Russia tempted to ease fiscal rule and spend more

Russia entered 2020 with a spending backlog of around 1% of GDP, which the new cabinet may now start unwinding. With the budget breakeven oil price below $50/bbl there is some space to increase spending. A potential easing of fiscal rules remains a key question as it affects FX interventions and state borrowing plans

| 1.8% |

of GDP: Russian budget surplus in 2019down from 2.6% of GDP in 2018 |

| As expected | |

Russian budget surplus strong in 2019 on strong non-fuel revenues, restrained spending

According to preliminary government estimates, the Russian federal budget surplus reached 1.8% of GDP in 2019, or RUB2.0 tr, which is slightly below the Bloomberg consensus forecast (of three analysts) but very close to our RUB1.9 tr expectations. While the surplus shrank compared to 2.6% GDP seen in 2018, it is not a sign of deterioration in Russia's fiscal position:

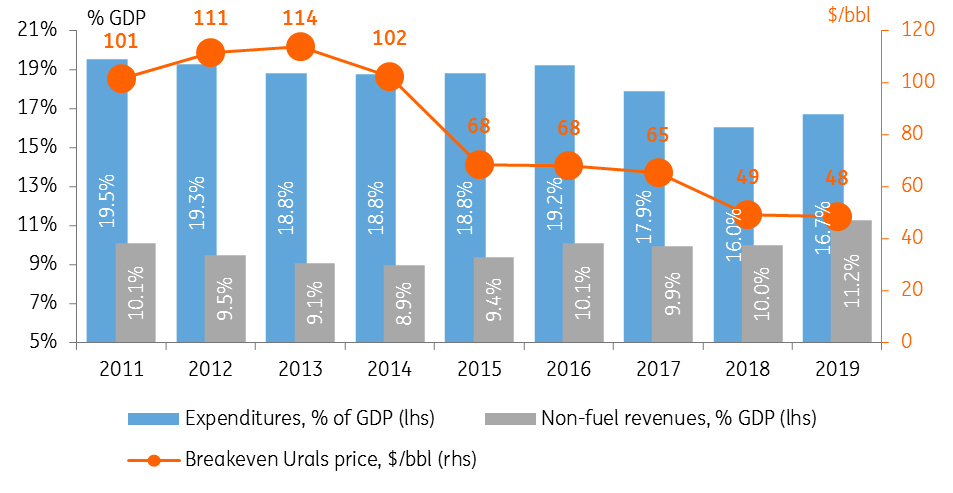

- The key reason for the contraction in the headline surplus was the $5-6/bbl drop in the average annual oil price that led to the decline in oil & gas revenue by 1.3 pp of GDP to 7.3% of GDP

- Non-oil revenues increased by 1.2 pp of GDP to 11.2% of GDP mostly due to the 2 pp increase in the VAT rate

- Expenditures were up by 0.7 pp of GDP to 16.7% of GDP in 2019, which is still below the 18-19% of GDP seen in 2012-17

- The non-oil & gas deficit of the Russian budget shrank by 0.5 pp to 5.5% of GDP, budget breakeven oil price (a measure of the vulnerability of the Russian budget to the oil price) declined from $49/bbl in 2018 to $48/bbl in 2019, the lowest reading since 2007

Figure 1. Russia's fiscal position strengthened in 2019 on VAT rate hike and restrained spending

2020 budget plan may be revised to incorporate higher spending

Overall, the 2019 budget report highlights the decline in macro risks, which has been the Russian government's key priority over the last five years. However, with the recent government reshuffle ahead of parliamentary elections scheduled for 2021, this approach might be adjusted in favour of a somewhat more relaxed fiscal approach. Therefore, over the coming weeks, investors should expect some indication from the government as to what will be the scale of extra spending.

For now it appears that budget stability remains a priority

For now it appears that budget stability remains a priority. The new prime-minister Mikhail Mishoustin indicated that new social support measures anounced by the president and worth 0.3-0.5% of GDP per year will not require an ncrease in the overall spending plan (i.e. there will be some redistribution). As a result, there is a chance that the previous spending plan for 2020, which assumed a 0.6 pp of GDP increase to 17.3% of GDP, will remain intact.

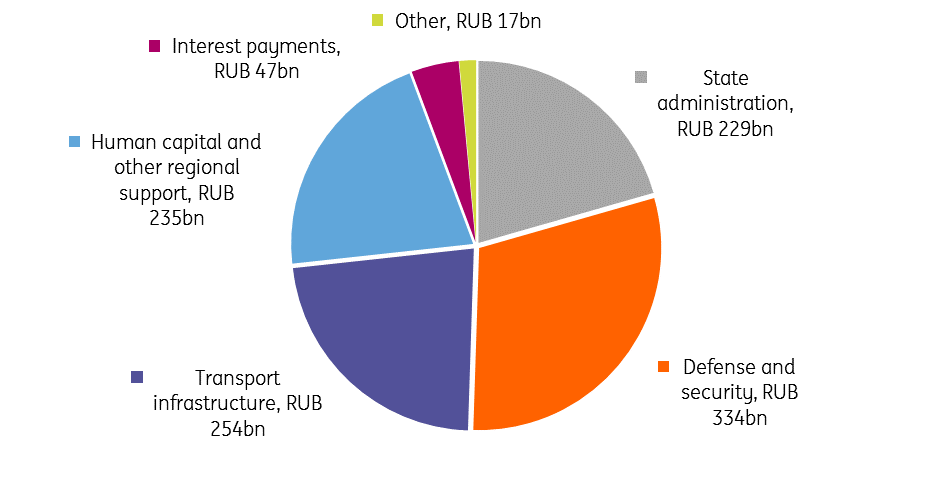

Meanwhile, the question remains as to what will happen to the spending backlog that has been accumulating over the past few years as a result of continuous under-spending relative to the plans. Looking at the Finance Ministry's budget reports, it appears that the government fulfilled 98.5% of its spending plan for 2019, suggesting underspending of around 0.2% of GDP for 2019 alone. In the meantime, the total amount of unspent allocations is RUB1.1 tr, or 1.0% of 2019 GDP.

The structure of this backlog is broad-based, as it appears that over the last few years only spending on social support and mass media has reached nearly 100% fulfilment. As the new prime minister has been credited with improving the efficiency of the state administration, not least in taxation services of which he was in charge, it would be reasonable to assume that some unwinding of this backlog will take place in 2020, with possible redistribution towards more targeted spending on both social support and infrastructure spending.

Details on spending plans will be key for determining household and corporate activity expectations as well as their inflationary consequences.

Figure 2. Russia has accumulated around 1% of GDP spending backlog

Future of the fiscal rule is the key uncertainty for markets

The second big question (and to market participants, it's probably the first) is whether some easing in the fiscal rule will be required in order to accommodate the shift in economic policy priorities. In practice, easing means an increase in the 'base' oil price - determining which portion of the (base) fuel revenues s allowed to finance current expenditure and which part is treated as extra and needs to be transferred into the National Wealth Fund beyond the currently designated 2% per year (see Figure 3). The PM has recently indicated that it is a possibility.

As we mentioned in our recent article, the fiscal rule may indeed be eased and not just to accommodate new economic policy initiatives on the spending side. It could also account for the likely under-collection of oil revenues stemming from the actual ruble exchange rate being stronger than drafted in the budget. According to our estimates, should USD/RUB remain at the current 61-62 range in 2020 (although not our base case) instead of depreciating to the currently drafted 65.7, the budget will under-collect RUB500-600 bn in annual revenues.

In either of these two events, the unchanged budget rule would dictate an increased net borrowing, which is already planned at a high level of RUB1.7 tr for this year. The increase in the threshold oil price by US$1/bbl lowers the annual borrowing need by RUB110-120 bn per annum and reduces the amount of annual FX purchases by US$1.7-1.9 bn. Therefore, it would be reasonable to expect that in order to address either of the two challenges (extra spending and fuel revenue under-collection) the budget-rule oil price could be increased by around US$5/bbl. That would lower the expected amount of annual FX purchases by up to US$10 bn in 2020 and prevent the potential increase in the borrowing requirement by RUB500-600 bn.

Depending on the fiscal rule decision - and we hope to see some signals in the coming weeks - and the scale of potential easing, some relief to the ruble and bond market may follow. However, a sharp easing (i.e. increase in the base oil price by $10/bbl or more) might cause the investment community to question the sustainability of Russia's previous commitment to macro stability.

Figure 3. Potential easing in the fiscal rule (higher base price) would result in lower borrowing and lower accumulation of fiscal savings

Budget policy signals matter

The full list of the new Russian Cabinet members is expected to be announced this week, after which some details on the budget policy my follow. For now, we expect to see a modest upward revision in the 2020-24 spending plan, in order to unwind the 1% GDP spending backlog accumulated over the previous years. With the budget breakeven oil price staying below $50/bbl and fiscal reserves of over 7% of GDP along with a public debt of under 15% of GDP, this is unlikely to cause nervousness about Russia's macro stability and on the contrary might improve the mood of households and corporates. Meanwhile, the discussion on the fiscal rule remains the key uncertainty for the FX and bond markets' outlook right now.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article