Russia: Hit by a double shot of sanctions

Russian assets have sold off heavily over the last 24 hours on the back of two US sanctions stories. The mood in the US Congress towards Russia certainly seems more aggressive and less predictable. Ahead of US mid-term elections in November, we expect a greater risk premium to be demanded of Russian asset markets

What’s the news on sanctions?

The first is the leak of the contents of a draft bill - the Defending American Security from Kremlin Aggression Act of 2018 (DESKAA) – which currently sits in the US Senate. The contents were roughly known, but the leak in the Russian Kommersant Daily provided the full text of the bill including naming eight Russian financial institutions with whom US persons would be prohibited from trading.

The leak also highlighted the threat that would prohibit US participation in new Russian sovereign debt issuance. Since Russia’s annexation of Crimea in 2014, a series of US sanctions have so far avoided targeting Russian sovereign bonds, OFZs, largely because of the potential impact on US funds invested in Russia. Were the DESKAA bill to progress, it would certainly open a new chapter in the financial sanctions against Russia.

The second piece of news was the imposition of sanctions, largely on Russia’s ability to buy US national security sensitive goods and technology. This followed the US State Department’s finding that the Russian government had been involved in the use of chemical weapons in the Skripal attack in the UK. These sanctions can be extended if Russia does not deliver a commitment against the use of chemical weapons or does not allow UN inspectors into Russia – neither of which seems likely.

How has the Russian Rouble reacted?

In response, the rouble has sold off 4% against the dollar over the last 24 hours. Modelling the rouble is a challenging task in light of sanctions and the Finance Ministry’s budget rule, which seeks to convert excess oil and gas revenues into hard currency. That said, ING's Petr Krpata has put a short-term financial fair value model together which tries to identify the amount of risk premium in the currency.

The rouble could easily fall another 2-3%

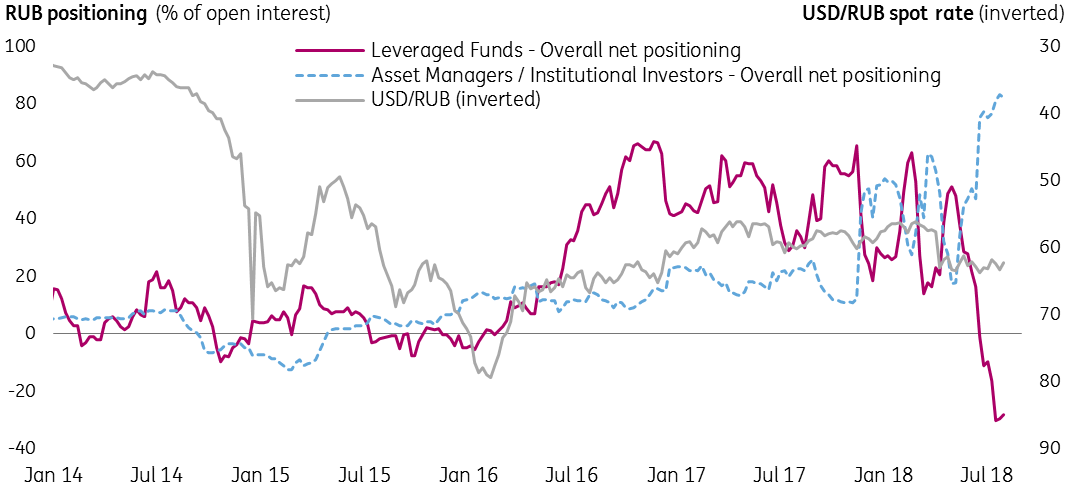

Based on the way the rouble has traded this year, the model suggests it could easily fall another 2-3% to match the risk premium seen in April when the US published secondary sanctions against Russian oligarchs and related businesses. Additionally, data put together by ING's Viraj Patel shows that asset managers are still running relatively large net long RUB positions – which could change were sanctions rhetoric to heighten over coming months.

These factors could easily send USD/RUB to the 70 area and perhaps prompt a reaction from Russian authorities either to:

a: slow Finance Ministry purchases of FX from the budget rule or

b: prompt a more hawkish response from the Central Bank of Russia.

Speculative positioning in the rouble: Asset Managers are long

What about the Russian bond market?

Russian 10-year sovereign OFZ yields at one point were 30-40bp higher on the sanctions news (widening 55-90bp over the last week), hitting the highest levels since March 2017), but have since retraced. Most investors we speak to continue to believe that OFZs will not be targeted with sanctions – clearly leaving room for some negative surprises were the DESKAA bill to make progress.

Most investors we speak to continue to believe that OFZs will not be targeted with sanctions

As our Moscow research team have noted, the OFZ yield curve rose 300-400bp after sanctions and lower oil prices in 2H14-1H15, but after a few months stabilised at 100-150bp over pre-spike levels. That kind of bond market sell-off would be at the extreme end of outcomes given a more balanced Russian economy than we saw in 2014. For reference, Russia's budgetary position is largely balanced now compared to the 1% of GDP deficit it was running in 2014 (3% deficit in 2015). And because of the budget rule, Russia's FX reserves are now back to US$460bn versus the low point of US$350bn seen in early 2015.

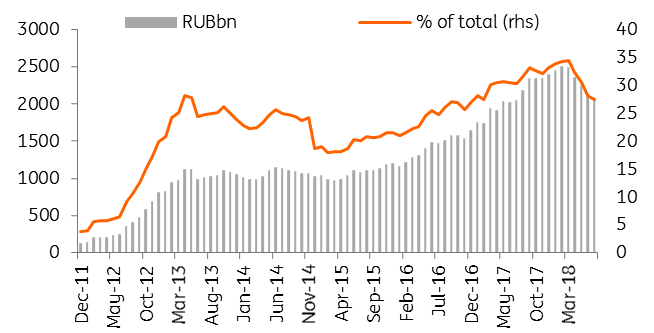

Non-residents owned 27.5% or around RUB2000bn (USS32bn) of the Russian OFZ market at the end of July compared to 34.2% at the end of February 2018. Since February, non-residents' holdings in OFZ have been reduced by more than RUB400bn. Sales from non-residents were offset by strong demand from Russian local investors, banks and private pension funds. For reference foreigners sold RUB150bn worth of Russian assets in the 4Q14-1Q15 window. Additionally, non-residents hold larger shares of the US$40bn sovereign Eurobond market and actively participate in the US$120bn corporate Eurobond market.

Non-residents now hold 27% of the Russian OFZ market

Russia’s sovereign risk

In the external credit markets, Russian’s sovereign 5yr Credit Default Swap (CDS) and 10yr USD denominated credit have both widened by 20bp over the last two days, with foreign investors looking to add protection and sell Russian exposure.

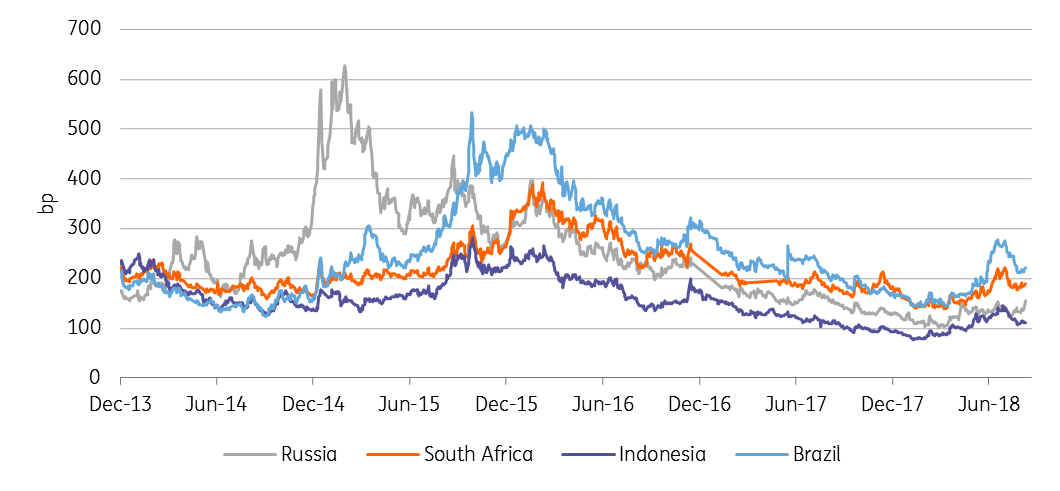

Ongoing sanctions talk will keep the pressure on

Ongoing sanctions talk will keep the pressure on but we are unlikely to see a sell-off to the extent we have seen in the second half of 2014 when Russia 5yr CDS widened from 180bp to 630bp when the first round of sanctions was introduced.

The government had planned to raise up to another $3bn in sovereign bonds for the rest of this year. But while the budget rule has created additional demand for OFZ issuance, Russia is less reliant on tapping external markets thanks to strong external and fiscal balance sheets.

For now, we believe that spreads will stabilise around here although more concrete developments towards sanctions against sovereign debt and Russian banks could see Russia’s 5yr CDS widen beyond those of South Africa - which has not been the case on a sustained level since end-2015.

Russia's sovereign CDS starting to widen

Watch this space

We expect to hear more rather than less on US sanctions over the next few months. Of course, the DESKAA bill could be watered down over coming months to expedite progress, but it is certainly more aggressive than anything we’ve seen so far. For reference, the Senate returns from recess on Monday, August 13th but both Chambers of Congress are not in session until September 4th.

Expect markets to sharpen their focus on this DESKAA bill over coming months. And the congressional backlash against President Trump’s meeting with President Putin in Helsinki this July would make it a seemingly impossible environment for Trump to veto such a bill were it to be passed by Congress. Needless to say, it looks like Russian assets are in for a tough few months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 August 2018

In case you missed it: Emerging markets in turmoil This bundle contains 7 Articles