Philippines: August remittance flows slip

August Overseas Filipino Worker (OFW) remittances slip 0.9% but year to date remittances chug along at 2.5%

| 2.48% |

Year-to-date OFW remittance growthslow and steady structural flow |

Remittances continue to provide structural FX flows despite volatile growth

August Overseas Filipino remittances slipped by 0.9% year-on-year with a total of $2.476 billion sent home in August. All major sources of remittances saw growth save for the Middle East which experienced an inexplicable 28.8% drop in flows. This brings the year-to-date haul to $19.056 billion, up 2.5% from the same period in 2017 as OFW remittances continue to be a stable source of FX to the Philippines.

Changing season(ality)

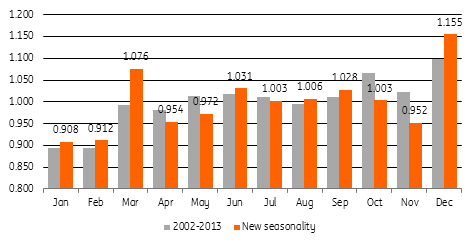

The contraction in annual terms shows that the seasonality in remittances continues to shift, mainly due to school year changes as well as to possible late payments to workers. A structural shift occurred in 2014 to yield the new seasonality, with remittances apparently saved for the December holidays (more pronounced now) and in March. Nuances in exchange rates given the divergence in monetary policy may have also caused the discrepancy given yearly growth rates. Going forward, annual and year-to-date growth rates are still seen to average around 3%.

OF Remittance Seasonality 2002-2013 vs New

Seasonality of OF remittance flows

Slow and steady vs fast and furious

Many sectors have lamented the fact that the trade deficit has zoomed past the traditional structural sources of FX, namely OF remittances and BPO call centre receipts. Given the robust growth in capital goods and raw materials imports, the trade deficit has ballooned to eclipse both remittances and BPO receipts, yielding current account deficits. However, once the investment cycle turns, we could expect remittances and BPO call centre receipts to chug along steadily while capital imports and raw materials peter out to once again yield current account surpluses after the Philippines has built up its infrastructure and productive capability.

Tags

PhilippinesDownload

Download article

17 October 2018

Good MornING Asia - 17 October 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).