Rates: Just 30bp, seriously?

This July, rates remain under wraps due to dollar strength, geopolitics and a resistance by central banks to hike rates

The 'too low' 30bp German 10yr yield

The fall to sub 30bp for the 10yr German yield is remarkable when contextualised against an ECB intending to (1) end quantitative easing (QE) this year and ready to (2) raise rates next year. While there is lots of talk about a weakening economy, that’s neither the driver nor a persuasive argument. We think there are two dominant influences, which added to a number of sideshows, are keeping rates under wraps.

Dollar strength

The first of the dominant influences is dollar strength and the risk that more could still be in the works. The transition mechanism here is chiefly through emerging markets, as the firmer dollar has exposed vulnerabilities in the likes of Turkey and Argentina, among others. While there has not been mass contagion, there has been correlation and outflows generally from risk assets as a result. The counterflow is into core bonds.

And by the way, the ECB’s intention to exit QE has seen the bid falter in investment grade Euro corporates too, adding to strain in lower rating product.

The Eurozone factor

The second dominant influence is Italy and the wider Euro project. This is a big driver for flows into Germany in particular. A decent rump of the bid to bunds is driven by its hedge quality should things ever turn sour; effectively it is a long in a Deutschmark proxy. Pension funds will always be forgiven for over-allocating in the ultra-safe core.

The market's questioning rate hike ambitions

The various sideshows then centre on geopolitics, the trade war narrative (which risks becoming a dominant influence, but we’re not there quite yet) and market chatter on resistance to future hikes from central banks. For example, there is no conviction rate hike discount for the Fed above 2.75%, and many doubt the ECB will be in sync enough with the current upturn to get any material traction on a 2019/20 rate-hiking cycle.

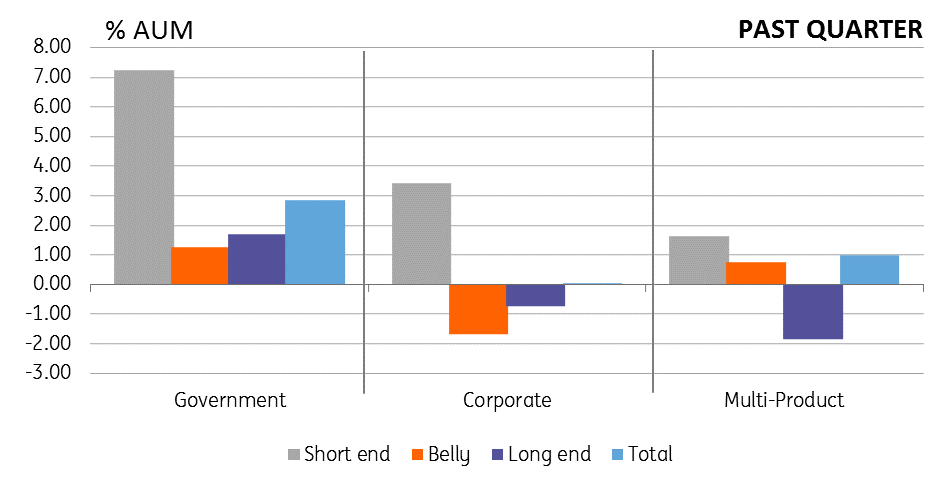

This all leaves investors with a nervousness on being too short carry, and the average investor has been slowly liquidating some of the over-exposure on the front end of the yield curve and fading longs back into the belly and long end funds. This can be clearly gleaned from flows data in the past month, although on a 3-month snapshot we still find a heavy overweight build in the front end over the back end (implied duration short).

Change in assets under management – last month

Change in assets under management – last quarter

The 3% 10yr US remains in the rear view mirror

In consequence, the 10yr Treasury yield finds the path of least resistance is lower, with 3% now seen as a hurdle too far, at least for now. That all said, our US macro model for rates continues to flag fair value at north of 3% but below 3.5%; essentially we find that market rates should be 100bp above the normal rate, which we identify as 2.25% (flat to core inflation). Bund yields would correlate higher and should rise by more.

As our US economist eloquently notes, this is a near 7% nominal growth rate environment. It won’t last, but there is a window ahead for rates to re-test higher again.

Download

Download article6 July 2018

Global Economic Outlook: Trump’s Trade Gamble This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more