Poland to opt for a gradual adjustment in retail electricity prices from mid-2024

Poland’s electricity prices to households remains frozen until mid-2024. A hike of about 15% is pending from July, but – thanks to favourable energy market developments – further hikes in 2025 may be spared. This will affect the inflation paths for this year and next, and may open space for interest rates cuts by the National Bank of Poland

This article provides an update to a Think article we wrote in mid-December. Aside from new hints from the rhetoric of policymakers, the main reason for this update is the surprisingly fast downward adjustment of wholesale electricity prices.

Frozen energy price in electricity bills to households from 2022 to mid-2024

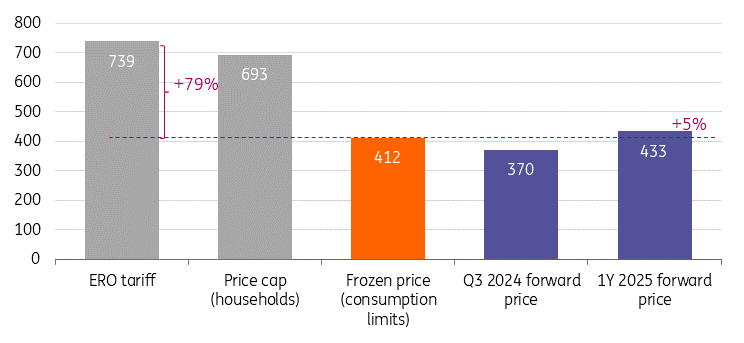

In response to the energy shock in 2022, the Polish authorities decided to keep the regulated electricity prices for households frozen at 2021 levels. The freeze at PLN412/MWh has been applied, however, only within a limit of annual consumption up to 3000MWh per household, with higher thresholds for farmers or families with three children or more. For consumption above the 3000MWh annual limit, the electricity price goes up to PLN693/MWh. The latter value is relatively close to the upper tariff band set by the Energy Regulatory Office (ERO) at PLN739/MWh for 2024. The ERO decision was announced in mid-December 2023.

Retail electricity prices in 2024 (first 3 bars) and forward wholesale prices (averages in February, last 2 bars), in PLN/MWh

In today’s status quo with frozen electricity bills to households, the energy price accounts for more than a half of the average electricity bill, variable distribution fees constitute nearly 40%, while the remaining fixed fees around 10%. According to ERO President Rafal Gawin’s statement of late February, the distribution fees were also frozen by the Parliament (at PLN289/MWh, otherwise it would reach PLN430, on average). Therefore, the forthcoming price adjustment in electricity bills can be introduced via electricity cost or energy distribution fees, or both, while the remaining fixed fees are likely to remain unchanged.

Continued downward trend in energy prices; energy contracted earlier was at a higher cost

Energy market developments surprised positively (at least from a consumer perspective) in the recent three months, based on the underlying price declines in natural gas, coal, and carbon (EUA allowances). In the context of gradually rising power generation from renewables, wholesale market prices of electricity went down in Poland. For example, a baseload band electricity to be provided in the third quarter of 2024, declined from around PLN540 on average in November 2023 to PLN370 on average in February 2024 (a 31% decline), while a 1Y 2025 contract declined from PLN600 to PLN433 in the same period (a 28% decline).

Wholesale electricity prices at Warsaw TGE exchange (in PLN/MWh)

However, this significant drop in market prices cannot be translated into electricity tariffs this year. According to ERO President Gawin, around 80-90% of electricity for 2024 was already contracted in late 2023, so the recent favourable price developments may affect only the remaining 10-20% of electricity volume. Therefore, the ERO president does not see a justification for a downward electricity tariff adjustment this year. He suggested though that the authorities could unfreeze the ‘electricity distribution’ component this year, while freezing the ‘electricity price’ component.

We find this proposal sensible, as it would mean a gradual price increase of ‘electricity bill’ by around 15% from July (and 0.6 percentage point impulse to the headline CPI inflation, given that electricity constitutes 4.2% of the CPI basket). This is also broadly in line with the increase of the electricity bill we have assumed in our inflation forecast so far for this year.

Possible scenarios for the second half of 2024

If no policy actions are taken, electricity prices will automatically rise to the level of the ERO's tariffs i.e. PLN739/MWh (energy) and PLN430/MWh (distribution) from mid-year, which would raise the total electricity bill by about 60%. The Ministry of Climate and Environment is soon about to present measures to protect households from such an abrupt increase of the electricity bill in the second half of 2024. The minister publicly suggested a possible increase of electricity bills by around 15%. The range of potential scenarios is wide, and each has specific implications for the path of inflation in the second half of the year and affects the outlook for 2025. We list the scenarios below:

- Full unfreezing: unfreeze energy and distribution prices. In this scenario, the price of energy for households increases to PLN739MWh (the current ERO tariff). There is also an unfreezing of distribution rates (currently PLN289MWh) and their increase by about 50% to the level of the tariff set for 2024 (average PLN430MWh). As a result, the average bill for a customer not exceeding consumption limits would increase by around 60%, bumping up CPI inflation by about 2.5 percentage points.

- Partial unfreezing: adjust the energy prices by around 15% and unfreeze distribution fees. Until recently, the most likely scenario was a partial unfreezing of energy prices for households, and their gradual adjustment to wholesale prices in several stages. But as wholesale prices have fallen to levels below "frozen" prices, this scenario has become less likely. In this scenario, average electricity bill rises by around 25%, pushing CPI inflation up by 1.1 percentage points.

- Baseline (ING scenario): unfreeze distribution fees but continue freezing energy prices. If the energy price were to continue to be frozen (PLN412MWh), and only distribution fees were fully adjusted to the ERO tariffs, the average bill of a household falling within the annual consumption limits would the increase by about 16-18%, bumping up inflation by about 0.7 percentage points.

- Continued freezing: continue freezing both energy prices and distribution fees. This scenario adds no impulse to CPI inflation path this year (0 percentage points).

Possible scenarios for changes in electricity bill components from July 2024 (in PLN), and its overall increase in % (RHS)

If current market prices were sustained, only minor adjustment in tariffs would be ahead in 2025

The price overhang between market prices and currently frozen retail prices has faded away in recent months. If current low energy prices persisted, ERO tariffs for 2025 – to be set late this year – could be set at levels close to the currently frozen levels, which would mean no major impact on electricity bills, and inflation. With the 1Y forward prices for 2025 in the vicinity of PLN430MWh, it could be acceptable to suppliers. The scenario of a full unfreezing of energy prices implies a large increase in energy prices for households in July 2024, and a significant decrease in January 2025. This looks like a shock scenario, which in our view needs to be averted.

The baseline scenario of releasing distribution fees and maintaining frozen electricity prices in the second half of the year, and then (unless market conditions change significantly) adopting a tariff for 2025 at a level close to the current frozen price (PLN412/MWh) provides the least volatility, and is our baseline scenario. We therefore assume that the average electricity bill will increase by around 15% starting in July. This scenario is also good for the climate, as it warrants increased proceeds to electricity suppliers, which are needed to satisfy high investment needs in the expansion and modernisation of electricity grids. This has been a major bottleneck for rapid deployment of renewable energy in Poland.

Potential CPI inflation scenarios through end-2024 (in %)

The baseline scenario offers better prospects for price stability, which is good news for the central bank. Lower inflation paths for this year and next may open space for the National Bank of Poland to cut interest rates cuts. It adds just 0.6 percentage points of electricity price adjustment, rather than around 2.5 percentage points, embedded in the extreme scenario.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more