Poland’s first payment from the EU’s Recovery and Resilience Facility

Unlocking funds from the European Union’s Recovery and Resilience Facility is a top priority of Poland’s new government. In late December 2023, Poland received the first advance payment of €5bn, and around €20bn is pending for 2024, mainly in EU preferential loans, in which the financial terms are comparable to French T-bonds

First RRF advance payment – two years later

As the EU’s Recovery and Resilience Facility (RRF) was enacted from early 2021, EU countries could apply for advance payments constituting 13% of their initial national envelopes through the end of December 2021. However, because of the legal dispute on the rule of law with the EU, Poland did not submit a notion for such a payment (of around €4.6bn). As the legal deadlock remained unresolved during the following two years, Poland could not tap from the RRF at all. While the risk of a sudden stop in EU payments in 2024 due to overlapping disbursements from the two European financial perspectives was mounting, the situation was radically changed by the outcome of the 15 October general elections in Poland. We wrote about it in a previous Think article.

Re-power chapter in Polish Recovery and Resilience Plan

The extension of the National Recovery and Resilience Plans (NRRP) by the Re-Power chapter, dedicated to strengthen European energy independence and security amid Russia’s aggression on Ukraine, allowed for a new round of advance payments with no legal strings attached. The advance payment of around 20% of the country’s Re-Power budget of about €25.8bn, enabled for a €5bn payment from the EU to Poland in late December.

EU funding is very much needed to support Poland’s energy transformation from an electricity mix, which is still 70% dominated by coal. Policy reforms facilitating expansion of renewable or distributed energy and investments in RES (e.g. offshore wind), energy efficiency, and electricity grids will serve Poland well to co-finance huge investment needs associated with energy transformation. According to estimates from the Polish Electricity Association, the investment needs of the Polish power and heat sector through 2030 were estimated at €135bn. As we pointed out in our recent regional report, Poland needs to at least double its investments in the zero-carbon electricity supply (PV, onshore and offshore wind, nuclear) and electricity grids this decade.

Grants-to-loans ratio in the NRRP

Poland’s Re-Power chapter constitutes €2.8bn in EU grants and €23.0bn in preferential EU loans. Therefore the just-received advance payment of €5bn is made up of grants and loans in an 11:89 proportion. In the remaining NRRP value (everything but the Re-power chapter), this ratio is 66:34 in favour of grants, which makes the overall NRRP grants-to-loans ratio 42:58. While preparing its NRRP revision in mid-2023, Poland was entitled to additional grants due to Re-power incorporation, and the country could utilise the existing space between the applied loan amount in the original NRRP (€12bn) and its cap in loan allocations of €35bn. Hence, the amount of EU loans in the revised NRRP was tripled.

EU already played a financial intermediary role in the anti-pandemic SURE programme

During the Covid-19 pandemic, Poland made good use of EU loans under the SURE programme. Through this instrument (Support to mitigate Unemployment Risks in an Emergency), EU member states were granted a total amount of €98.4bn in 2020-22, of which Poland received €11.3bn. The major beneficiaries of this programme were Italy (€27.4bn) and Spain (€21.3bn). In order to finance SURE, the EU organised nine issuances of EU bonds (the first in October 2020 and the last in December 2022, which – by the way – was the EU’s first issuance of social bonds) with maturities from 5 to 30 years (14.5 years on average).

According to the EC’s impact assessment, the SURE programme – offering better terms for the EU as a AAA issuer than for most of the EU countries – allowed for €9.0bn interest savings for the EU as a whole. Poland – with an average spread at 0.55pp – benefited from €0.8bn interest savings. This ‘preference’ is to be replicated though the lending programme under the RFF, though offering higher interest savings as spreads widened in an environment of much higher interest rates than in 2020-22.

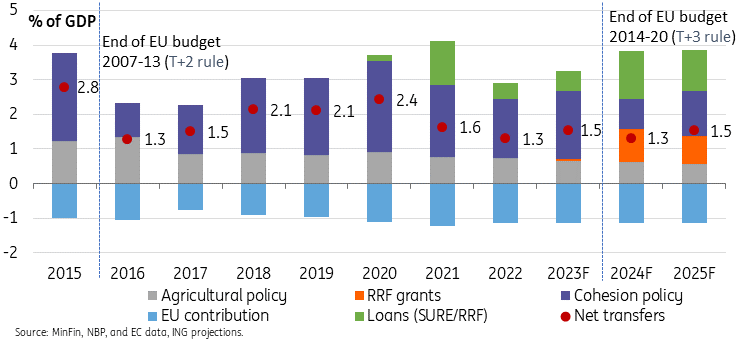

Sudden stop in net EU transfers to Poland in 2024 to be prevented by RRF grants

Based on the latest developments and statements of the Ministry of Funds and Regional Policy, we estimate that net EU transfers to Poland (non-refundable transfers deducted by the Poland’s contribution to the EU budget) as an equivalent of 1.3% of GDP in 2024, roughly flat compared to 1.5% of GDP estimate for 2023. The latter accounts though for a last-minute 0.1% of GDP grant component in the €5bn advance payment. Our projection for 2024 envisage a significant drop in transfers from the cohesion policy, comparable to 2016 – the former transition year, when disbursements from two EU budgets overlapped. However, grants from the RRF are to fill the gap. For an alternative what-if scenario, please imagine the projected flows in 2024-25 without the orange and green bars in the chart below.

Net EU transfers and EU loans to Poland, as % of GDP

Catching-up with RRF payments in 2024

According to the Ministry, in mid-December Poland submitted its first notion for payment of €6.9bn, constituting €2.8bn grants and €4.2bn loans. (Please note a difference between a notion for RRF payment or tranche rather than for a one-off advance payment, which already occurred). The transfer is expected to be disbursed in late March or in April, after the European Commission’s review. The payments are made with roughly semi-annual frequency, and based on the country’s payment notions, and reviewed by the EC against the realised milestones in the RRF timeline. At the same time, the Ministry informed that it plans to submit two more notions in 2024, while blocking four of the originally envisioned semi-annual tranches. Therefore, the first notion comprising tranches #2 and #3 is to be submitted by mid-2024 (and disbursed sometime in the late summer), while the second notion comprising tranches #4 and #5 are to be submitted in late 2024 (and paid out in early 2025).

The EC re-confirmed Poland's first payment request of mid-December though for an amount of €6.3bn, as it is net of pre-financing (via the latest advance payment and some minor technical payments in 2022-23). In its press release, the EC stated that Poland's request is related to 37 milestones and one target covering investments and reforms in the areas of the resilience and competitiveness of the economy, green energy, digital transformation, health and clean mobility. At the same time, the EC noted that payments under the RRF are performance-based and contingent on Poland implementing the investments and reforms outlined in its NRRP. According to the EC, no disbursement is possible until Poland has satisfactorily fulfilled the “super milestones”. Please stay tuned for further developments regarding the rule of law provisions. We assume that all in all Poland will satisfy these conditions in the coming months.

Loans do not add to net transfers from the EU, but increase € liquidity and pressure on the zloty

Because loans – even if preferential – are to be repaid according to the schedule in the future, we do not add these flows to net transfers from the EU. Nevertheless, they are to affect Poland’s economic performance though. On the positive side, they are to support aggregate demand and short-term GDP growth as total payments from the EU (transfers and loans combined) are to increase in 2024 by an equivalent of 0.6% of GDP compared to 2023. But on the other hand, these flows add to the appreciation pressure of the zloty and undermine price competitiveness of Polish exports, and hence may dampen GDP growth. The abundance of EU funds is one of the factors explaining why we see the €/PLN exchange rate in the baseline scenario around 4.20-4.25 at the end of 2024 compared to about 4.35 in late 2023.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more