Our latest views on the major central banks

Despite recent setbacks, we continue to expect three rate cuts from the US this year, starting in September. A European Central Bank rate cut in June looks like a done deal

How our central bank views compare to market pricing

Federal Reserve

At the May FOMC meeting, Federal Reserve Chair Jerome Powell suggested the Bank's monetary policy stance was “in a good place”, but it is obvious that officials are concerned about the recent lack of progress on inflation. Rate hikes remain unlikely, but the Fed is prepared to leave interest rates at current levels until that progress is achieved or the jobs market clearly weakens.

Ahead of that meeting, markets were only pricing around 28bp of rate cuts for this year, having fully discounted over 150bp in January. But some cautious comments on the prospects for the labour market from Chair Powell and the subsequent softer-than-anticipated April jobs report have seen the pricing move back towards 50bp of cuts.

We continue to forecast three 25bp moves for the year, starting in September. Business surveys suggest caution on the outlook for the economy is warranted while employment surveys point to a pronounced slowing in hiring in coming months. We also expect inflation to post more encouraging readings as cooler economic activity and subdued labour cost growth help dampen price pressures. However, to deliver a cut we would likely need to see at least three 0.2% month-on-month core inflation prints by September, some signs of cooling consumer spending and the unemployment rate trending upwards to perhaps 4.2% or higher.

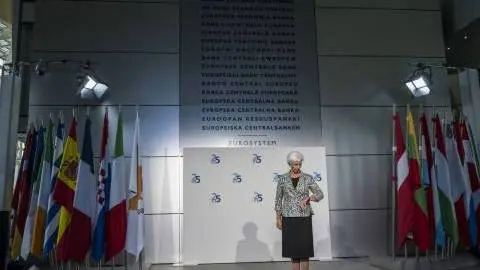

European Central Bank

Despite first signs of a possible reflation in the eurozone, a rate cut at the European Central Bank's June meeting still looks like a done deal. The fact that some ECB members already wanted to cut at the April meeting as well as the communication by almost all ECB speakers since the April meeting make it almost impossible for the ECB not to cut. However, looking beyond June, the path for the Bank is anything but clear. The risk of reflation has clearly increased. Not only has US inflation been a good leading indicator for eurozone inflation over the last two years and is currently on an upward trend again, but there are also other factors closer to home pointing to new inflationary risks. The cyclical rebound in economic activity as well as higher oil prices and a weaker euro exchange rate could easily push the ECB’s own inflation projections for 2025 above 2% again. A longer substantial rate cut cycle will only materialise if inflation quickly returns to 2%. Any signs of reflation and also stronger economic activity will limit the ECB’s room for manoeuvre. This is why we expect the ECB to cut rates this year by no more than 75bp.

Bank of England

The Bank of England’s May meeting left little doubt that the committee is edging closer to its first rate cut, though it’s keeping its options open. A June rate cut is a possibility, though there are two inflation reports due before then and we think April’s release risks being punchy. This is the time of the year when annual index-linked or contractual price increases kick in and last year this saw a big and unexpected surge in services inflation. There’s a risk something similar happens this year, albeit on a smaller scale. If we’re right, then we think the committee will lean towards waiting until August before cutting rates, at which point another inflation print will be available. Either way, we think the BoE cuts rates before the Federal Reserve and we expect three rate cuts in total this year.

Bank of Japan

This month’s key data, including 1Q24 GDP, earnings, and inflation prints are expected to support the BoJ’s dovish stance. GDP is expected to contract 0.2% quarter-on-quarter (seasonally adjusted) as a result of the safety scandal-related halt in car production in January and February, overshadowing the improvement in private consumption. Inflation is expected to fall sharply to below 2% in April due to various government programmes, while FY24 Shunto results have not yet been reflected in the earnings data yet. We continue to believe that the data will turn supportive of an additional hike of 15bp in July, but if the GDP contraction is deeper than expected and real wage growth remains negative by June, then the timing of the hike could be pushed back by a few months.

Download

Download article

9 May 2024

ING Monthly: I wanna dance with somebody This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more