Portugal: Riding the growth wave

Portugal's economy will grow more than 2% this year, helped by some mild fiscal stimulus. But with lingering bank issues, a spending splurge is unlikely

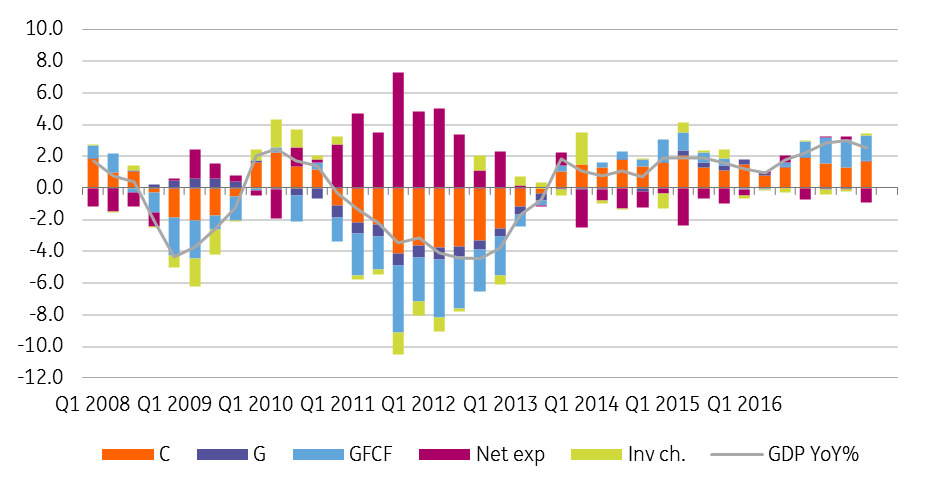

Domestic demand drives growth

The Portuguese economy is still riding the growth wave with no sign of a slowdown. In 3Q17, private consumption (which added 1.7% to growth year-over-year) and gross fixed capital formation (which contributed 1.6% YoY) were confirmed as the main drivers of annual GDP growth. Despite a substantial export drive, net exports acted as a drag on growth (-0.9% YoY).

Investment recovery and surprisingly strong employment

With capacity utilisation almost back to pre-crisis levels, a recovery in private investment was expected. The improvement in private consumption came somewhat as a surprise, however, though this was consistent with unexpectedly strong employment and recovering wage growth. Data on employment expectations suggests that this pattern might continue in the short run, but could soften over time, as the current high elasticity of employment to GDP looks unsustainable. The recent decline in productivity already signals some potential future strain in cost competitiveness.

Domestic demand traction continued unabated (contribution to YoY GDP growth)

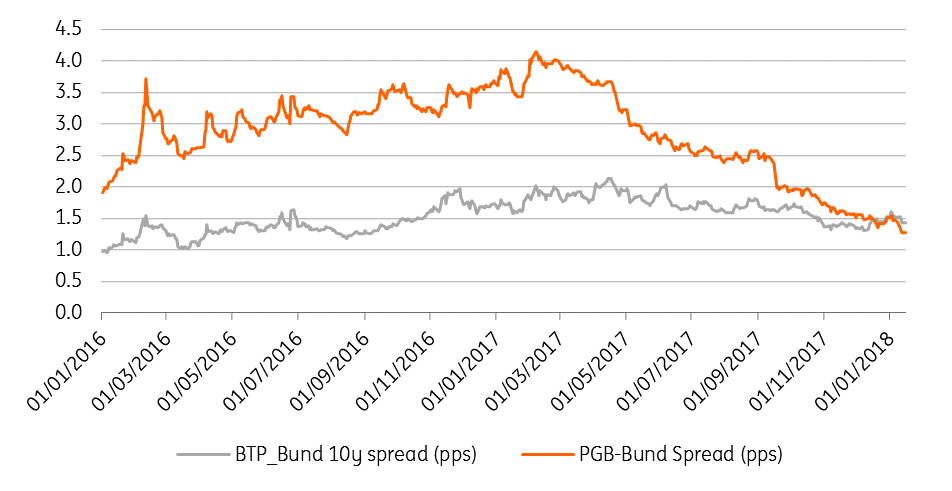

Strong growth and fiscal adjustment at the heart of a two-notch upgrade

Above-potential GDP growth had a positive impact on fiscal data, putting the 1.5% deficit-to-GDP target for 2017 well within reach. The concurrent expected decline in the debt-to-GDP ratio was an additional piece of evidence that led Fitch to upgrade Portugal by two notches in December. We expect Portugal's fiscal stance to remain mildly expansionary in 2018, which should help the economy to grow slightly more than 2% over the whole year.

Growth and adjustment mix did the magic: now 10y PGBs trade through Italian BTPs

Mild fiscal push to support GDP growth in 2018, but lingering bank issues suggest prudence

Room for laxer fiscal policy remains limited, though. Despite the ongoing deleveraging and improved financial stability, Portuguese banks’ balance sheets are still burdened by a heavy load of non-performing loans. Keeping some fiscal room for a rainy day could still be prudent. With the Portuguese finance minister Mário Centeno now heading the Eurogroup, the risk of Portugal indulging in any fiscal splurge looks very small indeed.

Download

Download article

18 January 2018

ING’s Eurozone Quarterly: All systems go This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more