The FX road to recovery: Which currencies to back on the path out of lockdown?

As confidence builds that Covid-19 curves are turning lower and gauges of market risk improve further, attention in the FX world turns to the outperformers on the road to recovery. To help in this assessment, we’ve put together FX scorecards. Our results favour G10 activity currencies over the dollar and we prefer north Asia in the emerging market FX space

Market confidence slowly improves

The length of lockdowns and the investment outlook are inextricably linked. The length of the lockdown determines the size of the economic contraction – particularly in 2Q20 – and the impact on corporate earnings profiles.

Markets are therefore welcoming the turn lower in Covid-19 curves and plans to re-open closed economies. These, along with the aggressive action of global policymakers, have combined to drag gauges of financial market risk further away from their peaks in March. Volatility levels are declining across the board and the USD Libor-OIS spread, a metric of inter-bank funding stress, is now at levels not seen since early March.

These developments will mean that in the FX space investors will be starting to re-assess their positioning. In particular, do conditions still merit holding the highest cash ratios since 2001 – that cash typically parked in near zero-yielding US Treasury bills?

With this question in mind, we’ve put together a FX scorecard for both the G10 and emerging market currencies. This shows the factors we think are important and how currencies rank on each of those factors.

Fig. 1 - Covid-19 contagion has slowed in major economies

Putting together a FX scorecard

In selecting factors for our scorecard, we’re incorporating the assumptions from our April monthly update of a U shaped recovery. Putting a letter on a uniform recovery is far from perfect and clearly other factors can be selected and weighted depending on one’s views. But we think, some of the most relevant factors for FX market now should be:

- Valuation: Cheaper currencies should be favoured because if the environment turns negative, a valuation premium will be welcome. We use a BEER model to estimate the mis-valuation of each currency versus the USD.

- Real rates: In a world of zero/negative yields, investors will be seeking decent returns as sentiment stabilises. We calculate real rates as the policy rate minus the latest annualised inflation figure.

- Correlation with US yield curve: If we are very slowly moving into a recovery stage, one might expect the US yield curve to start to steepen as optimism unfolds. We particularly look at parallels with the March 2009-March 2010 yield curve steepening. In our scorecard, we take the correlation of each currency with the US 10Y-2Y rate differential in that window.

- Exposure to oil markets: Rather than looking at current account balances, which could mistakenly favour the oil exporters, exposure to oil exports will be a burden into the summer, and we would want to avoid these. In this podcast, our Head of Commodity strategy explains why the oil crash may not be over yet. The measure we use in our scorecard is the latest available data on net crude oil exports as a percentage of GDP.

- Sovereign ratings: A conservative approach to risk would also favour those sovereigns at the higher end of the ratings spectrum. We think this issue is more relevant for EM and less so G10, the latter group being more able to issue debt in their own currencies. For the sake of our analysis, we've assigned a numerical value to S&P sovereign rating scores.

All numbers are expressed in z-score terms for normalisation purposes. The scorecard aggregates each factor’s z-scores. When Eurozone-aggregated numbers were not available, we computed the GDP-weighted average of eurozone countries. For net oil exports, the eurozone value is a sum of Germany, France, Italy, Spain and the Netherlands.

We acknowledge that different lockdown measures will inevitably be key to determining how deep the recession will be in each country and ultimately have an impact on the respective currencies in the coming months. For this purpose, we looked at two potential measures to include in our analysis: a) Google’s Covid-19 Community Mobility Reports, which shows how much visits to certain places (such as shops, workplaces) and help gauge the disruption caused by the lockdowns in each country; b) Oxford’s Stringency index, which gauges how stringent lockdown measures have been in different countries.

We chose, however, to exclude these factors from our analysis as they don’t factor in the announced “exit plans” to the ongoing lockdowns. How gradually an economy will allow people’s movement again and what businesses will be allowed to re-open is surely going to drive most of markets expectations on each country’s recovery from the shock. Without this information embedded in the data, the results could be misleading.

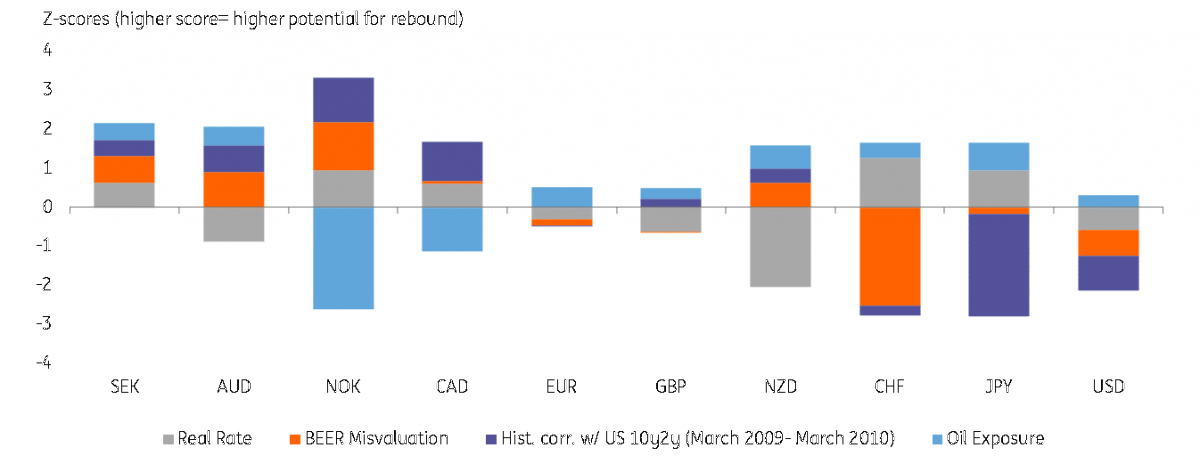

Fig. 2 - G10 FX scorecard

G10 FX: SEK and AUD may be the out-performers, $ looks vulnerable

Based on our scorecard, some of the pro-cyclical currencies which don't have exposure to the oil market look as though they may lead FX markets through the recovery phase.

The SEK and AUD are both under-valued on our medium-term valuation model, are positively correlated with a steeper yield curve in a recovery phase and aren’t saddled with exposure to oil.

AUD has already pared most of its 1Q losses and relatively strong fundamentals should allow it to keep leading any additional risk recovery in G10.

Here are the key points in favour of AUD: (a) the Australian government has stepped in with a massive AUD 320bn (around 16% of GDP) relief package; (b) as shown in Figure 1, Australia has been particularly successful in flattening the contagion curve; (c) Australia's biggest export, iron ore, is proving particularly resilient thanks to relatively stable demand from China and lingering supply shortage from Brazil; (d) the central bank has already started some tapering and may be one of the first ones to lift stimulus measures as the global economy recovers.

The SEK and AUD are both under-valued on our medium-term valuation model, are positively correlated with a steeper yield curve in a recovery phase and aren’t saddled with exposure to oil

The tide has also turned for SEK in our view as (a) the Riksbank has lagged its cyclical G10 peers on the easing front (no rate-cuts, only an extension of QE), which in turn materially narrowed the SEK negative rate differential versus its peers; (b) the lack of SEK exposure to commodity prices. This makes SEK well-positioned for a cautious recovery in sentiment towards G10 currencies in coming months and the currency screens as the most attractive in the G10 FX space. SEK should also benefit from the anticipated EUR/USD recovery more than some of its G10 peers.

Consistent with our views that the dollar will underperform during a recovery phase, our scorecard shows the dollar performing poorly in valuation, real rates and yield curve steepening episodes. The EUR appears mid-table and it seems unlikely to lead pro-cyclical currencies higher at the moment. The JPY does not score particularly well, largely weighed by the steeper US yield curve and US yields leading USD/JPY higher – yet we may be attaching too much weight to this factor if the Federal Reserve keeps US Treasury yields low to allow cheaper financing of ballooning government debt.

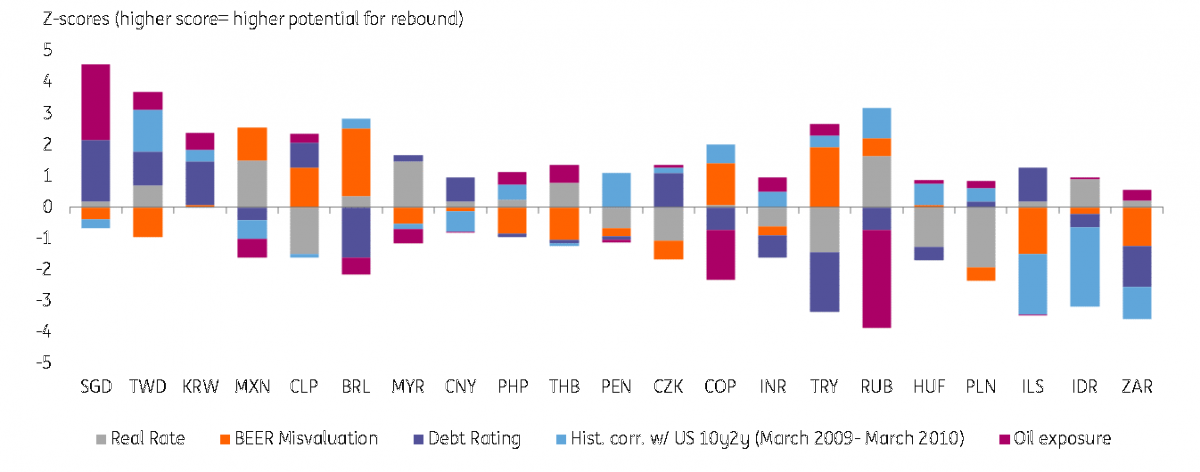

Fig. 3 - EM FX scorecard

EM FX: Better rated Asian FX may start to perform better, high yielders still vulnerable

When adding in sovereign debt ratings to the scorecard, Asian currencies move up our rankings. Here, Singapore is AAA-rated, while Taiwan and Korea are AA-rated.

Speaking to our Chief Asian economist, Rob Carnell, about top-ranked Asian FX he prefers KRW and TWD over the SGD. Korea and Taiwan look to have relatively better economic trajectories as exit strategies unfold. SGD gains may also be held in check by the managed FX regime, heavily weighted against the CNY. He agrees that the INR and IDR should be towards the lower end of our table, especially in light of how local authorities are handling lockdowns.

Our Chief Asian economist prefers KRW and TWD over the SGD and thinks INR and IDR should be towards the lower end of our table especially in light of how local authorities are handling lockdowns

While the higher-yielding MXN and BRL appear in the better half of our scorecard, we would handle these currencies with caution. Mexico stands to suffer the severest slow-down in Latin America and it looks as though Banxico is now ready to favour growth over currency stability. Equally, President Jair Bolsonaro’s handling of the economy and cabinet departures have added a political risk premium to the BRL, which may remain embedded during 2Q20.

In the EMEA space, the ZAR scores poorly on most metrics (including surprisingly on valuation) and we would like exposure in RUB, were it not for oil prices. RUB should nonetheless be the outperformer among the high yielding EM FX given the mix of high real rate, relatively solid fiscal stance and stable politics. All this, in one way or another, differentiates RUB from the likes of ZAR, TRY, MXN or BRL.

Within the CEE FX space, CZK looks the most appealing given its strong fiscal dynamics, no quantitative easing from the central bank (versus QE in other CEE countries) and the “CNB put“ placed under CZK given the bank’s high FX reserves. We see PLN as the least attractive CEE currency at this point due to its most negative real rate in the entire EM space and the large scale central bank QE - around 8% of GDP.

Key Takeaways

- We prefer G10 over EM, at least in the early stage of the recovery, where the sovereign balance sheet will be important.

- Within G10, we look for out-performance of SEK and AUD – largely at the expense of the dollar.

- Within the EM space, it looks too early to expect a sustainable bounce in the high yield space (we prefer G10 commodity FX over EM commodity FX). And north Asian FX (KRW and TWD) look best placed to take advantage in any global rebound.

For reference, all our latest FX views and forecasts can be found in the April edition of FX talking.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

FXDownload

Download article

30 April 2020

ING’s Covid-19 roundup: Lagarde and Powell’s whatever-it-takes moment This bundle contains 11 Articles