Rates: Italian hiccup for core

We continue to target 3.25% to 3.5% for the US 10-year and the 50bp to 100bp range for the 10-year German Bund (QE decision dependent)

“Quitaly” worries drove Bund and Treasury yields lower. But back now to a re-test higher in rates

The big dip in the US 10-year yield back below 3% was undoubtedly driven by the build of an Italy exit discount. ‘Quitaly’ remains a low probability event, but did require a price discovery exercise. One week later and Italy is still stranded in the 250bp area over 10yr Germany, but the US 10yr yield has managed to recover and now looks to have an appetite to get decisively back above 3% again. Our view is it will, and we remain of the opinion that it will remain above 3% for a number of months, if not quarters.

Still, these are dangerous times for Italy; elevated spreads maintain a worry discount

That, of course, assumes that ‘Quitaly’ remains in the black swan box. One problem here is Italy does not actually need to leave the eurozone for the market to discount it, and indeed discounting it is a clean way of giving Italian leaders a proper smell of what it could be like. There was an element of that last week; decision makers in Italy would have experienced at first hand the sense of helplessness that would obtain if the market were to begin to believe that an Italian exit could be on the radar screen.

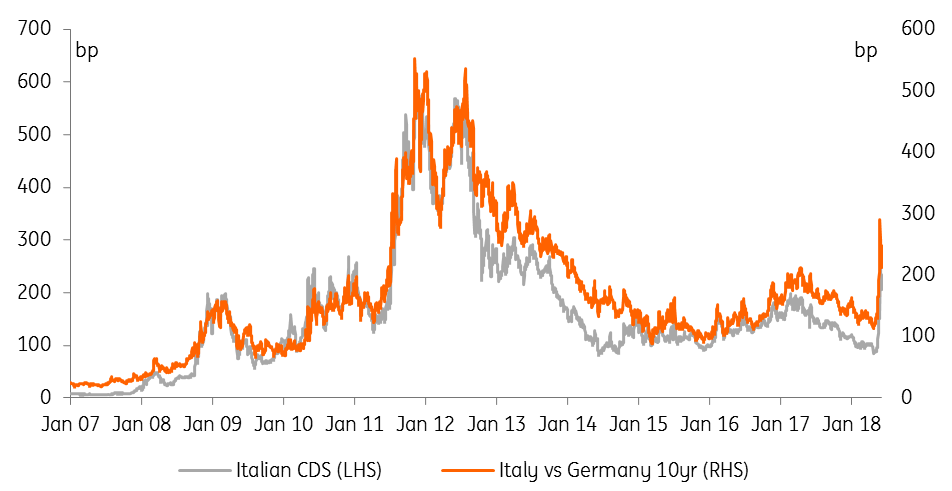

Italy CDS briefly got to Nigerian levels. Lower since, and still well below the bigger Greek worry

The question is whether this has had the desired effect. And the answer is not that clear. Italian credit default swaps (just like the spread to Bunds) have come off their highs, but remain very elevated. In fact, they rose to levels above the likes of Nigeria and Egypt at one point (and now having fallen back are still just 40bp through Nigeria). Still, Greek CDS is some 100bp wider than these African states, which illustrates the market view that Greek vulnerabilities are still significantly more elevated than Italian ones.

Italian CDS vs Italy 10yr spread to Germany

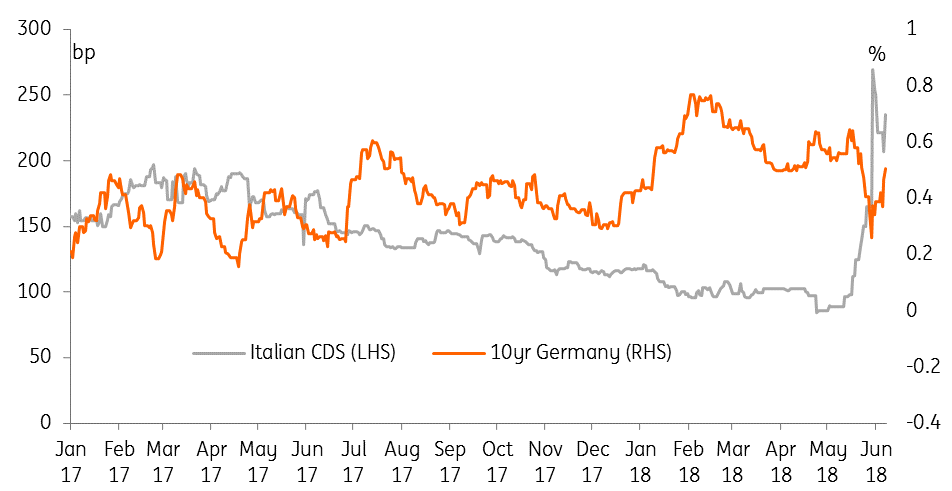

That aside, the central discount is Italy would commit economic suicide by leaving. Hence Bunds have recovered

That in part explains why core rates have managed to regain their poise, with not only the US heading back towards 3% but the 10yr Bund looks to have a re-take of 50bp in its sight (after having briefly touched the depths at 18bp). As angst recently crescendoed, the realisation dawned that Italy could not risk the economic suicide that euro exit would bring with it. And especially for Italy, as it would have further to fall, and would likely land with a far bigger thump (vs Greece). Hence, Bund yields are back up despite the maintenance of wide Italian CDS spreads.

Italian CDS vs Germany 10yr yield

We continue to target 3.25% to 3.5% for 10yr US and the 50bp to 100bp range for 10yr Bund (QE decision dependent)

Will all of this dent Fed rate hike ambitions? Unlikely, at least there would be no reason to abort the next planned move(s). The same thought process is in play for market rates, as long maturities will continue to reflect an estimate of where a rolling exposure to short rates would average out at, plus a premium. And, importantly, that premium is still not priced adequately. So even in the case where euro troubles manage to shave one or two hikes off the terminal rate, there is still room for the 10yr to edge higher. We maintain a target of 3.25% to 3.5% for the 10yr US and 50bp to 1% for 10yr Germany in the coming months. The wider range for Germany reflects an ECB QE unwind surprise factor, as despite talk of an extension, the ECB could still abruptly end QE by 4Q.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

8 June 2018

ING’s June Economic Update This bundle contains 8 Articles