Rates Spark: Markets have turned complacent to inflation risks

The rise of oil prices against a backdrop of turmoil in the Middle East has not translated to higher euro inflation swaps. Markets are underestimating the possibility of upside risks to inflation materialising more broadly. The US refunding numbers are due on Wednesday, but we got the Treasury lead in numbers, which show less net issuance than expected

US refunding precursor has good news and bad news

The US Treasury released its estimates for net borrowing through January-March 2024. Contrary to most expectations, there was a $55bn downward revision to $760bn (prior estimate was $815bn). The swing factors were a combination of a higher beginning of quarter cash balance, and higher net fiscal flows. The former was largely known, but the latter was a surprise to most, and is likely reflective of decent tax revenues, which in turn is reflective of economic robustness. The Treasury noted “despite many uncertainties and headwinds, the US economy proved resilient and strong in 2023 and remains well-positioned as we move into 2024”.

The release also showed a “recommended” refunding scheduled for the first quarter. It shows an increase in issuance for all tenors for the February refunding. But then for March and April, issuance sizes continue to rise in short-dated securities (2yr out to 7yr), while there are reductions in issuance sizes for longer maturities (10yr to 30yr). Even with the reductions for March and April, issuance sizes for longer tenors are higher than seen for January.

In total, total net issuance for the first quarter is set out at $984bn. That compares with $921bn for the third quarter of 2023. That is still an increase, but not as large an increase as many had feared. The market reaction has been focused on the headlines that talk of the lower-than-expected net issuance for the second quarter. There is less reaction to the higher issuance right along the curve still for February, and suggestions that even with a cut in long-dated issuance sizes for March and April, they are still above the levels seen in January,

These are not the final refunding numbers. We will see these at 8:30am EST on Wednesday morning. But the indications based off the Treasury release today point to another iteration of higher net issuance, the weight being felt by shorter tenors, but with longer tenors too seeing some increase in auctions sizes. Not enough here to push the 10yr back below 4%, and the market will reserve judgement until we see the final refunding intentions on Wednesday morning.

Euro rates seem indifferent to inflation risks from higher oil prices

Another weekend of unrest in the Middle East reminds us of the geopolitical risks that continue to loom. So far financial markets seem resilient to much of the escalation worries over the past weeks. But slowly oil prices have been creeping up with Brent now trading above $80 per barrel. Also, the supply disruptions around the Strait of Hormuz seem to persist and a retaliation to this past weekend’s attacks by the US is likely forthcoming.

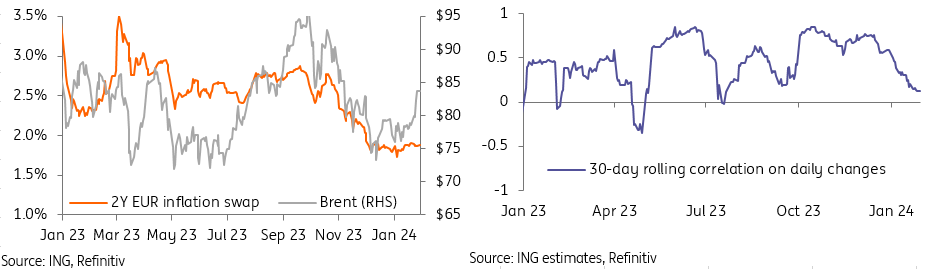

The resilience of markets may also be a sign of complacency. Despite a 10% increase in oil prices over the past month, euro forwards continue to price in rate cuts earlier and earlier. The European Central Bank’s push back against premature cuts has been feeble, but some have also cited a geopolitical escalation as a source of inflation risk that would warrant moving cautiously. The 2-year EUR inflation swap yields in the figure below illustrate the disconnect with oil prices most clearly, moving completely sideways since the beginning of this year. In our view the aggressive pricing of rate cuts by markets may underestimate the upside risks to inflation. Markets now seem to be more sensitive to ambiguous hints from ECB speakers that cuts are incoming than to the more classical inflation drivers.

EUR inflation swaps seem to disconnect from oil prices

Also, our economists still see upside risks to inflation in the coming months. Besides geopolitical risks, a number of government measures will expire, resulting in more price pressures in, for example, Germany and France. In addition, selling price expectations have been picking up again. Markets are currently positioning for an almost perfectly smooth return to the inflation target, which might be on the optimistic side in our opinion. Some upside surprises may materialise in due course which would nudge 2-year yields back upwards.

Tuesday's events and market view

Tuesday's GDP figures in the eurozone may be able to shed some more light on the growth dynamics, which in our view will remain in stagflation mode. If indeed GDP figures do not turn into severe recession territory, we do not believe the ECB will be persuaded to cut rates as early as April. A first rate cut in June remains our baseline.

Consumer confidence figures of both the US and the eurozone should provide some insights in the underlying strength of consumer spending. US confidence is expected to remain high, while a continuation of last month's rebound is expected for the eurozone.

Next to a busy data release calendar, a total of four ECB speakers are scheduled, ranging from hawkish (Vujcic, Vasle and Nagel) to dovish (Lane). Together these speakers should provide plenty of material for markets to ponder over so some rate movement can be expected.

In terms of supply, Germany has announced a 30-year syndicated deal and Greece a 10-year deal. They come on top of already announced auction issuance in the form of a new 2Y bond from Germany and 5Y to 10Y taps out of Italy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more