OPEC meeting: Four things to watch

How markets could react to the four major issues to be worked out in Vienna on the 25th May

Encore to an empty room

Five months into a 1.8 MMbbl/d production cut agreement, the OPEC and NOPEC band are getting back together this week to discuss an extension, but is the crowd still listening? The original deal initially supported markets but stubbornly high levels of inventories have depressed prices and concerns for the redux linger – Saudi Arabia can compensate for other members’ non-compliance, but when the orchestra turns out to be a one man band, who isn’t disappointed?

Bigger, better and even less believable

Like most attempts to outdo the original, this week’s extension promises to both improve and expand – compliance from countries which were previously lagging (Iraq, Russia) will be corrected and new members will join the band (Egypt, Turkmenistan).

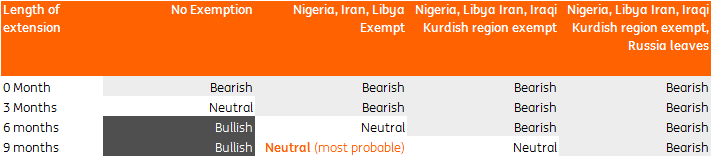

Realistically, we believe there are four major issues to be worked out in Vienna on the 25th, with the market impact of possible outcomes drawn below

Possible market outcomes from the OPEC meeting

1) Nine months or six months to recover

While initial plans were to discuss a three-to-six month extension, the conversation now seems to be centred on a nine-month extension i.e. until March 2018. The extension is designed to dissipate the high levels of oil in storage - OECD petroleum inventories at the end of 1Q17 stood nearly 260MMbbls above the five year average. The IEA estimates a stock drawdown of c.0.7-1MMbbls/d for the duration of the OPEC deal, which would theoretically place inventories back at the five year average by the end of the nine-month extension. Anything shorter, or slower drawdown rates, spell price weakness

2) Allowed exemptions and the Iraqi wildcard.

The current deal saw Libya and Nigeria being exempt from cuts as domestic issues reduced output and both needed time to recover lost production. As the geopolitical position of both countries remains tense, both countries are likely to seek further exemptions, despite a significant recovery in Libyan production towards 700 Mbbls/d.

Iran has also been allowed to increase its oil production by 90Mbbls/d to 3.797MMbbls/d during the last deal; and the country has been largely adhering to the production limit since then. Iran also understands that oil prices above US$50/bbl is crucial to attract the foreign investment into the oil exploration in the country; and hence likely to agree to the deal limiting its output near the same level of the last deal.

The wildcard for this topic is Iraq and specifically oil production and exports from semi-autonomous Kurdistan region. Iraq and Kurdistan follow independent oil production strategies while OPEC considers Kurdistan production as part of Iraqi supply. Hence, if Kurdistan doesn’t comply with cuts targets, Iraq needs to compensate by cutting more than its fair share of targets. Kurdistan doesn’t currently report production figures and could add nearly 50-60Mbbls/d of ‘ghost production’ this year: complying with Iraq’s production cut, but flowing into the market nonetheless.

3) Discipline amongst strangers

On paper the original agreement has been oversubscribed - compliance increased to 109% in April 2017 (increasing from 103% in March 2017) with 5 of 10 OPEC countries including Qatar, Saudi Arabia, Kuwait, Venezuela and UAE cutting even more than targeted. Setting aside Venezuela’s seemingly terminal decline, the question is how long these ‘overcutters’ will adhere to an agreement which others such as Iraq and, crucially, non-OPEC countries like Russia, are failing to meet. According to Reuters, non-OPEC members were only adhering to 64% of their agreed cuts earlier this year.

| 109% |

OPEC compliance in April 2017 |

4) New friends or name dropping

The first production cut included eleven non-OPEC countries like Russia and Oman, but reports suggest new members may be joining. Turkmenistan and Egypt will be present during the Vienna discussion on 25 May, and while they are not considered heavyweights in global production, together producing 700 Mbbls/d of oil. We doubt either country will be willing to reduce production, and even if they agree to a cut of 5%, monitoring compliance to a 35 Mbbls/d cut in Egypt/Turkmenistan will be a difficult feat. All told, unless Canada decides to the party, we think the impact of additional countries is likely to be psychological rather than physical.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).