Federal Reserve on track for another 75bp hike

It's been a volatile couple of weeks for interest rate expectations ahead of the 27 July FOMC meeting, but the market now appears settled on a 75bp hike. There are encouraging moves in gasoline prices, but we still look for 50bp hikes in September and November with a final 25bp hike in December. Recession risks linger with rate cuts our base case for summer 2023

Choppy markets, but 75bp remains the call

Following the 9.1% US inflation print and the surprise 100bp rate hike from the Bank of Canada, the market got behind the notion that the Federal Reserve could follow suit. On 13 July, 91bp basis was priced for the July 27 FOMC meeting decision, but comments from two of the most notable hawks (St Louis Fed President James Bullard and Board of Governors' member Chris Waller) saw doubts quickly emerge. While all options were on the table, they indicated they wanted to see strong numbers between then and 27 July to convince them that 75bp wasn’t the better option.

Last week’s retail sales and industrial production numbers were mixed and this week’s housing numbers have been poor. Last Friday’s University of Michigan sentiment index showed confidence amongst households is dire while, importantly, long-term inflation expectations dropped back. Waller had suggested that “if the data come in marginally stronger than expected it would make me lean towards a larger hike at the July meeting”. They certainly didn’t, so if Waller and Bullard aren’t voting for 100bp then it isn’t going to happen.

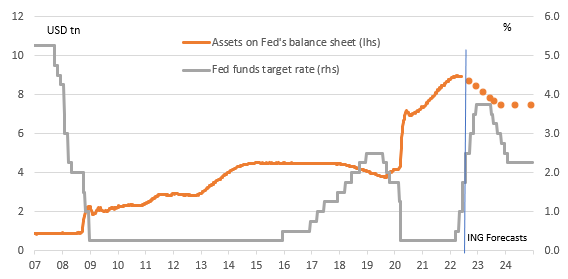

This leaves a 75bp hike as the strong call with three banks out of 62 surveyed by Bloomberg forecasting a “dovish” 50bp hike and just one predicting a more hawkish 100bp move. We are certainly in the 75bp camp with ongoing quantitative tightening to be confirmed while the market is hedging its bets a little, pricing around 80bp of hikes.

Fed funds rate and the balance sheet with ING forecasts

Another 125bp of hikes likely before year end

It’s clear that the Fed is not going to stop there. They've accepted that supply-side improvements will not come to their rescue to get inflation lower - hence the dropping of the "transitory" narrative - and they’ve recognised the onus is on them to hit the brakes on demand via higher interest rates.

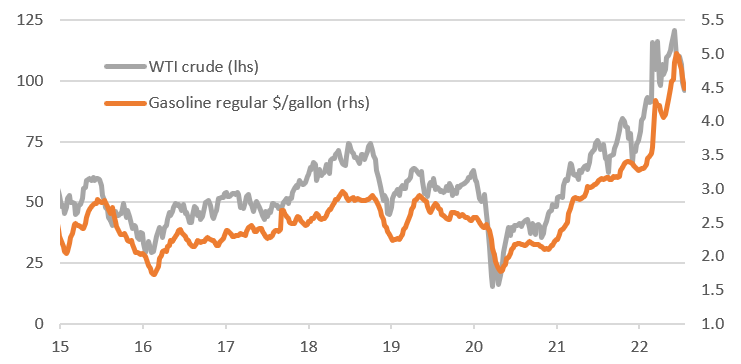

Recent falls in gasoline prices have offered some encouragement that 9.1% probably marks the peak for US inflation, but it is set to remain stubbornly high for at least the next six months. There is little sign of easing price pressures surrounding food and surging airline fares while the lagged effects of a red hot property market continue to feed through into the housing components. The strong jobs numbers recorded in recent months with unemployment at just 3.6% also point to more rate hikes ahead.

They will likely leave guidance on the scale of the next hike vague ahead of their September FOMC and forecast update, preferring to watch the data. Nonetheless, we think this will be the last 75bp hike and forecast 50bp hikes in September and November with a final 25bp move in December.

Inflation could fall quickly next year

As for next year, we strongly suspect rate cuts will be the key theme. By delaying their response to high inflation and now having to move policy faster and deeper into restrictive territory, there is clearly the fear of a recession. At the same time, we think inflation could fall sharply from March next year onwards.

The housing downturn that is underway looks set to sharply slow house price inflation and lead to a more modest contribution from the housing rent components within CPI (35% weight). We think this could knock a full two percentage points from the annual inflation rate. Used car prices have a 4.1% weight and have risen 53% since February 2020. We see weaker demand and greater supply of new cars potentially sparking major price falls that subtract another one to two percentage points from headline inflation. Then with interest rates dampening activity, which will likely compress company profit margins, plus some supply chain improvements I think we can get back to 2% by the end of the year. If gasoline prices were to fall back to say $3/gallon we could even be talking inflation below 1%!

Gasoline price falls to provide some relief

Rate cuts on the cards for summer 2023

The economy has been in a massive state of flux over the past couple of years and there are numerous paths it could yet head down. But our mindset is moving to one where authorities are frantically trying to get a grip on the inflation situation, but may end up overshooting. Credit spreads are widening out and the dollar has strengthened 12% this year and equities are down nearly 20%. Throw in sharp increases in interest rates as the Fed slams on the brakes and we could have both the economy and inflation being squeezed too much.

Moreover, interest rates don’t stay high for long in the US. Over the past 50 years, the average period of time between the last Fed rate hike in a cycle and the first rate cut has only been six months. This suggests the door could be open to rate cuts as soon as next summer.

The easing in market inflation expectations present a positive picture

The signalling from the yield curve is that market rates peaked in the 3.5% area. That’s where the belly of the US curve got to about a month ago (the 5yr actually hit 3.6%), and since then the belly of the curve has richened notably, which suggests that we’ve seen the peak for market rates. The Fed will see this, and they will also see the significant fall in market inflation expectations (correlating with falls in nominal rates). The fall in the 10yr inflation breakeven to 2.4% (from a 3% peak) is impressive, but even more stark has been the fall in the 2yr inflation breakeven from 4.5% in mid-June to a little over 3% now.

These market pressures point to 1. a reduced need to accelerate the pace of tightening (75bp is good), and 2. the possibility of reducing the pace of tightening at future meetings (say to 50bp). The US yield curve is under flattening pressure now as the Fed continues to hike. As the hikes begin to slow (which we see by the autumn), the next big move will be a steepening from the front end, as the curve begins to get ready for potential cuts at some point in 2023.

Money market technical conditions, however, are not a great look

We’ll be interested to see whether the Fed pays closer attention to front-end technicalities. From the June FOMC meeting, the reverse repo facility rate was pitched at 1.55%. However, SOFR has failed to hit this rate, only getting to 1.54%. In fact, it was initially in the low 1.40% range post the Fed hike as it failed to get even close to the fed funds floor. This correlates with in excess of $2trn going back to the Fed on this facility, as the rate offered by the Fed at 1.55% is a clear draw for money market funds. Not a huge issue. But at the same time not a great look. It also takes liquidity away from the repo market itself.

So far the Fed has viewed this as a facility doing its job during a period when there clearly remains an excess of liquidity in the system. At the same time, the Fed could also choose to battle against that by accelerating the roll-off of bonds on its balance sheet. Unlikely that they do, as the focus for now is on getting the funds rate to where it needs to be. But it should still be part of the conversation that the Fed needs to have with the market.

FX: Fed still offering a floor to the dollar

The correction in the dollar earlier this week appeared not only to be related to some recovery in risk sentiment but also to the growing narrative that other major central banks may close the gap with the Fed. The way this second theme impacts the FX market is obviously related to how much tightening is already priced in for the Fed and other central banks. We keep highlighting that the Fed’s pricing is in line with the Dot Plot projections and we don’t deem it too aggressive considering the US still has good economic momentum and lower exposure to geopolitical/commodity shocks.

On the other hand, the likes of the European Central Bank and the Bank of England are still seeing markets pricing in a very hawkish tightening path, somehow detached from the evidence of looming slowdown and major exposure to global risks, which raises the risk of dovish repricing hitting their currencies.

With this in mind, unless the Fed sends some dovish signals along the lines of the July policy announcement, we think that the 75bp rate hike can fit well into a largely supportive dollar narrative on the monetary side.

Our view is still that the dollar will start edging lower in the autumn, but the risks to this scenario are admittedly high, and mostly boil down to the magnitude of the growth divergence between the US and other parts of the world (especially Europe).

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more