Poland’s CPI inflation surprised to the downside in January

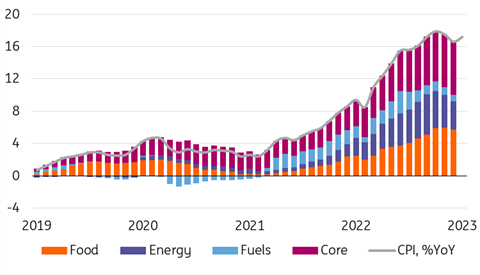

Inflation increased to 17.2% YoY in January from 16.6% YoY in December 2022. The reading was well below the market forecast of 17.6% YoY mainly due to a slower-than-expected increase in energy prices, even though VAT rates went back to 23%. We do not expect monetary easing in 2023 due to elevated core inflation, but the Council may make such a move in late 2023

Headline figure lower than feared

Contrary to developments in the Czech Republic and Hungary, where January CPI figures surprised to the upside, in Poland January inflation fell short of market expectations. As projected, the start of 2023 saw a renewed rise in CPI inflation, following its decline in the last two months of 2022. Its scale, however, turned out to be lower than our forecasts and market expectations. In January, consumer prices rose by 17.2% year-on-year, following an increase of 16.6% YoY in December. Market consensus was at 17.6%.

CPI inflation

Spike in energy prices below expectations despite higher VAT

As expected, a large part of the increase in the annual inflation rate relative to December (around 0.3 percentage points) was due to the higher dynamics of prices of energy carriers following the return of the standard VAT rate (23%) on electricity, natural gas and heating from January. At the same time, it is worth noting that the scale of the impact of this factor was clearly lower than our forecasts, with energy carriers increasing in price by "only" 10.4% month-on-month. Moreover, the price increase in the entire category related to housing costs was only 6% MoM. Gasoline prices were unchanged vs. December, but the annual growth rate of this category increased to 18.7% in January from 13.5% in December, mainly due to the low reference base of last year (fuels cheapened by 4.4% MoM in January 2022). Food and non-alcoholic beverage prices, on the other hand, rose by 1.9% MoM in January, close to our expectations. January 2022 saw an increase of 2.6% MoM.

Main trends still not great

The January CPI figures are preliminary and will be revised in March when the CSO publishes data for February and updates the CPI basket weights. Moderate upward revision the January headline CPI is expected. The National Bank of Poland will publish core inflation data for January and February.

Although the level of inflation turned out to be clearly below expectations, the main trends remain similar to our scenario. Inflation will peak in February this year, but probably below 19% rather than close to 20% as we feared earlier. The odds of inflation falling to single-digit levels by the end of the year have also increased substantially. Core inflation, however, remains stubbornly high. Based on today's data, we estimate core inflation excluding food and energy prices (using 2022 weights) at around 11.7-11.9% YoY.

Monetary Policy Council to welcome lower hump of inflation in early 2023

From a monetary policy outlook point of view, the January CPI data should allow the Council to formally end the interest rate hike cycle in the first quarter of 2023, despite the expected rise in inflation in February. The MPC will welcome the fact that CPI inflation is likely to peak below 20% in February and likely moderate to single-digit levels in December. The key factor for the Council's next decisions will be the pace of disinflation from March onwards. It looks like the next move by the MPC will be a rate cut. In our view, there may not be macroeconomic conditions for monetary easing before the end of 2023 due to the sticky core inflation, but it cannot be ruled out that the Council will nevertheless decide to make such a move.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more