Poland: Minimum wage set to rise sharply

The ruling PiS decided to raise the minimum wage by ~15% in 2020 and 2021, followed by 10% rises per annum until 2024. As a result, we expect CPI to reach 3.2-3.5% YoY in 2020. The investment dynamics will suffer as well, but its impact on GDP will be offset by new spending pledges

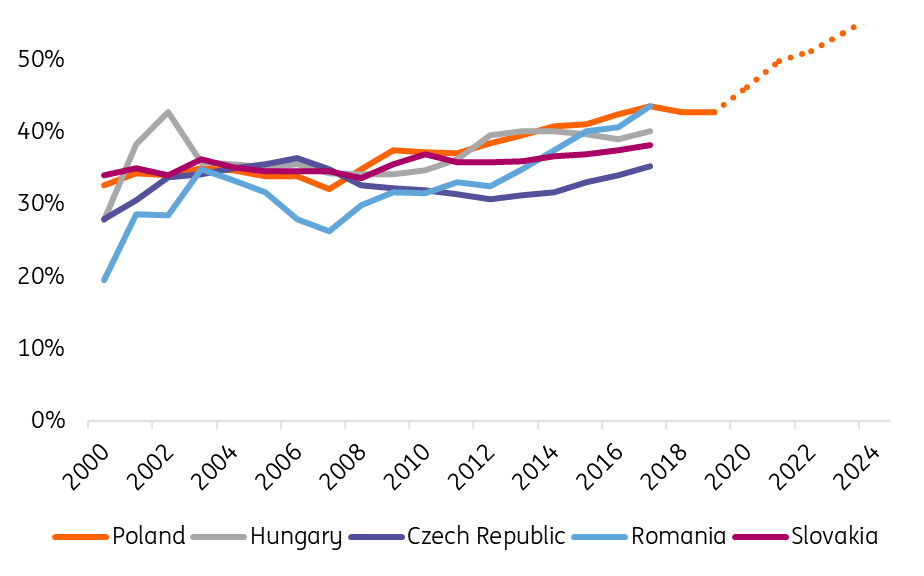

The rise of the minimum wage in perspective

The minimum wage is set to grow from PLN2250 (€520) per month in 2019 to PLN4000 (€930) in 2024. The first step has already been taken. The government has decided to amend its own decision on the 2020 minimum wage to raise it from PLN2450 to PLN2600. This means that the minimum wage is set to grow by about 15% in 2020 and 2021 and by 10% for the following three years. This is the strongest growth of the minimum salary since 2008-09 when it grew by 20% and 13%, but from a much lower base (from 35% of average wages to 41%). With the pace of growth proposed now the minimum wage should likely rise from 46% of the average wage in 2018 to 57% in 2024 – significantly more than in most countries in the Organisation for Economic Co-operation and Development.

Minimum wage as % of average wage

We don’t worry much about unemployment…

Minimum wage as a policy instrument is often criticised that it leads to lay-offs of low-skilled workers, which contributes to a rise in unemployment. However, the empirical evidence for such impact is mixed at best. Moreover, the Polish labour market is very strong at the moment. The unemployment level is very low (below 4% according to the Labour Force Survey) and the share of enterprises complaining about labour shortages remains close to an all-time high. Therefore, we don’t believe that an increase in the minimum wage is going to push unemployment in Poland up, unless it coincides with a deep recession.

… but we do worry about inflation and investment

Even if the companies won’t lay-off workers after the minimum wage rise, they will still face higher labour costs. To some extent they will pass them on to consumers by raising the prices of services and to a lesser extent goods produced. According to our own estimations, these strong minimum wages rise should add 1.2-2.2 percentage point to average salaries dynamics in 2020 and hold their elevated growth in coming years. Each 1ppt of wages growth adds 0.15-0.3ppt to CPI. We see some upside risk for an above-consensus forecast of average CPI for 2020 at 3.2% YoY (now we see 3.2-3.5% YoY), but no longer expect a CPI slowdown in 2021, when the economy is prone to slow. In 2021 we expect average CPI close to 3-3.2% YoY.

Those companies that won’t be able to raise prices, for instance due to international competition, will lose profitability. Some will invest to raise labour productivity or substitute capital for labour. But many (especially SMEs) won’t be able to do that due to limited access to financial and capital markets. Even without this factor, investment in Poland was sluggish in the last two years, rising below GDP dynamics (as opposed to the past when investment dynamics was 2-3 times higher than GDP during the peak of the business cycle). That is why we think the sharp rise of the minimum wage should aggravate the problem of losing competitiveness, which might hurt the long-term potential growth of the Polish economy to some extent.

A pinch of salt

The minimum wage law is never enforced by 100%. There are always companies that don’t comply, either directly or by requiring more hours of work than the usual full-time. According to IZA research[1] such non-compliance is more prevalent in countries where collective bargaining is rare and wages are negotiated individually. Poland is a prime example of such country, especially when one takes into account the high incidence of fix-term or so-called zero-hour contracts. Therefore, the high minimum wage might have less bite than the government would like to admit.

[1] Garnero, A., Kampelman, S., Rycx, F. Sharp Teeth or Empty Mouth? Revisiting the Minimum wage Bite with Sectoral Data, IZA DP No. 7351, available at: https://www.iza.org/publications/dp/7351/sharp-teeth-or-empty-mouths-revisiting-the-minimum-wage-bite-with-sectoral-data

Fresh spending pledges and their impact on the budget

The sharp rise in the minimum wage is not the only pledge made by PiS – the current ruling party. It has also promised to provide an annual pension benefit (dubbed 13th pension) from 2020 (introduced as a one-off in 2019) and introduce a new one (dubbed 14th pension) from 2021. The government admitted that such a decision will force it to amend the 2020 budget bill that made rounds in the media as the first balanced budget since 1990. We rather see higher spending of the social security sector, while the central budget deficit should still be a PLN0bn deficit. Additional expenditure should be covered by one-off revenues from taxing the transition of pension capital from OFE to private funds. They were planned to appear in the budget in 2020 and 2021 but we think they can be collected in one year. Also, we have left some room for additional expenses in our forecast of the general government deficit in 2020 for 0.5% of GDP and we maintain it. What we have not expected is the introduction of the 14th pension. It will cost PLN7bn and will raise the deficit of the general government by 0.3pp to 1.9% in 2021 and 2.6% in 2022.

The bottom line

Due to the acceleration of minimum wage growth we see an upside risk for inflation. We expect CPI to reach a 3.2-3.5% YoY average in 2020 (above consensus). Average CPI in 2021 should stay at 3.0-3.3% YoY and not slow despite slower GDP growth expected. We also think the aggressive hike of minimum wages is another new burden for the corporate sector (on the top of the rise of effective taxes in the last years and high tax/regulatory risk), which undermines the propensity to invest. In the short term, this will be offset by higher consumption growth (by 0.6ppt in 2020 on average) due to new pension benefits. All in all, we’ve revised our GDP forecast by 0.1ppt up to 3.4% in 2020.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more