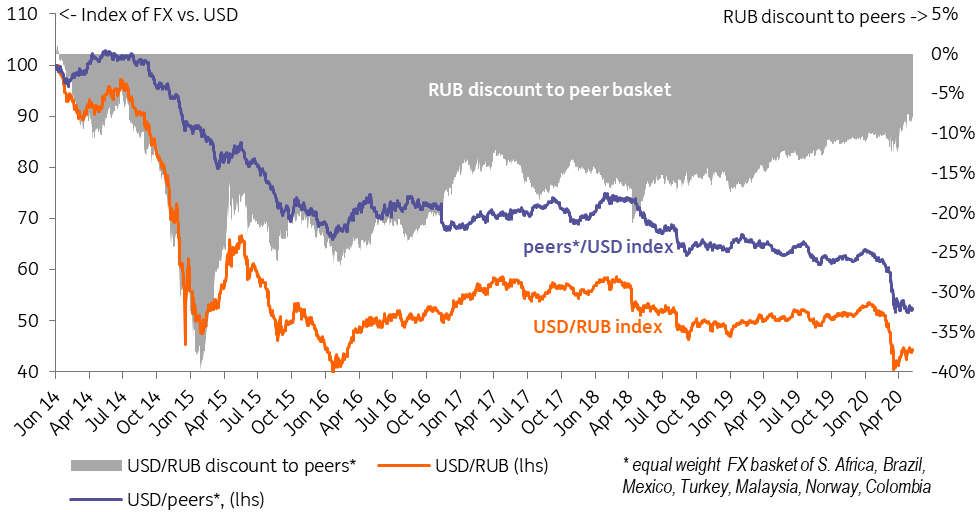

Active FX interventions lower near-term risks for RUB, but overall BoP remains a watch factor for longer-term trends

The CBR's active position on the FX market may raise the question whether it was instrumental in assuring the ruble's relative strength in the last couple of months. The ruble depreciated only 10% to USD in March-April, which is better than the 12% seen among the ruble's EM/commodity peers, and that has led to a decline in the RUB's country discount to peers from 10 percentage points to a new post-2014 low of 8 pp (see Figure 4). While we do not exclude the CBR's FX interventions indeed contributed to the ruble's performance, we also note that it was only one of several factors, with the overall balance of payments likely playing a major role:

- Ruble's 'catching up' with peers has been a steady trend since at least mid-2018, reflecting active portfolio investor interest to the local bond market. Looking at foreign participation in OFZ, local currency government bonds, after the initial globally-driven US$4.0 bn sell-off in March, foreign investors seem to have bought US$0.7 bn in April (non-residents bought around 20% of new placements), reflecting continued confidence in Russia's macro stability indicators (public debt of 12-13% GDP, liquid FX fiscal reserves of around 10% GDP), relatively high real rates, dovish CBR guidance, and lack of negative sanction newsflow.

- Capital flows by local actors also appear benign, as local banking statistics suggest that households have sold around US$5 bn into ruble weakness, suggesting a counter-cyclical approach to FX rate moves. There was also no indication of accelerated corporate capital outflow given the lack of heavy foreign debt redemption schedule and large accumulated foreign asset position.

- Finally, the narrower-than-expected fuel revenue undercollection for April may also point to a better-than-expected current account balance, as the physical export volumes may have remained stable, and the actual delivery prices have not yet reached low spot levels. We expect to see confirmation of a benign current and capital account in the April balance of payments statistics to be released on 14-15 May. Meanwhile, since May, Russia is supposed to lower its fuel supply as per OPEC+ deal, and the lagged effect of oil prices may also take effect.

Figure 4: Ruble has massively outperformed its EM/commodity peers

Overall, it does not appear at this point, that the CBR's active involvement in the FX market has resulted in a major deviation of the RUB exchange rate from the market reality, but rather supplemented it. This, combined with likely elevated interventions in May lowers the risk of USDRUB depreciating to the 80-85 range in 2Q20 as per our initial expectations. At the same time, a potential reduction in the CBR's support to the FX market after 2Q20 combined with the likely delayed effect of lower Urals and OPEC+ commitments on financial flows, and low visibility on the global market mood, also suggest limited scope for RUB appreciation from current levels.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more