One more cut from New Zealand’s central bank?

Markets are still pricing in one more rate cut from the Reserve Bank of New Zealand, which would take cash rates to 0.75%, in line with Australia. But the argument for the cut is running quite thin. With the help of extended short speculative positioning, NZD could regain momentum

The arguments for a rate cut...

The arguments for another rate cut in New Zealand seem to boil down to the following:

- Inflation remains below the central bank's target

- Growth and the labour market are weak

- External headwinds need some offsetting support

To which you could add some supplementary arguments along the lines of:

- The New Zealand dollar has appreciated recently tightening financial conditions

- Reserve Bank of Australia rates are lower than policy rates in New Zealand;

- Markets are still pricing in a cut

This last argument is a frequent fallback for forecasters. These days, it almost seems inconceivable that a central bank should do anything that might take markets by surprise. Yet the recent behaviour of financial markets suggests that in terms of monetary easing, they always want more. The last cut is never quite enough, and every rate cut sets up an expectation for another. At some stage, you have to bite the bullet and ask, who is setting monetary policy, markets or central banks?

A rate cut now that was followed by higher inflation in a few months' time might look like a brilliant piece of central banking, but it would have been totally unnecessary

Even now, at about 70%, the market pricing of a further cut does not come across as particularly heartfelt. Before the recent labour market "disappointment", it was only just over 50%. A single decent data release might eradicate any lingering expectation of another cut. Unfortunately, there is no top tier data due before next week's meeting on 13 November.

As for what Australia's central bank has done - historically, New Zealand's policy rates have exceeded those in its bigger neighbour by about 25bp - as they do currently. They only tend to coincide briefly, when easing or tightening cycles overlap and timing differs slightly. In other words, there is no sense in which the current difference in cash rates between these two economies is anything other than normal, or that it has any undesirable connotations for AUD/NZD movements.

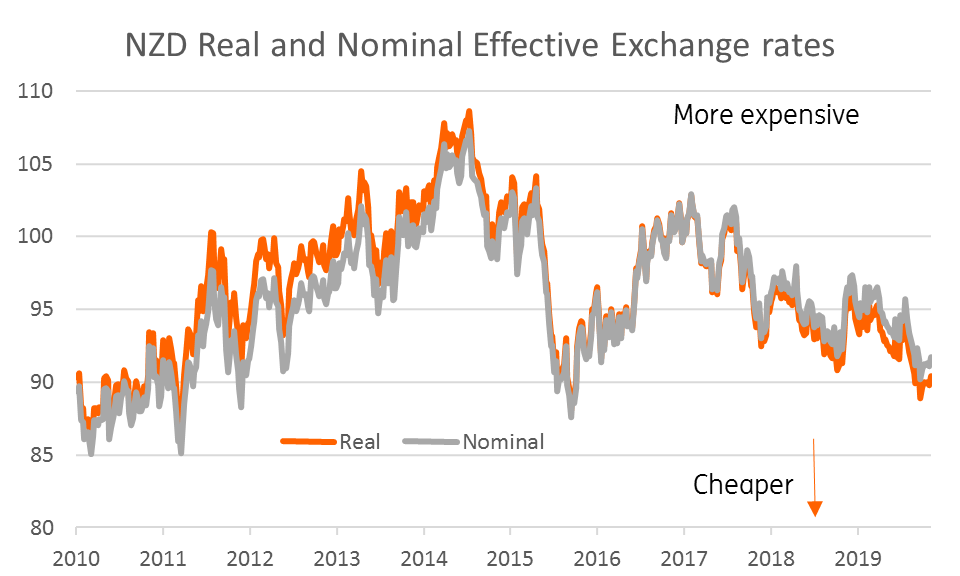

And as for the current value of the NZD, in neither real nor nominal terms, does its effective exchange rate index look anything other than fairly weak, If there are deficiencies in the economy (and that is looking increasingly debatable), they are not there because of an overvalued currency.

Few valuation concerns about the NZD despite recent pick up

Back to the fundamentals then?

Well at 1.5% for 3Q19, inflation is lower than it was in 2Q19 (1.7%) but came in higher than expected as consensus was 1.4%. Moreover, the hurdle for it to climb back to 2.0% - the RBNZ's target midpoint in 4Q19 is very low. Two consecutive 0.1% QoQ readings in 4Q18 and 1Q19 mean that New Zealand's inflation should hit 2.0% in 4Q19, and something in the 2.3 - 2.4% range in 1Q20 if current trends persist, and depending on series noise. A rate cut now that was followed by higher inflation in a few months' time might look like a brilliant piece of central banking, but it would have been totally unnecessary.

The argument that growth is weak is old, and no longer really stacks up against the evidence. The economy looks as if it will show year on year growth of about 2.8% in 3Q19 and 4Q19

The argument that growth is weak is old, and no longer really stacks up against the evidence. The economy looks as if it will show year on year growth of about 2.8% in 3Q19 and 4Q19. And though this will have been flatter in comparison to the weak base, underlying growth adjusting for that should be about 2.4% - not a bad result, even if it is a bit slower than the 3% historical trend. Economic momentum seems to be creeping back into the economy. The housing market is showing signs of renewed life. Business confidence is improving. Employment growth is positive albeit not very strong, and the uptick in the unemployment rate in 3Q19 looked to be more to do with increased participation in the labour force than a genuine rise in the proportion of joblessness. In 3Q19, the labour force increased by 13,000, unemployment increased by 7,000, so for all the new entrants to the labour force last quarter, almost half went straight into employment. The residual will probably be mopped up next quarter.

Even the external headwinds don't seem quite as threatening as they did a few months ago. Admittedly, part of this stems from the US administration taking a softer tone with China as their own economy shows signs of faltering. But the tit-for-tat escalation in the trade war seems to have stopped. So even if current expectations are, in our view, too optimistic about the prospects of any sort of deal, sentiment-boosting rate cuts at today's already very low levels also seem an unnecessary waste, when there may be a genuine need for such cuts in the future.

Inflation should hit its target next quarter

Net result...

Of course, we don't get away with just making the argument for or against a particular decision, we also have to second-guess what the central bank will do, even if we disagree with their reasons for doing it. That is much harder. The early easing in May showed the Reserve Bank of New Zealand more ready to act then Australia's central bank which didn't cut until June and then left rates unchanged this month. The back to back RBNZ cuts that then followed in July and August also showed the RBNZ is happy to be aggressive.

Our call then is for no change at this meeting since any rate cut this month would be seen in all likelihood as the last in a series

Our call then is for no change at this meeting since any rate cut this month would be seen in all likelihood as the last in a series, and make little difference to current activity or sentiment, and would also be more useful held in reserve in case really needed in the future. But this isn't far off being a 50:50 call.

NZD is the biggest speculative short in G10

NZD: Positioning to exacerbate positive catalysts

The kiwi dollar has enjoyed a very positive October but things corrected in the first week of November. The optimism around trade talks has not only pushed yields higher but also contributed to a re-pricing in rate cut expectations. Over the past three weeks, the implied probability of a November rate cut went from 100% to a low of 50% and is now hovering around 70% after the disappointing labour market data this week.

If as we are inclined to believe, the RBNZ stays on hold, this will set NZD to substantially outperform the rest of G10 next week

At the same time, these dynamics in spot prices were not matched by similar moves in the markets speculative positioning. According to CFTC data, the net short positions on NZD have been consistently more than 50% of open interest since mid-September. This suggests that there is a high potential for some short-squeezing to exacerbate any positive catalyst for the currency.

The high uncertainty around the RBNZ meeting suggests caution around next week's performance for the kiwi dollar. However, the balance of risks seems marginally tilted to the upside. Even if the Bank decides to cut, markets may well assume this would represent the end of the cycle, and price out more easing for the months ahead, thereby mitigating the fall in rates and in NZD.

If as we are inclined to believe, the RBNZ stays on hold, this will set NZD to substantially outperform the rest of G10 next week. When adding the over-mentioned extended short positioning, it is fair to assume a more limited downside room compared to the upside potential ahead of next week's meeting.

Download

Download article

8 November 2019

Good MornING Asia - 8 November 2019 This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more