Russia: Consumer spending increasingly reliant on leverage

Retail trade growth of 2.0% (YoY) in February beat estimates, outstripping real wage growth (0.7%) for the first time in 3 1/2 years. But the sustainability of this spending growth is questionable, given its increased reliance on leverage; retail lending is at five-year highs and growing, while rouble retail deposit growth is at 3 1/2 year lows and slowing

| +2.0% |

February retail trade growth (YoY)+1.8% YoY for 2M19 |

| Better than expected | |

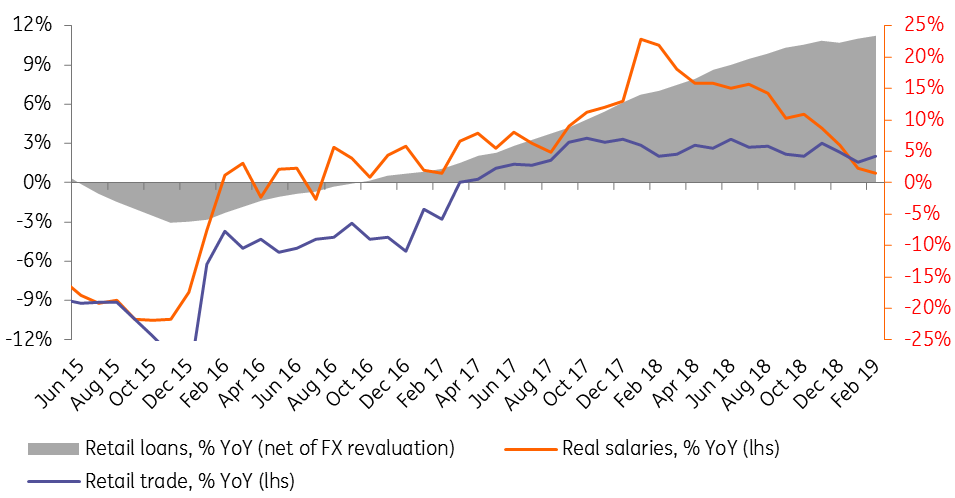

Consumption growth is relying more heavily on borrowing

February activity data for Russia brought a positive surprise on the consumption side, with retail trade growth accelerating from January's 1.6% YoY to 2.0% YoY instead of decelerating to the 1.0-1.5% range we and the market had anticipated. The growth structure suggests that the acceleration was driven by the non-food segment, where the growth rate doubled from 1.2% YoY to 2.4% YoY.

The outperformance in consumption was apparently supported by a slightly better-than-expected income trend, as real salaries were up 0.7% YoY in February vs. expectations for a reading of 0.0% to -0.3%. However, this still marks a deceleration from the upwardly revised 1.1% YoY figure in January. Given the adverse effect of the continuing acceleration in consumer prices from 4.3% in 2018 to 5.2% YoY in February (due to a VAT hike) overall household income growth and household sentiment might have been partially supported by the injections from the state budget. According to recent statistics, federal budget spending accelerated from 2% in 2018 to 10% YoY in 2M19, with outlays for healthcare, the pension system and other social benefits being the key outperforming items.

Still, our concern is that despite some government measures to support household income, consumption growth seems to be increasingly dependent on leverage, to which we see several signs:

- February's retail trade growth of 2.0% noticeably outperformed real salary growth (salaries represent around 65% of the total household income) of 0.7% YoY - the first time salary growth has lagged behind retail trade growth since mid-2015

- Recent data from the Bank of Russia points to the continued acceleration of retail loan growth to 23.5% YoY in February, a five-year high. Around half of this growth represents non-collateralised consumer loans. According to our estimates, non-mortgage debt of households, plus interest payments, went up from 15% to 17% of household income, which is the highest historical ratio, barring the 2012-14 period of explosive retail lending growth in Russia

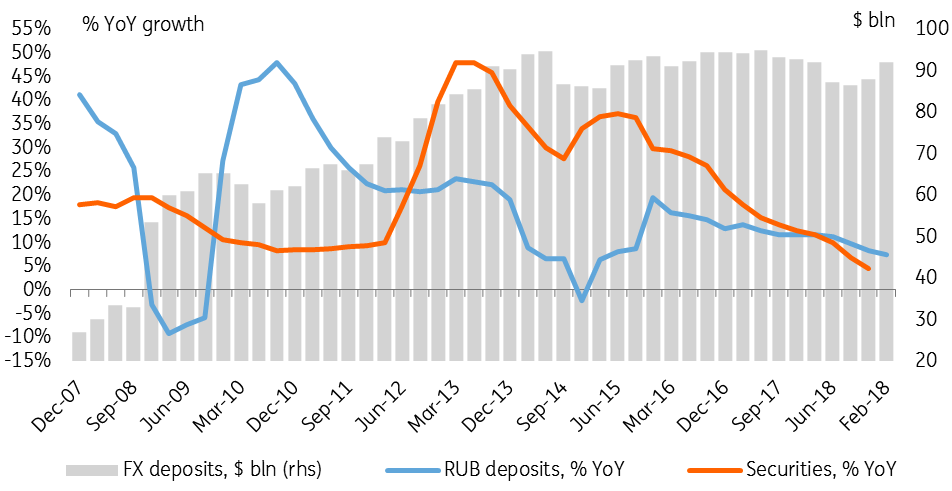

- Household saving, on the other hand, as we had already mentioned previously, is under pressure, with growth in securities holdings and rouble deposits down to multi-year lows of 5-7% YoY. Even accounting for some recovery in FX deposit inflows, overall deposit growth adjusted for the FX revaluation effect is at just 6% YoY.

Given the pressure on the savings rate, continued acceleration of consumer price inflation, and the central bank's intention to limit consumer lending growth, we continue to expect consumption to be constrained in 2019.

Key indicators of consumer trends

Key indicators of households' savings

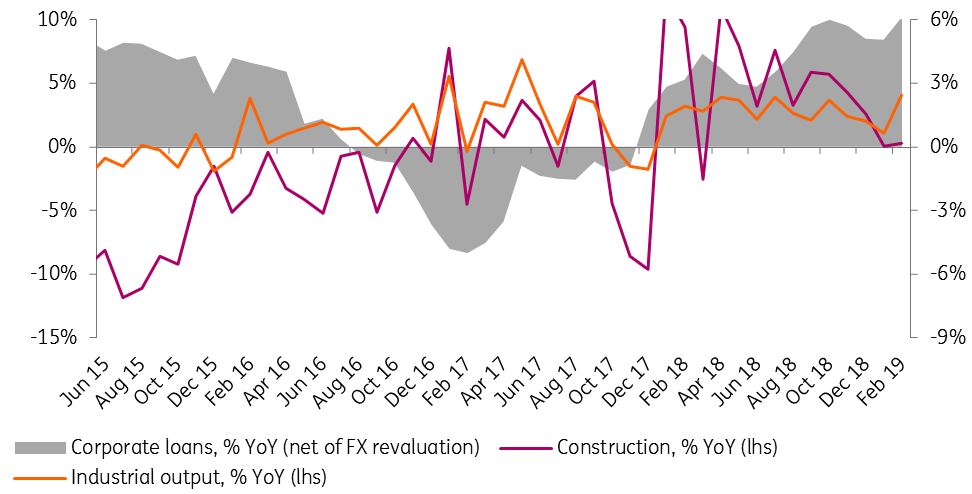

Outside industrial production, corporate activity indicators remain modest

On the corporate side, the full set of data confirmed the likely technical nature of the recent spike in industrial production from 1.1% YoY in January to 4.1% YoY in February, as construction volumes showed only a minor acceleration from 0.1% YoY in January to 0.3% YoY in February. Corporate loan growth adjusted for FX revaluation accelerated from 5.1% YoY to 6.1% YoY in nominal terms, pointing to a moderate increase in demand for credit.

Key indicators of producer trends

Acceleration in retail trade growth from 1.6% YoY in January to 2.0% YoY in February, combined with a spike in industrial production growth from 1.1% to 4.1% YoY, is positive and points to a noticeable acceleration in GDP growth vs. the 0.7% YoY rate seen in January. However, given that household spending is increasingly reliant on leverage and corporate activity has not seen a broad-based recovery, we remain cautious on economic growth in 2019.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more