Rates: All the 2s in 2020

The rates profile for 2020 has a particular focus on the 2s when it comes to the global benchmark (the US). Or more correctly, the sub 2s. That describes the growth, inflation and 10-year yield prognosis. It's L-shaped in the sub-2% area, but with a downside bias as a central risk. We could see breaches above 2, but the central tendency is resumption below

The logic for higher rates in 2020 is there. The US 10-year yield trades with a negative term premium of -90 basis points. That suggests the 10-year yield is far too low. Inflation expectations from the TIPS market pitch inflation in the next 10 years at 1.75%. That's a 25bp discount to current inflation in the 2% area; it should be a 25bp premium. That's a 50 basis point deviation from a "fairer value". Meanwhile, the US consumer is very confident and the labour market is firm. Our basic macro model pitches fair value for the 10-year at 2.25% to 2.5%.

But to get there will prove quite difficult in 2020 on account of a number of other competing drivers. There is still very strong demand for fixed income. This comes from pension funds looking to match liabilities which are discounted with something close to the risk free rate. Also from banks, which must fill liquidity buckets, and remain big buyers of core bonds globally. Central banks also hold a significant rump of core government bonds through quantitative easing programmes, and these holdings will increase by $1 trillion in 2020.

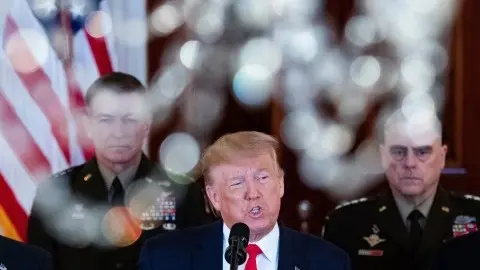

On top of that, uncertainty with respect to the rules of engagement remains. We are one tweet away from a pivot in policy, and a key election event awaits in November. The best barometer of how this is affecting sentiment is in manufacturing surveys, which are below 50 in the US and still well below that threshold in Europe. Then from a technical perspective we find that yield curves remain quite flat, implying a muted forward uplift. And curve structures remain bullish (5-year trading rich to the wings, both on the US and European curves).

Things have improved through. The Chinese PMI is back above 50 and European PMIs look to have troughed (albeit at uncomfortably low levels). Imminent recession risk in the US has also receded. Tensions in Iran have been tamed for now. Brexit is more certain. And trade tensions have diminished. That all being said, the risks here remain elevated, which is why the US 10-year has struggled to break back above 2%. It could do so now though, and has a window in the coming weeks, but it's unlikely to stay there. There are just too many balls being juggled, and it only takes one of them to fall. That would take the 10-year back below 2%, to that famed sub-2% zone.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 January 2020

January Economic Update: Turbulent twenties This bundle contains 7 Articles