Rates Spark: More US-Europe decoupling

Signs of slowing economic growth abound but they only seem to affect EUR rates. USD rates are more circumspect heading into today’s FOMC meeting, where a 75bp hike is probable

FOMC focus and a 75bp hike; delivery of the market discount

It took some time for the Fed to move, but it's been up and running for a number of months now. A 9% handle on the latest inflation reading caused some to call for a 100bp hike from the Fed this week. We argued against that. The biggest reason? Inflation expectations have fallen. In fact, they have fallen significantly. The 2yr breakeven fell from 4.5% about a month ago to around 3% currently. This in fact looks too low, as to average at 3%, underlying inflation needs to get below that, and from a starting point in the 6% area.

A 75bp hike today, and the 5yr should richen further to the curve

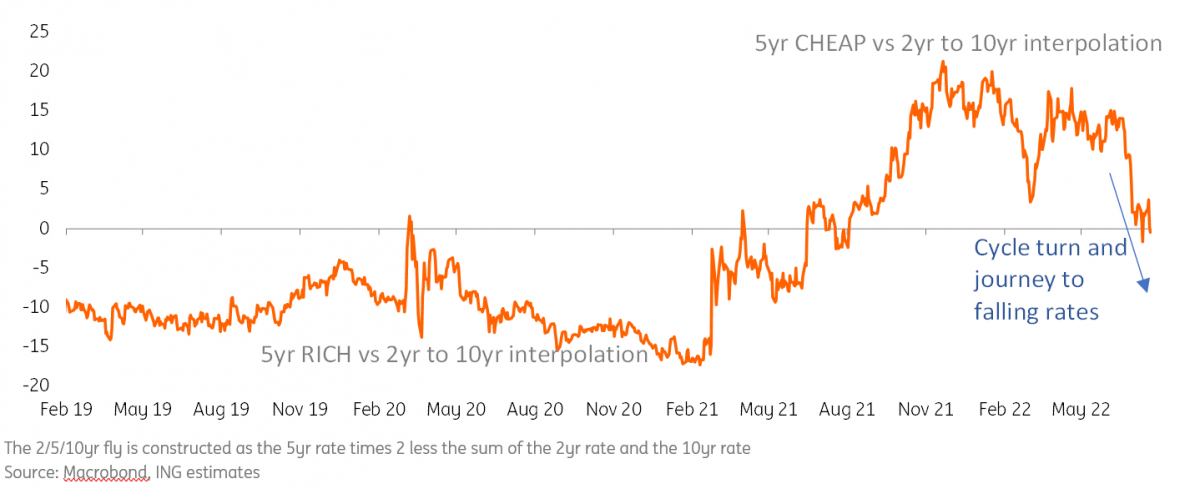

Chair Jerome Powell rationalised a 75bp hike at the June meeting as he saw inflation expectations on the rise (which is in fact questionable). But right now, inflation expectations have calmed considerably. Also, the curve structure has morphed from one discounting higher market rates to one that is not, as the 5yr area has moved from a point where it traded cheap to the curve to one where it is now a tad rich. A 75bp hike today, and the 5yr should richen further to the curve.

The positioning of the 5yr on the curve as a turning point signal

The signalling from the yield curve is that market rates peaked in the 3.5% area. That’s where the belly of the US curve got to about a month ago (the 5yr actually hit 3.6%), and since then the belly of the curve has richened notably, which suggests that we’ve seen the peak for market rates. The Fed will see this, and they will also see the significant fall in market inflation expectations (correlating with falls in nominal rates).

These market pressures point to 1) a reduced need to accelerate the pace of tightening (75bp is good), and 2) the possibility of reducing the pace of tightening at future meetings (say to 50bp). The US yield curve is under flattening pressure now as the Fed continues to hike. As the hikes begin to slow (which we see by the autumn), the next big move will be a steepening from the front end, as the curve begins to get ready for potential cuts at some point in 2023.

More gloom but European rates are still in the lead

The theme in Developed Market rates remains very much gloomy with energy shortages casting a long shadow over Europe's growth prospects, and US data confirming a similar direction of travel for the US economy. The more recent data confirms that widespread fears for the housing markets, suffering both from affordability problems and from rising mortgage rates, are warranted. As our economics team is fond of highlighting, this will feed into a negative contribution of the shelter component in CPI next year.

We expect further re-pricing of ECB hike expectations to also drag bond yields lower

We spoke in more detail in yesterday’s Spark about the downside risk to Bund yields, even below our medium-term 1% forecast. In a nutshell, we expect further re-pricing of ECB hike expectations to also drag bond yields lower even after yesterday's rally took yields to 0.92%. The other theme we highlighted, Bund yields decoupling from that of US Treasuries is also playing out. The 10Y spread has now widened back to close to 183bp, a level it failed to break in mid-July. It is unusual for the spread between the two to widen when rates drop, but a hawkish FOMC meeting could add to the widening. Longer-term however, as we expect the Fed to engage in a sizable cutting cycle in 2023-24, that spread should naturally re-tighten below 150bp.

Tentative signs of lower rates volatility are a good sign for risk sentiment

The good news for markets outside of rates is that low yields will eventually lead to lower rates volatility. Tentative signs of this are already visible in short-dated swaption markets. A fall in implied volatility after an event like last week’s ECB meeting is not altogether surprising. However, we think the magnitude of the move and the fact that it coincides with an adjustment lower in hike expectations make the move more significant. Our base case is that the combined effect of lower rates across the euro curve, and improving liquidity conditions as the summer ends, will result in durably lower rates volatility. This, in turn, will send a positive signal to other assets classes unnerved by the recent gyrations in rates.

Today’s events and market view

This morning sees the release of a number of confidence indicators from the likes of Germany, France, and Italy. Consumer confidence numbers are expected to plumb lows last seen at the worst point of the Covid-19 pandemic. Eurozone M3 money supply is expected to decelerate.

Germany is planning to sell €4bn 10Y Bunds which may well be its first sub-1% auction in the sector since early May.

US data consists of mortgage applications, the trade balance, pending home sales, and durable goods orders. The latter has the greatest chance to move markets but we expect rates to remain in a holding pattern going into the FOMC meeting. Housing data should confirm the slump in the sector after both house prices and new home sales missed the consensus yesterday.

The main event of the day will be after European hours: the Fed is widely expected (including by us) to shift its Fed funds target range by 75bp to 2.25-2.50%. Barring a surprise in the size of the hike, the main focus will be on hints about the size of the next move and whether growing recession risk is affecting the Fed’s thinking in any way.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more