Risk-on, risk-off

Geopolitics may have flagged the fragile nature of 'global recovery' trades, but the lead up to Jackson Hole means that it could be time for global tightening to cause a market shakedown

Theme of the week: Risk-on, risk-off

Rising geopolitical tensions last week may well have given investors a wake-up call when it comes to the fragile nature of 'global recovery' trades. Tail risks such as geopolitics, protectionism and the unwind of easy central bank money all provide valid reasons to remain cautious in chasing risk. This is especially true given that not all the foundations to what many have dubbed a 'synchronised' global recovery are actually in place; missing global inflation - and uncertainty over near-term growth in US and China - means that there are two-way risks to global growth.

As investors countdown to Jackson Hole, the Fed and ECB minutes this week may shed light on the proximity of global tightening. It has been a strange environment to see markets relatively calm despite two of the world's biggest central banks both on the verge of making significant changes to their respective balance sheet policies. With global tightening around the corner, one would have expected carry trades to come under some pressure. We still think that August may be the month in which the 'penny (or cent) will drop' and see the dollar bloc currencies as being particularly vulnerable.

Majors: Will the ECB speak now or forever hold its strong EUR peace?

The key question for EUR markets this week is whether the ECB minutes will express any concerns about the impact of the strong exchange rate on the economy or inflation. Back at the July ECB press conference, President Draghi talked about the exchange rate in terms of its impact on the financial conditions. Unless the ECB conveys serious concerns about the strength of EUR, any meaningful fallout in the single currency looks unlikely this week.

EUR: Solid US data and ECB minutes to limit upside

- We look for a somewhat wider trading range in EUR/USD around the 1.18 level this week. While both the July retail sales report (Tue) and industrial production data (Thu) should be US growth supportive, we doubt that decent activity data will be enough to drive EUR/USD materially lower. Doubts about the pace of additional Fed tightening - one of the factors weighing on the USD - stem more from weak US inflation concerns. We would probably need to see a revival in short-term inflationary pressures - something which last week's US data failed to convincingly show - before markets can positively re-price expectations for a third Fed rate hike later this year.

- In the Eurozone calendar this week, the main focus will be on the July ECB meeting minutes (Thu); any comments on tighter euro area financial conditions - and what this means for the central bank's inflation and growth outlook - could implicitly be seen as a concern over recent market moves. Elsewhere, German 2Q GDP (Tue) should confirm the strong EZ economic recovery. Overall, we think solid US data - and what may be perceived as ECB "jawboning" - should contain EUR/USD upside in the week ahead.

JPY: Geopolitical panic over, for now...

- Easing regional geopolitical tensions are taking a toll on the yen at the start of the week, with the currency - along with its safe-haven peer CHF - being the key underperformer in global FX markets. From a risk-management perspective, it may be too early to fade the recent move and JPY will remain sensitive to near-term geopolitical developments. Solid US activity data, however, provides another reason for why USD/JPY downside could be limited this week.

- After 2Q17 Japanese GDP came in much stronger than expected, the domestic data focus turns to the final June industrial production and July trade balance releases (both Wed).

GBP: Data to deliver final blow to a 2017 BoE rate hike

- Key UK data, as well Brexit and geopolitics, could present some turbulence for GBP this week. On the data front, headline and core CPI (Tue) may nudge higher to 2.7% and 2.6% respectively - but the BoE's tolerance for "hot, but not too hot" inflation suggests this is unlikely to be a game-changer.

- Instead, stagnant wage growth (Wed) and weaker consumer activity (Thu) may deliver the final blow to a 2017 BoE rate hike. We acknowledge, however, that GBP's fallout from any dovish BoE re-pricing this week may be more limited given that markets are now only pricing in less than a 25% chance of a 25bp increase in Bank rate by year-end.

Dollar bloc: Keep calm and carry off?

Both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) have been quick out of the blocks to talk down their respective currencies, with concerns over the negative domestic macro implications met with some tentative - albeit non-credible - threats of FX intervention. Unjustified currency strength - or one driven by a weaker USD and a "global risk bubble" - is like kryptonite for the Antipodean economies and expect to hear more of the same from these central banks over the coming weeks.

Read our latest piece Keep calm and carry off? for more in-depth analysis on the dollar bloc currencies

AUD: Intervention talk a bit of a curve ball

- Governor Lowe's testimony reiterated a neutral policy tone, citing no real rush to tighten. Yet, the RBA chief's admission that the central bank may be willing to intervene in certain scenarios was a curveball and could well keep the AUD$ on the back foot. Throw in a shaky global risk environment driven by geopolitics and we think AUD long positions could neutralise further.

- Domestic calendar sees the July jobs report (Thu) and 2Q wage data (Wed). Both matter for the RBA's near-term policy reaction function, especially as the policymakers attempt to grapple with a "lowflation" economy.

NZD: RBNZ clearly don't want a strong currency

- The RBNZ ramped up its jawboning efforts by dropping the threat of FX intervention into the mix. Like the RBA, officials noted that a strong currency comes at an external disinflationary cost - which is undesirable at a time when domestic price pressures have also slowed down.

- Despite the RBNZ's forward policy path pointing to a 3Q19 hike, markets continue to price in a 25bp policy increase 12 months earlier. 2Q retail sales (Mon) and PPI data (Wed) likely to test this hawkish assumption.

CAD: CPI a big test of BoC tightening expectations

- The CAD rally looks to be running out of steam in the face of more realistic BoC tightening expectations and range-bound oil prices. The narrowing of 2-year US-Canadian rates has been extreme and we think a 2H17 recovery in the US economy - coupled with softer macro data in Canada - should see a partial reversal. This points to upward pressure in USD/CAD towards 1.30.

- CPI data (Fri) will be a big test of the market's expectation for another BoC hike in 2017. A negative core surprise will see CAD unwind further.

EUR crosses: Welcome back, the Swiss franc

There are signs the CHF is coming back in from the cold and a sense of normality is returning. As we noted in our latest CHF update, we expect EUR/CHF to rekindle its correlation with risk. A return to more normal trading conditions, arguably for the first time since 2008, makes a case for EUR/CHF to move up to more normal levels - potentially even 1.30. Fading geopolitical risks means that the bearish CHF story could come back into the mix for markets this week.

CHF: Fading geopolitical risk easing upside pressure

- Unless we see a further escalation of the North Korea situation, EUR/CHF should take a pause for a breath and stabilise around current levels - although we do think it is too early for a rebound towards the previous high of 1.1538.

- Swiss PPI data (Tue) likely to have a fairly negligible impact on the franc. With EUR/USD likely to be hovering around 1.18 for now, we look for USD/CHF to remain range-bound around the 0.9600 level this week.

SEK: Solid Swedish CPI to provide a one-off boost

- The key focus is on the July inflation report (Tue), with the CPI-ATE likely to breach the 2% YoY level. Given the recent focus on global monetary policy normalisation, solid CPI should be SEK supportive and bring EUR/SEK to 9.55. Also, watch out for Prospera Inflation expectation survey (Wed), which could fuel any Swedish inflationary sentiment.

- However, we don’t actually expect the latest CPI data to prompt a reaction from the Riksbank; the central bank has a history of erring on the cautious side due to concerns about strong SEK. Thus, any boost to SEK from a strong CPI release may prove to be one-off.

NOK: Oil price and SEK spillover risks

- A typical summer week in the Norwegian calendar, with the July trade release (Tue) the only relevant data point to note. EUR/NOK should be primarily driven by the oil price this week and our commodity team's view that oil prices may have reached a near-term top suggests limited downside in the pair.

- Should Swedish CPI surprise on the upside, it may put some upside pressure on EUR/NOK - with investors opting for relative value short NOK/SEK positions.

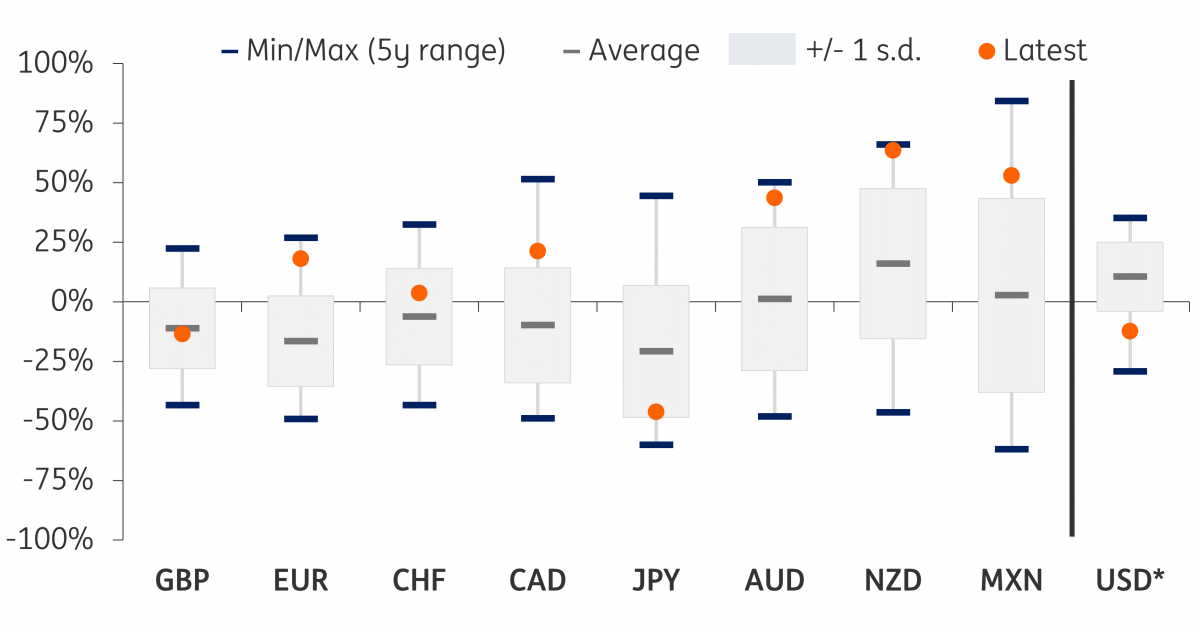

G10 FX positioning: Safe-haven longs increase

- Geopolitical risks last week saw an increase in JPY and CHF net longs, with both registering a "bullish" weekly signal on our positioning dashboard.

- Net long CAD positions also picked up last week on rising oil and BoC tightening sentiment. However, we now see positioning as a major risk to CAD - especially ahead of this week's Canadian CPI data.

- More broadly, we think above-normal long dollar bloc FX positions look vulnerable to rising headwinds - not least further central bank "jawboning". This suggests AUD and NZD downside could continue throughout August.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).