Poland: Trade balance to worsen

We expect the trade balance to deteriorate in 2018 as imports accelerate. The income deficit should also widen due to the inflow of foreign workers

Current account gap wider-than-expected

Poland's current account balance ended December with a deficit of €1152mn, wider than market expectations (€425mn). As a result, the 12-month current account/GDP ratio was neutral at 0% of GDP compared to a deficit of -0.6% in 2016. In 2018, we expect the external position to deteriorate, although the potential deficit should not exceed 0.5% of GDP.

The trade balance fell into negative territory (deficit of €1268mn) as imports accelerated amid a recovery in investment. Official GUS data based on business reports provided evidence of a significant export drop to Eurozone countries. We see this as a temporary phenomenon (likely related to the lower number of working days after Christmas, which supported taking longer holiday leave).

Exports to major EU countries temporarily slide in December

Trade surplus shrinks

On an annual basis, the trade surplus shrank from €3bn in 2016 to €0.5bn (still above expectations at the beginning of 2017). The strong performance of machinery and consumer electronics manufacturing (mainly focused on export), as well as the opening of new assembly lines in automotive, partially offset the increase in imports. Looking ahead, we expect the trade balance to deteriorate and fall into negative territory in 2018. A structural improvement in production in the automotive and machinery sector is unlikely to offset the need for imports from infrastructure investment.

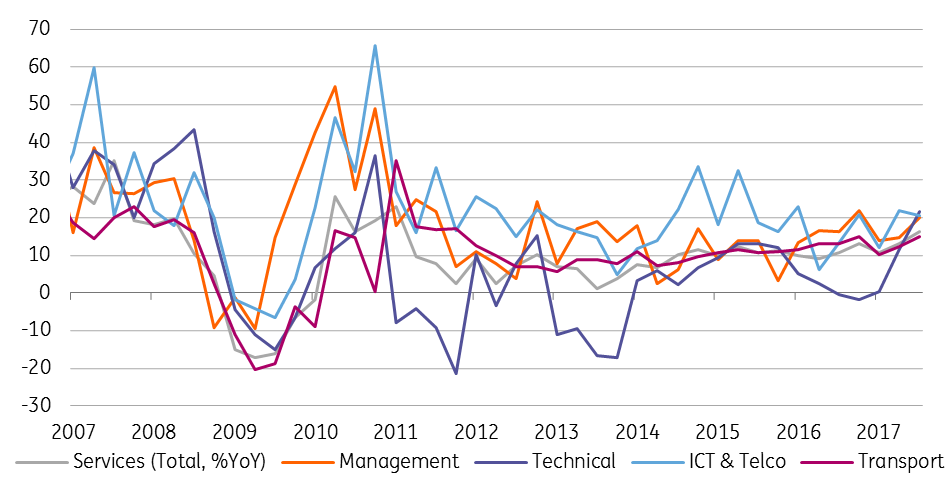

Services accumulated a surplus of €1.6bn in December. On an annual basis, the positive balance on this account increased from €14bn in 2016 to €17.9bn. Eurostat data point to an expansion of technical services, ICT & telco and management positions (supported by the expanding number of shared services centres). Looking into 2018, we expect the surplus to increase further, albeit at a slower pace, as labour shortages limit the development of transportation and telecommunication services.

Poland - Export of services (%YoY)

Income deficit expands

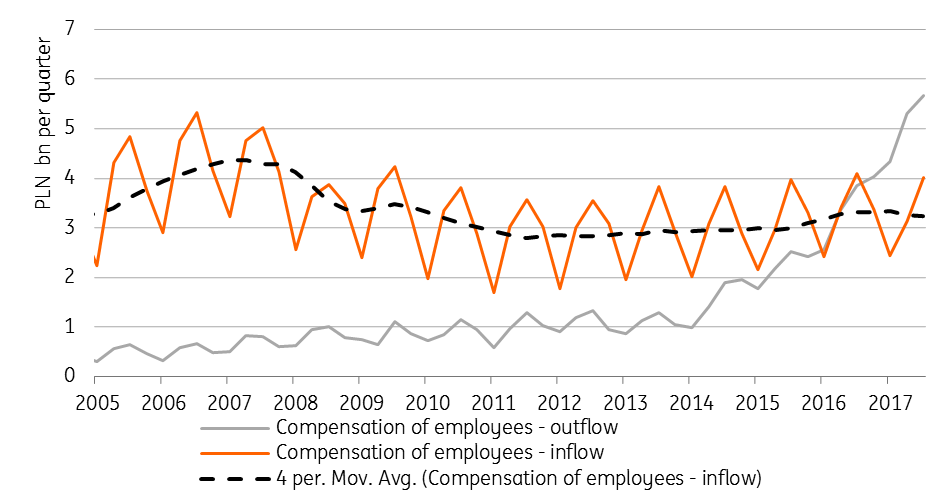

The income deficit expanded further from -€16.9bn in 2016 to -€17.9bn last year. The significant inflow of migrants (MinLabor reported 900 thousand workers, mainly from Ukraine) resulted in a negative balance of compensation for employees (annual deficit of €2bn vs €0.1bn in 2016). Among pure financial flows, changes were limited.

Compensation of Employees created approximately €2bn deficit in 2017

In 2018, we expect the income deficit to widen even further as the number of economic migrants is likely to increase (again implying a negative balance of compensation of employees). Coupon payments are likely to decrease due to the Ministry of Finance's strategy of lowering the share of foreign investors in the public debt market.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).