Why we’re forecasting the yuan to depreciate

Even though concerns about depleting foreign exchange reserves could limit the extent of yuan weakening, a depreciation trend is more likely than before. That's why we're changing our USD/CNY forecast to 6.60 for 2018 from appreciation to depreciation

Why China will be more willing to take advantage of a stronger dollar

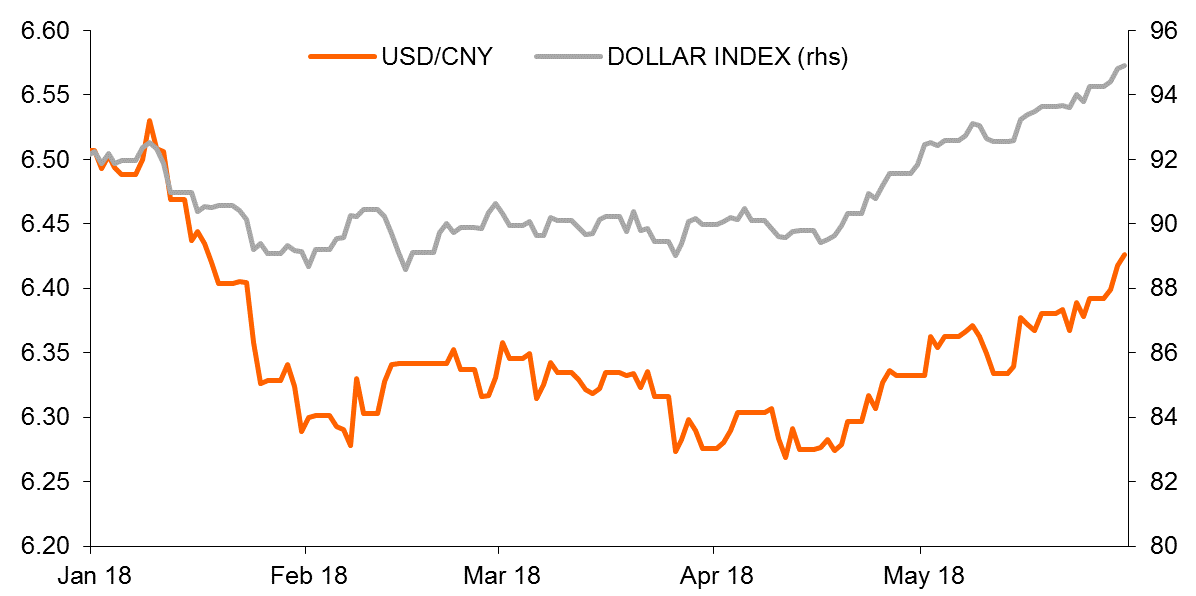

Trade war escalations between China and the US along with rising political risks in Italy and Spain have formed a strong dollar trend, and this is the key reason why we're revising our yuan forecast.

A strong dollar is likely to create headaches for the US administration as this won't help narrow its trade deficit with China. As the greenback strengthens against most major currencies, China should be willing to allow a weaker yuan as it sends a signal to the US that the exchange rate movements are largely a result of a steep dollar rather than any manipulation by China.

In other words, this means China is being passive ending up with a weaker yuan against the dollar. This passive influence by the strong dollar makes us think a slight depreciation of the yuan against the dollar is more likely than we previously believed, even though we thought this was unlikely.

But the central bank won't want capital outflows

But a steep yuan depreciation is not our call.

The dollar index has strengthened more than 1.7% year to date, and the yuan against the dollar has also appreciated by around 1.2% which implies that the yuan still has some room to weaken, especially if the dollar keeps strengthening.

The contradictory movements of appreciation of both the dollar index and the yuan at the same time show the Chinese central bank is unlikely to allow a longstanding yuan depreciation against the dollar. The People's Bank of China (PBoC) will try to prevent the yuan weakening to a level that attracts massive capital outflows and lead to depletion of foreign exchange reserves. It probably wants to avoid a repeat of mid-2014 and 2016 when reserves fell too quickly.

We think if foreign exchange reserves fall below the $2.5trillion level, the weakening yuan will start to stabilise to avoid further capital outflows.

Yuan still appreciating against the dollar YTD even though the dollar has been stronger

Capital inflows are coming but might not be enough to offset outflows

The central bank could get some capital inflows from China's open-up policy in the financial sector and A shares' inclusion into MSCI. These would offset some of the value effects on China's foreign exchange reserves from a strong dollar (i.e. non-dollar asset values come down in dollar terms).

Another way to avoid capital outflows would be to increase interest rates in China to widen the interest rate gap between China and the US. Currently, interest rate spreads have narrowed, which triggers a capital outflow worries.

To reverse the recent trend and increase interest rate spread, China needs to tighten liquidity further and/or raise the 7D policy rate by more than five basis points each time when it follows the Fed's hike. However, by doing so, the interest costs will increase in China. The central bank may be hesitant to do this now as there are increasing default risks from local government related credits, and the timing is nearer to half-year end when liquidity is usually tighter.

In short, creating a wider interest rate spread between China and the US by the Chinese central bank is quite unlikely, at least for now. This makes attracting capital inflows and retaining potential outflows more difficult.

It is also likely that the capital control regulator, SAFE, may start to slow down outflows via administrative measures. This was the main tool used in 2016 and could again be a handy tool now.

Yuan and capital flows are intertwined

Revising yuan forecast

Considering all these factors, we revise our USD/CNY forecasts to 6.60 from 6.33 for 2018. In other words, we expect 1.5% yuan depreciation against the dollar in 2018.

Between now and the end of 2018, there are chances that the dollar strengthens very quickly, which could originate from escalating risks in Europe and USD/CNY could surpass our year-end forecast.

However, we expect that rapid capital outflows (even with administrative measures in place, similar to the scenario in 2016) would then begin, and could trigger falling foreign exchange reserves to the $2.5 trillion level. By then the central bank is likely to stabilise the yuan to stop foreign reserves from continuously falling. So the chance of USD/CNY surpassing 6.60 for a prolonged period is quite small.

Download

Download article1 June 2018

In case you missed it: Brave new world This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).