Our latest calls for central banks

All of the latest from our team on ING's central bank forecasts and the key risks

Our developed market central bank forecasts

Federal Reserve

Our call: Interest rates cut from June, with 125bp implemented in 2024 and 100bp in 2025

Rationale: The combination of tight credit conditions and the most aggressive period of monetary policy tightening for 40 years will eventually slow the economy. Pandemic-era accrued household savings are close to being exhausted and will provide less support to growth, while high consumer borrowing costs are intensifying the pressure on household finances, with delinquency rates on credit cards and car loans rising quickly. Anecdotally at least, job loss announcements are on the rise and housing and vehicle price developments should help inflation slow to 2% later in the year, giving the Fed the scope to return monetary policy to a more neutral footing and helping facilitate the “soft landing”.

Risk to our call: The Fed errs on the side of caution and keeps interest rates higher for longer. After all, the economy is still growing, the labour market is tight and inflation remains well above 2%. As markets price for fewer interest rate cuts, Treasury yields rise back above 4.5% towards 4.75%, pushing up borrowing costs for households and businesses. This leads to a more serious increase in loan defaults and potentially reignites concerns about small bank solvency in the US economy, as well as the potential for recession. Such a scenario dampens inflation, with the Fed eventually cutting rates more aggressively than we are forecasting in our base case.

James Knightley

European Central Bank

Our call: First rate cut in June, followed by cautious and gradual easing totalling 75bp in 2024

Rationale: Headline inflation, particularly services inflation, remains stubbornly high and the ECB is still not convinced that a price wage spiral can be entirely avoided. At the same time, the eurozone economy is not weak enough for the ECB to justify imminent rescue rate cuts. Therefore, we expect the central bank to wait for actual headline inflation to come down to around 2.5% for more than only one month, and for the first quarter wage data published in late May as well as for longer-term inflation forecasts to remain anchored at around 2%. The meeting in June should be the moment when all three boxes are ticked and the ECB can start cutting rates. As inflationary risks remain rather to the upside, the ECB will be very cautious in gradually easing monetary policy.

Risk to our call: Are twofold. On the one hand, inflation could come down faster than expected and longer-term inflation forecasts fall below 2%. This could push the ECB to cut rates more aggressively, e.g., by a total of 150bp this year. It would be a return of the Draghi ECB, putting more emphasis on growth than on inflation. On the other hand, it could take longer than June before actual inflation settles down at around 2.5%. In combination with higher wage pressure, the ECB could delay the first rate hike by one or two quarters.

Carsten Brzeski

Bank of England

Our call: The first rate cut in August with 100bp of total easing in 2024

Rationale: Plunging household energy bills and rapid food price disinflation are set to drive headline inflation below 2% in April, and it’s likely to stay below target for much – if not all – of this year. But the Bank of England is more focused on services inflation specifically, as well as wage growth. Both have shown more progress than the Bank had anticipated back in November, but the downtrend is likely to remain gradual. Last year, we saw some big upside surprises in the second quarter which were linked to chunky annual re-indexations as well as the rise in National Living Wage. We’ll see something similar this year, though assuming the impact is less severe, we should still see services inflation come a little lower on an annual basis in the second quarter. Wage growth should continue to come lower too, given that the labour market is cooling. But surveys of business leaders and wage growth expectations suggest progress will be slow. Bearing in mind we’re also likely to get some (modest) tax cuts at the start of March, we think the second quarter is probably still too early to expect the first rate cut. By summer, we think the BoE should have greater comfort that underlying inflation is heading in the right direction to enable the first rate rate cut in August.

Risk to our call: Major downside surprises on services inflation could tempt the BoE to cut rates in June. Equally, having been caught out by the rise in inflation and given the economy isn’t rapidly deteriorating, the BoE may decide it can afford to wait a little longer before easing.

James Smith

Bank of Japan

Our call: The likelihood of a hike in June is slightly higher than in April

Rationale: The odds of the BoJ’s first rate hike in April have increased recently with the stronger-than-expected January CPI results and hawkish comments from Governor Kazuo Ueda. He mentioned recently that he believes that the Japanese economy is in a virtuous cycle where inflation will rise with wage growth and employment will strengthen, signalling to the market that the BoJ is preparing to change its policy. We still think June is more likely timing for this – though it’s a close call. First, there is little reason to rush into a rate hike after two consecutive quarters of weak growth. We expect overall growth to recover on the back of strong exports but consumption data to be on the soft side, which should be a key concern for the BoJ. Second, inflation is expected to be choppy over the next three months mainly due to the government’s energy programmes last year. Inflation eased to 2.2% year-on-year in January (vs 2.6% in December) though not as sharply as the market expected. It's set to rebound to close to 3% in February. The BoJ is therefore likely to wait until May to assess trend-like inflation. Finally, the central bank is expected to hold off on raising rates until it sees not only the outcome of wage negotiations but also the pass-through to consumption. Regarding the yield curve control programme, the BoJ could scrap it in April as Japanese Government Bond (JGB) market functioning has improved and 10-year JGB yields have stayed below 0.8% for a considerable time.

Risk to our call: April’s Tokyo inflation data, a leading indicator of nationwide CPI, will be out a week prior to the April BoJ meeting. If this alongside a stronger-than-expected preliminary Shunto result (wage negotiations) gives the BoJ confidence, the central bank could pivot in April.

Min Joo Kang

Bank of Canada

Our call: 100bp of cuts in 2024, starting in June

Rationale: Subtle dovish shifts in the Bank of Canada’s thinking and a weak growth backdrop give us increasing confidence that inflation concerns will fade and the BoC will cut rates from the late second quarter. The January policy meeting saw the BoC remove the line that the Bank “remains prepared to raise the policy rate further if needed” from the accompanying statement. Canadian mortgage rates will continue to ratchet higher for an increasing number of borrowers as their mortgage rates reset after their fixed period ends. This will intensify the financial pressure on households, dampening both consumer spending and inflation. Unemployment is also expected to rise given the slowdown in job creation, with high immigration and population growth rates adding to the slack in the labour market.

Risk to our call: The BoC may choose to be more cautious on rate cuts in the near term given it currently states that it doesn't expect inflation to fall to 2% until 2025. High debt levels and cooling growth may mean that this intensifies slowdown fears and the BoC has to accelerate the policy easing process in late 2024 to early 2025.

James Knightley

Reserve Bank of Australia

Our Call: Peak cash rates have been reached, and the RBA will commence easing from the third quarter of this year.

Rationale: Inflation has already dropped sharply, and there is clearer evidence that the macroeconomy is slowing and the labour market is loosening.

Risk to our call: In the near term, progress on inflation may start to unravel. Most of the fall in inflation so far owes to some helpful base effects. The current run-rate for inflation is too high to be consistent with the RBA’s 2-3% inflation target and needs to fall over the coming months. The RBA has recently signalled that there is still some upside risk to rates, and we don’t think (as most of the market does) that this is all bluster – though we tend to think that the need for higher rates can still be avoided. The RBA also has a very unambitious aim for getting inflation back to target, and policy rates didn’t rise all that high to start with. Consequently, the central bank can afford to be quite cautious when it comes to easing. So, the first cut may come later than we forecast.

Rob Carnell

Riksbank

Our call: First rate cut in June, with 75bp of easing in 2024

Rationale: The Riksbank dropped a large hint at its February meeting that rates could be lowered in the first half of this year. Reading the meeting minutes, it’s clear this is contingent on further progress on core inflation, which fell dramatically in the second half of last year. It’ll also hinge on the direction of the krona, something policymakers have been very sensitive to in the rate hike cycle. Barring a dramatic depreciation or unexpected upside surprises to the Riksbank’s core inflation profile we now expect the first rate cut in June. With the economy under clear strain, in part because of a more rapid rate hike pass-through than elsewhere, we think that will be followed with a rate cut per quarter for the rest of 2024.

Risk to our call: Fresh SEK depreciation and/or upside inflation surprises delay the first rate cut.

James Smith

Norges Bank

Our call: First rate cut in September, with 75bp of easing in 2024

Rationale: Formally, Norges Bank has signalled that its first rate cut is unlikely before the fourth quarter, and the pick-up in oil prices since the December meeting will probably have helped crystralise that view for now. Then again, we think there will be a lot of cross-dependency on other central banks, especially the Fed. We’re sticking to our call for the first Norges Bank cut to come in September, though there’s a risk that comes forward, not least given our Fed call detailed above.

Risk to our call: Lower oil prices, a stronger currency or a further dovish shift at other central banks brings the first rate cut forward.

James Smith

Swiss National Bank

Our call: More FX intervention and rate cuts to come

Rationale: Switzerland has the lowest inflation rate in the G10 space at 1.3% for headline CPI in January and 1.2% for the core rate. This is clearly in line with the SNB's target, which has now been the case for eight months. Forward-looking measures of inflation point to further downside potential. Despite a recent small depreciation, Swiss exporters are currently feeling the full negative impact of the strong franc. After several months of buying Swiss francs, the SNB changed its FX intervention policy in December and seems to be once again selling Swiss francs to weaken the currency. We believe that these FX interventions will accelerate and remain the main tool of monetary policy in the coming months. Given the already-low level of policy rates (1.75%), the SNB would probably prefer to wait until June to start cutting rates – although a first rate cut in March remains an option. That said, the potential for rate cuts is limited and should not exceed 75bp to 1% over the next two years.

Risk to our call: If the Swiss franc were to appreciate too much despite the SNB's interventions – for example, because of geopolitics – the SNB could be more aggressive and quicker to cut rates.

Charlotte de Montpellier

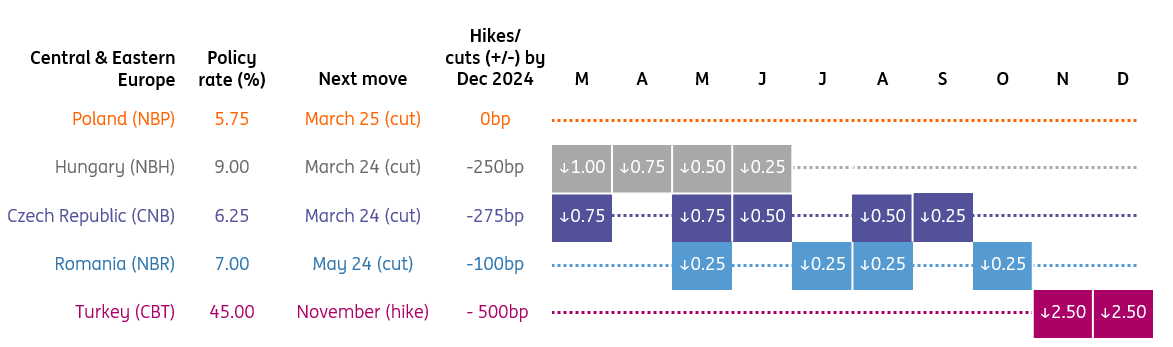

Our CEE central bank forecasts

National Bank of Poland

Our call: The MPC is likely to keep interest rates unchanged in 2024

Rationale: Despite a positive short-term CPI outlook and a delayed economic recovery, the MPC turned more hawkish and started paying more attention to medium-term risks to price developments. Policymakers no longer pay attention to growth prospects and stress the tight labour market, wage growth and expansionary fiscal policy.

Risk to our call: Should the major central banks start cutting rates and depending on 2025 prospects for regulated energy prices, some room for monetary easing may emerge in Poland in the second half of this year.

Rafal Benecki

National Bank of Hungary

Our call: Mid-cycle pause of monetary easing from July

Rationale: Our view on the pace of disinflation has not changed, and we still expect disinflation to continue in the first quarter – or, at worst, to stabilise. However, we then expect two rounds of reflation over the remainder of the year. For this reason, we believe that the NBH is only frontloading its rate cuts, as was the case with the 100bp easing decision in February. This front-loading means that the total amount of easing won't change with the change in pace, only the distribution within the year. The thinking behind this is that our year-end inflation forecast for December is around 5.7% YoY. This leads us to believe that if the NBH sticks to the need for market-stabilising positive real interest rates, the terminal rate cannot go lower than that. In this respect, we expect the key rate to be lowered to 6.5% by June, after which we expect a sustained pause by the NBH. In turn, this would still maintain a positive real interest rate environment supporting HUF assets.

Risk to our call: In the event of significant FX market turmoil and HUF depreciation, we see the central bank slowing the pace of rate cuts or, in the worst case, even stopping easing. The risk is that the cumulative size of the rate cuts will be smaller than in the base case.

Peter Virovacz

Czech National Bank

Our call: CNB accelerates the cutting pace again to 75bp in March, reaching 3.50% at year-end

Rationale: Inflation surprised to the downside in January, falling from 6.9% to 2.3% YoY. This essentially makes it one of the few central banks globally with inflation close to target. We believe the Czech National Bank has won from this perspective because, due to seasonality, most of the inflation takes place in January and the momentum in the rest of the year is only moderate. There is still a risk of a later new year repricing but so we see it very difficult for inflation to return above 3%. Conversely, inflation could fall below the central bank's 2% target by mid-year. At the same time, core inflation surprised to the downside and we expect it to fall further. Looking ahead, we expect the central bank to have a free hand to cut rates, and March will see a further acceleration in the pace to 75bp. Given the surprise in inflation, we have also revised our rate path to 3.50% at the end of this year from 4.00% earlier. However, the main driver now seems to be FX, which has weakened noticeably after the central bank sent its decision above its forecast.

Risk to our call: A weaker CZK and a later new year repricing is the main risk for the CNB, but we believe that inflation on target and a weak economy will prevail in the board's decision-making.

Frantisek Taborsky

National Bank of Romania

Our call: Easing cycle to start in May, with 100bp of cuts in 2024, taking the key rate from 7.0% to 6.0%. No change in the corridor

Rationale: Despite recently surprising to the upside, inflation should moderate enough in the near term to allow the NBR to start its easing cycle at the May meeting and tilt its attention slightly more towards growth headwinds. Our recently-revised key rate forecast for year-end (from 5.50% to 6.00%) is based on the slightly higher inflation profile in the near term due to the recent upside surprise, as well as the record-breaking liquidity in the interbank market (+60.7bn RON in January, with EU funds inflows as a key driver). We expect this to continue to diminish the need for rate cuts.

Risk to our call: The main higher for longer risk is related to potentially stronger-than-expected income growth, which could continue to keep services inflation high. Moreover, electoral year spending remains a key upside risk for rates through its negative effect on the already problematic fiscal deficit.

Valentin Tataru, Stefan Posea

Central Bank of Turkey

Our call: Policy rate at 40% at the end of 2024, with the start of the cutting cycle taking place in the last quarter

Rationale: The central bank has signalled that the current policy rate (45%) is tight enough to trigger disinflation, though it has signalled that a further deterioration in inflation could unlock further rate hikes. It has adopted a “higher for longer” stance, until there’s a sustained decline in the underlying trend in monthly inflation and inflation expectations converge to the projected forecast range. The bank expected seasonally-adjusted monthly inflation to hover below 4% on average in the first half of this year, reaching 1.5% in the fourth quarter, implying strong disinflation. Any diversion could see a possibility of higher rates, and market participants are projecting higher inflation than the central bank. Finally, the CBT has pledged further macro-prudential moves, potentially targeting credit expansion, likely credit card growth, and downward pressure on deposit rates in the coming period. Against this backdrop, the CBT expects real TRY appreciation – an explicit reference to ease any concerns about the currency.

Risk to our call: A stronger inflation path will lead to upside risks on our rate trajectory, while pronounced weakness in growth given the current level of policy tightness would create downside risks to our call.

Muhammet Mercan

Our Asia ex-Japan central bank forecasts

People's Bank of China

Our call: The PBoC will remain on a dovish path with one more 10bp rate cut to the benchmark 1-year Loan Prime Rate (LPR), and one more Reserve Requirement Ratio (RRR) cut in the next few months. Further easing is expected after the global central banks start rate cuts

Rationale: Low inflation and tepid growth momentum offer a strong case for more monetary policy easing. Policymakers continue to signal a supportive stance. However, rates are already lower than many global peers, and room for policy easing is therefore limited before other central banks start to cut. Potential RMB depreciation, concern over capital outflows, and the impact on bank profitability help deter aggressive easing.

Risks to our call: Dovish risks include a further deterioration of growth momentum, a failure to move out of deflation, or a new top-level policy consensus to accept a weaker RMB. Hawkish risks include delays in global rate cuts, upside surprises in economic growth, or shocks causing higher inflation.

Lynn Song

Reserve Bank of India

Our call: We expect the first cut from the RBI in August 2024, with a further 25bp of easing by the end of the year and an additional 50bp of easing in 2025

Rationale: Like most of the central banks in the Asia Pacific region, we don’t expect any easing from the RBI until after the first Fed rate cut which, given the RBI’s calendar, makes an August cut the most likely timing if the Fed begins cutting in June. India’s policy rate at 6.5% is quite a long way above the admittedly volatile inflation rate, which argues for a reasonably swift response once the Fed has started to ease, and perhaps provides more scope for easing than some other central banks where the “real policy rate” (derived from actual inflation) is lower.

Risk to our call: The RBI has been pursuing a policy of very tight currency management, with indications that it is more sympathetic to currency strength than currency weakness. Despite what might be a softer fourth quarter GDP number in 2023, India’s growth has remained very resilient and it may be that the RBI will favour more nuanced easing to help support the INR.

Rob Carnell

Bank of Korea

Our call: The BoK’s next move will be a rate cut in July

Rationale: Inflation has recently come down to the 2% level, but uncertainty ahead is quite high and inflation expectations are still anchored at 3%. The BoK would like to see these come down to the mid-2% range for a few months before making its first move. Private debt has also picked up again, which weighs on the BoK’s ability to cut rates.

Risk to our call: If project financing problems worsen and market credit tightens rapidly, the BoK could bring forward the timing of the first cut to the second quarter of 2024.

Min Joo Kang

Bank of Indonesia

Our call: BI is likely done with hikes. Rates should remain on hold in the near term before a pair of rate cuts in the second half of 2024

Rationale: Inflation remains relatively subdued in 2024. However, with BI recently lowering its inflation target to 1.5-3.5% (down from 2-4%) this year, the central bank could remain cautious of cutting rates ahead of the Fed.

Risk to our call: BI Governor Perry Warjiyo recently ruled out the prospect of cutting rates in the near term, although he remains open to cutting policy rates sometime in the second half of the year. We believe BI’s decision to shift to easing hinges on the timing of the Fed rate cut and also on IDR stability. A delay in the timing of the Fed pivot or sustained pressure on the IDR could mean that BI will need to push back the timing of their projected easing.

Nicholas Mapa

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 March 2024

ING Monthly: Deciphering the cycle This bundle contains 13 Articles