Policy implementation and infrastructure building are key to US hydrogen development

The US has huge hydrogen growth potential as the Inflation Reduction Act and the Infrastructure Investment and Jobs Act have spurred investor interest and project announcements. But these projects need clarity on policy implementation to move faster. Improved infrastructure is also key for the US to benefit from domestic and global hydrogen markets

Over the past fifteen months or so, the US shook up the global clean energy market—including that of hydrogen—with the signing of the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA) With $13bn of tax credits between 2023 and 2032 for clean hydrogen projects, as well as $9.5bn of funding through 2026 for clean hydrogen program development, these two pieces of legislation are highly expected to reduce clean hydrogen production costs, attract developers to advance their projects, and put the US on a level playing field with Europe for clean hydrogen development this decade. It is estimated that both the US and the EU will each produce around 3mn tonnes (Mt) of blue hydrogen (from fossil fuels using carbon capture and storage, or CCS) in 2030, although green hydrogen production (from electrolysis using renewable energy) in Europe (5 Mt) will still be a lot higher than the US (less than 1 Mt).

Now that the policy is in place in the US, what is needed to ensure the best use of this support? In this article, we suggest that the keys to success are clear guidance on policy implementation, a stronger focus on supply and end-use diversity, and as increased dedication to improving hydrogen infrastructure.

Hydrogen tax credits: all eyes on guidance and implementation

The IRA provides clean hydrogen projects with ten-year production tax credits (PTCs) of up to $3 per kg of hydrogen produced. In a simplified way, if the current product cost of a project is at $4/kg, then that cost could be lowered by a maximum of $3/kg to $1/kg. Alternatively, project developers can receive one-time investment tax credits (ITCs) of up to 30% of the cost of a qualified clean hydrogen (or hydrogen storage) property.

The highest levels of hydrogen tax credits are granted if a project’s lifecycle greenhouse (GHG) emissions do not exceed 0.45 kg CO2/kg H2 and if it fulfills the IRA’s labor and wage requirements. If the requirements are not met, then project developers will earn tax credits based on the baseline scheme.

To meet the labor and wage requirements, developers need to pay their workers the minimum wage set by the Department of Labor and use at least 12.5% of the labor hours from workers registered under the federal apprenticeship program or a state-level equivalent. There were roughly 600,000 active registered apprentices in the US in 2021, but large discrepancies exist across geography and industry. Therefore, it is not by default that developers can meet this requirement, especially with detailed rules pending.

IRA hydrogen tax credits with labor and wage requirements fulfilled

IRA baseline hydrogen tax credits

The clean hydrogen tax credits, if applied at their highest levels, can significantly lower the levelized cost of green hydrogen production in the US this decade. Assuming the $3/kg H2 PTCs are applied and stay in place, we expect the costs of green hydrogen in the US to be competitive with those of grey and blue hydrogen by 2025 and to become negative by 2030. The PTCs will expire in 2033, and it is uncertain whether the PTC rules will be changed prior to 2033 if the cost of green hydrogen production falls below zero. Whenever the clean hydrogen PTCs expire, developers and investors need to be prepared for a short-term cost increase in their projects.

In the case of blue hydrogen, the new PTCs can already put production cost in a competitive range with grey hydrogen today. But blue hydrogen will face challenges from green hydrogen in the years to come. Blue hydrogen will likely not be able to qualify for the highest level of PTCs—most possibly at $0.6/kg H2—due to higher life-cycle emissions. This is because not all the carbon is captured from CCS, the potential for methane leaks exists, and electricity consumed in production might not necessarily be generated from renewable sources. Therefore, blue hydrogen developers can choose to apply instead for CCS tax credits, which will be easier for them to qualify (CCS and hydrogen credits cannot be combined).

US levelized cost of hydrogen production estimate before and after the IRA

Thanks to the cost reduction potential, particularly in green hydrogen, the PTCs will drive more project development and accelerate final investment decisions (FID) from announced projects. Moreover, the current law allows hydrogen tax credits to be combined with hydrogen storage ITCs, as well as with renewable energy credits if the electricity used by a hydrogen plant is generated from such sources. These rules will benefit vertically integrated hydrogen plants to receive multiple credits.

Nevertheless, policy implementation is a major risk that can add uncertainties to developers’ revenue streams, project timelines, and investor appetite. The IRA specifies that for the consideration for tax credits, hydrogen project emissions will be assessed on a ‘well-to-gate’ basis using the Greenhouse gases, Regulated Emissions, and Energy Use in Transportation (GREET) model. This means that emissions from both producers’ electricity consumption and hydrogen delivery will be counted toward total carbon intensity. At the time of writing, there has not been specific guidance on how to calculate the emissions.

This raises two questions. First, how can hydrogen producers demonstrate the use of clean electricity in their operations? One way is to purchase renewable electricity directly from a generator without going through the grid; another way is to have a renewable electricity plant integrated into the hydrogen facility. If a hydrogen project chooses to take electricity from the grid, power purchase agreements (PPAs) and renewable energy certificates (RECs) can be used to demonstrate electricity purchase (and could be a preferred method), but further policy guidance on this matter is required. Policy guidance might also consider addressing the ‘additionality’ argument—that electricity demand from new clean energy projects should come from extra renewable electricity capacities—by requiring hydrogen producers’ purchased PPAs and RECs to come from new renewable plants.

Second, how should developers calculate the carbon intensity of hydrogen delivery? According to consultant ICF, transporting gaseous hydrogen through pipelines for 750 miles would increase life-cycle hydrogen project intensity by 0.5 kg CO2/kg H2, a number that could significantly increase if the hydrogen is liquefied and/or transported via diesel trucks. Therefore, to maximize the IRA tax credits, developers must carefully evaluate offtakers’ locations and hydrogen transport options (more on hydrogen transport later). Longer-distance delivery of clean hydrogen could bare more cost from having to take further measures to lower transport carbon intensity.

These two questions require further answers from the US DOE and Treasury. Challenges associated with tax credit implementation could add to project delays and make it harder to source financing. However, these potential concerns have not discouraged developers and investors, who remain confident about the benefit potential of the IRA’s tax credits. The more quickly guidance rules are out, the faster the projects will be expected to move to their next stages.

Comparatively, the EU recently released proposed rules on the definition of renewable hydrogen. These include additionality of renewables (imposing from 2028 a 36-month limit between the start of hydrogen production and renewables generation), a temporal requirement to hourly match hydrogen production and renewable electricity use starting 2030, and a geographical requirement for the renewable and hydrogen plants to be in the same power market bidding zone. Nevertheless, considerable challenges exist when it comes to implementation, which could trigger the US to think harder about the strictness and implementation timeframe of its own standards.

Funding through the IIJA will enhance the network effect and end-use diversity

A helpful addition to the IRA’s tax credits, the IIJA is allocating $9.5bn in funding between fiscal years 2022 and 2026 for clean hydrogen development. This includes $8bn to fund at least four clean hydrogen hubs (‘H2Hubs’), $1bn to advance electrolysis processes and reduce the cost of clean hydrogen production, and $500mn to strengthen domestic supply chains.

For H2Hubs, the DOE, the agency in charge of funding execution, is looking to fund both green and blue hydrogen hubs. The IIJA attracted some 80 hydrogen hub projects to submit proposals for federal funding in 2022. In early 2023, the DOE notified 33 of these projects to submit a full application. These include the Horizons Clean Hydrogen Hub (HCH2) by the Port of Corpus Christi Authority; the Northeast Regional Clean Hydrogen Hub proposed by New York, Massachusetts, New Jersey, and Connecticut to produce green hydrogen for the utilities sector; the Western Interstate Hydrogen Hub to be developed by Colorado, New Mexico, Utah, and Wyoming; and a hub proposed by Arkansas, Louisiana, and Oklahoma.

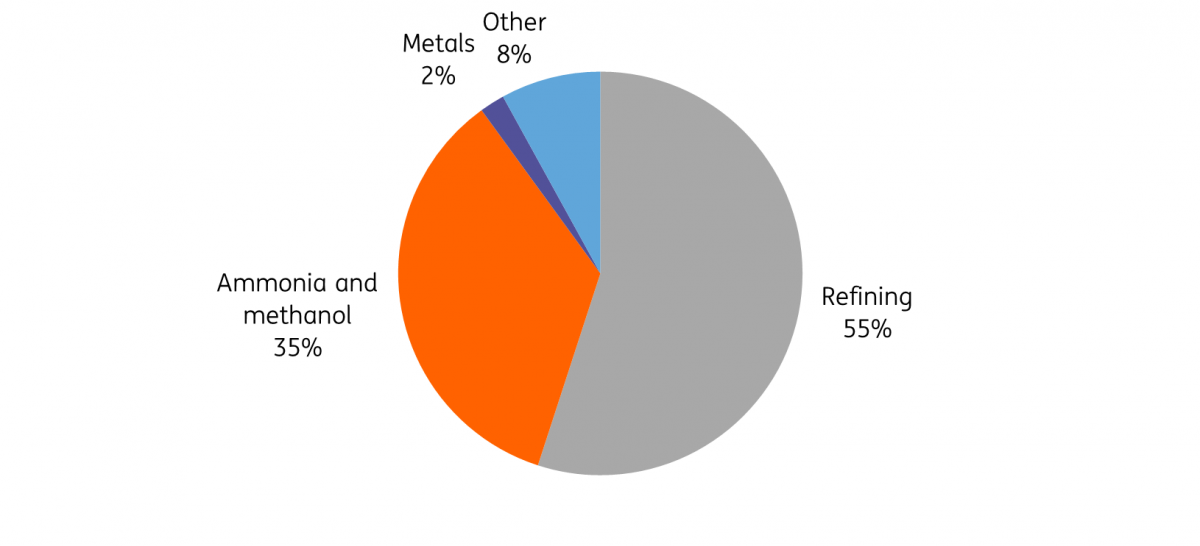

An added benefit of the H2Hubs program is the opportunity to push for a more diverse mix of hydrogen end-use applications. Refining is by far the largest industry for hydrogen consumption in the US, accounting for over half of total demand; the second largest use is to produce ammonia (88% of current total ammonia consumption is for fertilizer production) and methanol. But many more applications—such as heavy-duty trucks, steel production, and power-to-liquid fuels—have the potential to become more popular and economically desired in the future. Early decarbonization efforts are already happening in these end-use sectors globally: in steel production, for example, H2 Green Steel is receiving debt financing from financial institutions including ING to develop a green steel plant in Sweden.

In the US, the DOE has suggested that a wide range of applications will come in waves to the domestic clean hydrogen market, based on their attractiveness and breakeven period. The H2Hubs program can become more effective if funding selection is aligned with the scale-up of hydrogen use in a variety of sectors and the necessary infrastructure to link production with end use is established.

Hydrogen consumption in the US by end use, 2021

Development of clean hydrogen to come in phases in the US

Based on relative attractiveness and breakeven period in each end-use application

That said, these hydrogen hubs will become the backbone of the development of hydrogen in the US, as clustered projects will be able to take advantage of shared funding, infrastructure, resource endowments, technology know-how, and possibly more favorable local policy targeted at those hubs. This will in the long-term make the US an important exporter of hydrogen and facilitate the future of international hydrogen trade. The Netherlands is looking to become a key trade partner. In 2021, the Port of Rotterdam and the Port of Corpus Christi in Texas signed a memorandum of understanding (MOU) to collectively develop new technologies including hydrogen.

Additional loan guarantees available for some more projects

Under the IRA, the DOE’s Loan Program Office (LPO) is receiving roughly $12bn, which will increase the existing program’s loan authority by $100bn. About $40bn of the increased loan authority is dedicated to the Innovative Clean Energy Loan Guarantee program. In June 2022, the LPO closed a $504mn loan guarantee for the Advanced Clean Energy Storage hub in Delta, Utah. The project includes an industrial-scale green hydrogen facility that will produce and store hydrogen for use in a combined cycle power plant. The combined cycle plant will initially run on a blend of natural gas and hydrogen with a target to use 100% green hydrogen by 2045.

The LPO’s debt capital guarantee product is yet another means for the federal government to support high-quality, low-carbon hydrogen projects. To note, standalone commercial banks do remain an option for projects to seek financing, and indeed commercial banks can fund the LPO guarantee if the LPO client desires; the LPO’s loan guarantee program is an extra source that can potentially unlock longer-term tenors, diversify funding sources, and upsides for project reputation, among others. Even though not all projects will get approved by the LPO to receive debt guarantees, the LPO will effectively incentivize projects to be on a race-to-the-top game for lower-carbon project designs.

Infrastructure is key for domestic and international hydrogen delivery

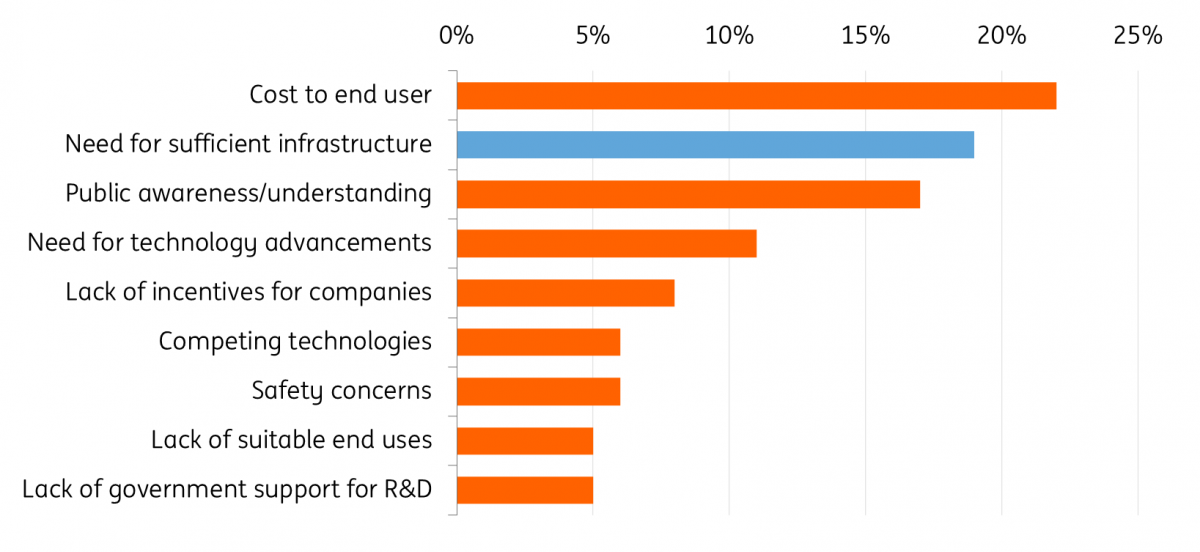

As discussed, a variety of tax credits and funding have the potential to reduce the costs of hydrogen production in the US, underpinning the potential to transport more hydrogen within the US and across the border. But a prerequisite for this to happen is a developed network of hydrogen infrastructure, which remains substantially underinvested for now. Today, less than 15% of the infrastructure investment needs are covered by project proposals. In the US, a DOE survey of over 3,000 stakeholders from 34 countries shows that a lack of sufficient infrastructure is the second major challenge to faster hydrogen development in the country.

Stakeholder identification of potential barriers preventing widespread public acceptance and market adoption of hydrogen in the US

Hydrogen infrastructure encompasses a system of facilities that includes pipelines, liquefaction plants, trains and trucks, storage, compressors, etc. Domestically, pipelines are a main way to move hydrogen. The US already has about 1,600 miles of hydrogen pipelines, mainly located near refiners along the Gulf Coast. The existing hydrogen pipelines give the US a starting point but are a fraction of the roughly 3 million miles of domestic natural gas pipelines.

In certain cases, midstream companies may be able to repurpose natural gas networks, at 50%-80% lower costs than new hydrogen pipeline investments. But this method will require reconfiguration and adaptation, to avoid problems such as hydrogen leakage (attention is needed for the entire value chain) and natural gas pipeline embrittlement (through adding coating).

Another alternative is transporting hydrogen by blending it with natural gas and using the existing natural gas pipeline infrastructure. Today, natural gas pipelines can handle up to 20% of hydrogen blending; beyond that, more research and modification is required to prevent hydrogen from damaging the pipelines. Hawaii Gas has a long history of blending 15% of hydrogen into its natural gas pipelines and the company is now looking to lower the emissions from its hydrogen value chain. There are also operating/announced blending projects in Minnesota, New Jersey, Oregon, and New York states. Hydrogen can also be transported via specialized intermodal (truck and train) tanks, but their application is now limited, and the infrastructure will also need substantial expansion.

More efforts are set to kick in to address the delivery challenges. Thanks to relevant funding in the IIJA, as well as the increasing awareness and interest from the hydrogen industry, we would expect to see a ramp-up in investment in hydrogen infrastructure in 2023 and beyond. This will help the hydrogen market in the US continue to expand and the perspectives for future exports continue to grow.

In the future, when the global hydrogen market becomes more mature, overseas shipping of hydrogen will be more popular, where hydrogen is transferred in liquid form as liquefied hydrogen, ammonia, or a liquid organic hydrogen carrier. Discussions are also happening around repurposing existing LNG infrastructure to liquefy and gasify hydrogen, but there are notable challenges such as high additional costs. That said, in the short to medium term, the US domestic hydrogen delivery network will come to shape first, as it has advantages from cost and infrastructure standpoints.

Lastly, as the energy system gets greened more holistically in the very long term, we would expect emissions from hydrogen delivery to be reduced considerably through synthetic fuels with hydrogen as an input. This can then lower the life-cycle emissions of the hydrogen industry as a whole. Nevertheless, for now, decarbonization in shipping remains challenging.

Conclusion and outlook: Generous policy support, a more mature hydrogen economy

With all eyes on the implementation of the IRA and the IIJA, their guidance rules need to be carefully and consistently designed. If executed well, these laws will lead the US to a growing hydrogen economy. Together with higher expected investment to improve infrastructure, this policy package has the potential to lead to lower costs, higher production & exports, and more diverse application across different sectors, all of which will point to economies of scale for hydrogen as a fuel storage medium for energy. Moreover, with a great emphasis on low-carbon production, we expect that the advancement of hydrogen deployment in the US will also boost the demand for renewable energy (for green hydrogen) and CCS (for blue hydrogen).

There have been concerns from the industry about policy uncertainty and how it is going to affect hydrogen—and clean energy in general—funding and tax credits. It is key to point out that while it is possible for Congress to vote and propose to repeal the IRA and/or the IIJA, it is unlikely such efforts, if any at all, are going to succeed before the end of Biden’s term, as the President has veto power to knock down any repeals.

Things can become more complicated after the 2024 presidential elections, where a Republican president is likely to approve any repeal proposals from a fully Republican-controlled Congress. If the repeal is successful, the remaining spending that will not have been allocated under the IRA could be in danger, but it will be difficult to pull back any money that has already been spent. This makes early successful policy implementation and capital allocation even more important.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article