Rates Spark: Recession fears take over

The tone has become markedly risk-off, bonds rallying as risk assets sell off. The US curve starts signalling a looming cycle change as recession fears take over. As the first ECB hikes draw closer the central bank deploys its first line of defence for bond spreads, but it remains clear that a more credible backstop is needed

Accelerated richening 5Y point on the Treasury curve signals looming change in cycle

Risk-off sentiment dominated market trading for another session as recession fears grow. Front end rates have taken the lead lower as central banks’ tightening trajectories are reassessed, and 10Y UST rates have also slipped back below the 3% threshold.

Data on real consumption was disappointing but it will also have helped bonds rally that the latest inflation readings are not pointing to a further deterioration of the inflation outlook. The Fed’s preferred inflation indicator – the core PCE deflator fell more than forecast from 4.9% to 4.7% year-on-year. In the eurozone it was an in-line French CPI reading that offered some respite from central banks' ever tightening grip.

Bulls are back: 10Y Treasuries test 3% and the 5Y point comes in on the curve

The Fed has made it clear that it is willing to sacrifice activity to get a grip on inflation

However, the Fed has made it clear that it is willing to sacrifice activity to get a grip on inflation. For now it is in particular the ongoing strength of the labour market that has provided the Fed with the necessary confidence to maintain its hawkish posture. Next week’s jobs market data will thus provide an important piece to the puzzle and it could determine whether bond markets can maintain their newly found bullish dynamic and leave their peak behind with more conviction.

What we have already seen over the past sessions is an accelerated richening of the 5Y on the curve. While still on the high side trading 6bp above the interpolated line between the 2Y and the 10Y curve points, the 5Y point further coming down typically signals a pending change in the cycle.

ECB PEPP reinvestment flexibility starts as of today

The trickle of details surrounding the European Central Bank’s efforts to stave off unwarranted spread widening continues. As the first line of defence, the flexible reinvestment of pandemic emergency purchase programme (PEPP) maturities kicks off today, Reuters reported that the ECB has classified member countries into “donors”, “recipients” and “neutrals” based on the magnitude and speed of their recent rise in bond spreads.

From German, Dutch and French donors to periphery recipients

Germany, the Netherlands and France were identified as donors and the ECB would start rebalancing part of their maturing debt towards Italy, Spain Portugal and Greece. Earlier reports had put the average monthly PEPP redemption from “core” countries at around €12bn out of a total €17bn. Merely focussing on bond redemptions may underestimate and also wrongfully suggest this firepower is restricted to certain months with large redemptions – as July is. Unlike the public sector purchase programme (PSPP) the PEPP was allowed to buy money market instruments and the central banks’ securities lists do feature bills maturing over the next three months from all three donor countries.

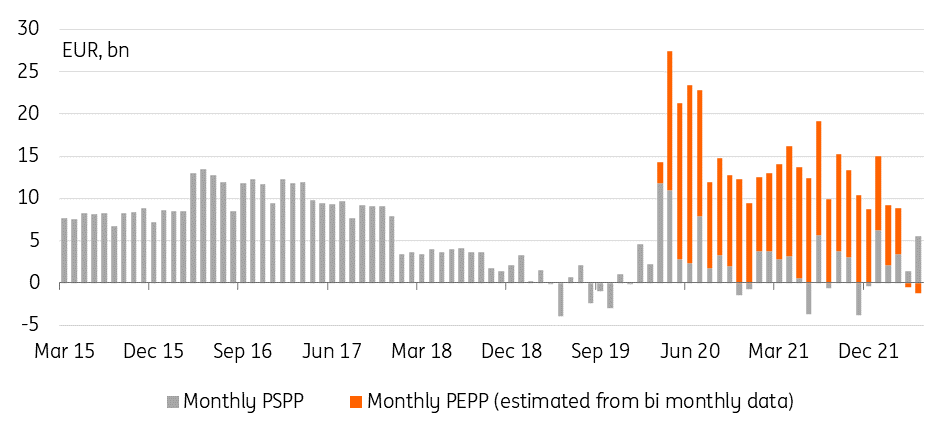

Monthly ECB net buying of Italian public sector debt (PSPP & PEPP)

Still, this cannot paper over the notion that the overall amounts pale in comparison to the monthly volumes the ECB bought for instance at the beginning of the pandemic when bond spreads threatened to spiral out of control. From the available data we derive monthly net buying volumes in Italy alone of above €20bn from April through July across the PSPP and PEPP. And that came paired with prospects of the ECB being able to maintain this pace for longer. It is a high benchmark for any tool to follow in the PEPP’s footsteps.

Today’s events and market view

Data is key as markets determine how resilient economies are in the face of tightening monetary policy and when the tipping point might be reached. The key release in the US today is the ISM manufacturing release As we know the Fed is ready to sacrifice activity and more weight could fall on the employment subcomponent also with a view to next week's job market data. More indications of softness here could help extend the bond market rally with Powell having emphasised the health of the job market.

EUR rates will be looking to the eurozone CPI estimate following the relief witnessed on the back of the German and French country readings. If not confirmed that may elicit the larger bearish market reaction. In other data we will see the final eurozone manufacturing PMI and alongside the first readings for Italy and Spain.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more