President Trump and the Fed - we’ve changed our view

President Trump is ratcheting up the pressure on the Fed to support his efforts on extracting concessions from China on trade. Policymakers appear reluctant, but market moves and other central bank actions look set to give them a nudge. This is why we think it looks increasingly likely that the Fed will step in with two 25bp cuts in September and December

President piles on the pressure

President Trump has been active again on Twitter this morning, saying that the Fed must make “bigger and faster” interest rate cuts and that it as an institution is “too proud to admit their mistake” of - in the President’s view - raising interest rates too aggressively over the past couple of years.

The latest blast follows the sharp sell-off in equities, but the President is also likely to have been irked by the fact that other central banks around the world are easing by more than expected. Today, we saw surprisingly aggressive moves from India, New Zealand and Thailand's central banks. At the same time, the European Central Bank appears to be gearing up for more aggressive stimulus in response to weak growth and low inflation. Meanwhile, in the Federal Reserve, President Trump has a central bank that seems far more reticent to offer the kind of support he feels is necessary as he battles China over trade practices.

In the Fed, President Trump has a central bank that seems far more reticent to offer the kind of support he feels is necessary as he battles China over trade practices

Yesterday, St Louis Fed President James Bullard, arguably the most dovish voting member of the FOMC, pushed back against the market pricing four further 25bp rate cuts over the next 18 months. He admitted that in June he was one of the eight FOMC members to have pencilled in 50bp of policy easing this year to the Fed “dot plot” and said his view has not changed dramatically since then. After all, the US is “not in recession mode here” and that “monetary policy cannot reasonably react to the day to day give and take of trade negotiations”.

Today, Charles Evans from the Chicago Fed talked similarly. He acknowledged the risks have "gone up", which can justify "more accommodation", and acknowledged the other central bank moves, commenting that "once a substantial number of central banks consider repositioning their monetary policy, it's natural that other central banks might be thinking that too".

Trade proving tricky

For now the US economy is in far better shape than other developed markets. Unemployment is low, growth remains “solid” and wages are rising. It was this contrasting story that had emboldened President Trump to push hard on trade with the narrative that trade partners would be desperate to cut a deal.

We simply don't have the visibility on the outlook for trade policy to give us much confidence in our forecasts when President Trump appears to over-rule his trade negotiation team on a whim

It hasn’t worked out that way with China offering domestic monetary and fiscal stimulus whilst also allowing the yuan to weaken against the dollar. Moreover, there is growing evidence that the US activity story is softening, with particular concerns over investment spending. Certainly, escalating trade tensions through higher tariffs and restricted access to markets is hurting sentiment, increasing costs, damaging supply chains and weakening corporate profitability. And the knock-on effect is that this deters companies from putting money to work, such as delaying investment decisions and hiring fewer workers – or even raising the prospect of lay-offs in key impacted sectors such as export manufacturing. This then feeds through into consumer sentiment and spending more broadly in the economy with recession risks mounting.

It is important to point out that this is in the realms of the “worst-case scenario”. We simply do not have the visibility on the outlook for trade policy to give us much confidence in our forecasts when President Trump appears to over-rule his trade negotiation team on a whim. It may well be that in the next couple of weeks he rows back on the prospect of additional tariffs. Alternatively, he could go harder.

Things set to get worse before they get better

Our assumption is that the tensions will escalate over the next couple of months, which will add to economic headwinds and result in weaker growth. China talks of the need for “respectful” negotiations, which it doesn’t feel it is getting when President Trump takes unilateral decisions, so there is little incentive to offer anything meaningful until there is.

This runs the risk of the US ramping up the pressure on China and further weakening global sentiment and economic activity. With commodity prices falling broadly, particularly oil which is in a bear market, and with the dollar remaining in the ascendancy there are more downside risks for headline inflation too.

Markets are priced for the worst

The market is ramping up the pressure for action

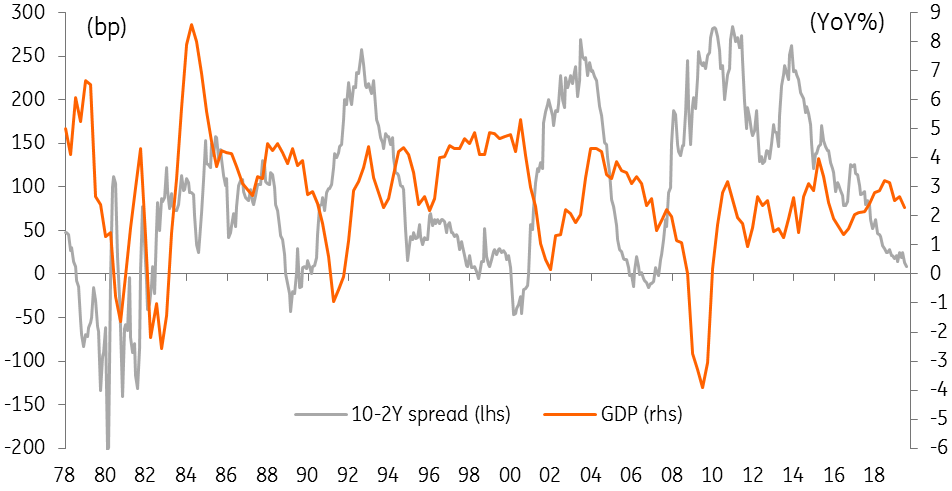

The ever flattening yield curve is also adding to a sense of nervousness. All nine recessions since 1955 were preceded by an inverted yield curve and we are there already on the 3M-10Y and only 8bp away on the 2-10Y. However, there have been false signals before and this time we have to recognise there are factors in play that are depressing longer US dated yields and thereby perhaps overhyping the threat of a recession.

What worries us more about a flat/inverted US yield curve is that it hurts banks and can disrupt and deter the process of credit creation

The lagged effects of the Fed’s quantitative easing programme is making the curve flatter than it otherwise would be (relative to previous cycles) while negative yields in Europe are also contributing to the demand for US Treasuries given the US safe-haven status and the fact investors at least get a positive return and the dollar remains strong.

What worries us more about a flat/inverted US yield curve is that it hurts banks and can disrupt and deter the process of credit creation since banks typically receive long term and payout short-term. This means weaker profitability while setting off warning signals about future credit quality in risk models. Less willingness to lend can, therefore, contribute to making the bond market’s downturn expectations self-fulfilling.

Yield curve recession warning

Fed set to cut rates further, but not as much as the market wants

All of this suggests to us that our current forecast of just one further Fed rate cut in September is looking too cautious. Growth risks and inflation risks are looking increasingly to the downside in the wake of the latest trade escalation. With other central banks easing aggressively, this risks exacerbating upside pressure on the US dollar, which could further dampen growth and inflation and add to the pressure on the Fed to ease policy.

It looks increasingly likely that the Fed will step in with more easing – with two 25bp cuts in either September and October or September and December (our preference)

As such it looks increasingly likely that the Fed will step in with more easing – with two 25bp cuts in either September and October or September and December (our preference). In this regard, the Jackson Hole symposium 22 -24 August will see a lot of Fed discussion on this topic with Fed Chair Jerome Powell’s favourite phrase of late that an “ounce of prevention is worth a pound of cure” likely to crop up again.

Though, we continue to doubt that the market will get the four additional rate cuts they are discounting. After all, we think that President Trump wants to be re-elected next year and recognises that a robust economy with rising asset prices is critical for that to happen. We continue to look for a “deal” even if not all of President Trump’s demands are met later this year.

Relief in business and markets that trade uncertainty has been lifted and with interest rates globally offering a decent stimulus, may well give President Trump what he needs.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 August 2019

What’s happening in Australia and around the world? This bundle contains 14 Articles