Omicron fails to hold back the US economy

January's consumer spending and manufacturing orders data show the US economy easily shrugged off the Omicron wave. GDP growth is now more likely to come in closer to 2% than the 0% we had been fearing and with the Fed’s favoured measure of inflation above 5%, not even Russia’s actions can hold back the Fed from hiking aggressively

Spending bounces back despite less movement

We had been fearing that the Omicron wave of Covid, which had prompted a steep drop off in mobility, dining and flight data, would translate into 1Q economic weakness. However, retail sales numbers had given us hope that it hadn’t discouraged spending meaningfully and this has been confirmed by booming January consumer spending numbers (which includes broader services spending rather than just physical retail activity) and robust durable goods orders numbers.

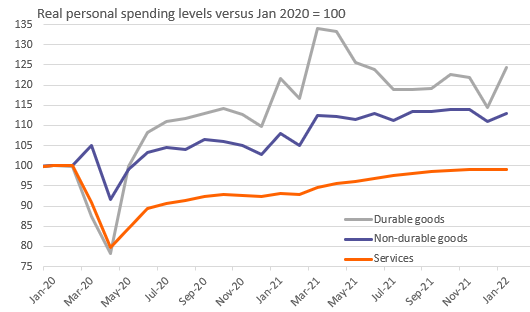

Nominal personal spending rose 2.1% in January and when adjusted for inflation, the real growth rate came in at 1.5% month-on-month versus 1.2% expectations. Durable goods (those that should last 3 years or more) jumped 8.5% MoM after falling 6% in December, while non-durable goods spending (such as food) rose a more modest 1.9% after contracting 2.6% in December. Services spending rose 0.1%, but this is still a pretty good outcome given the people movement numbers already mentioned.

Consumer spending breakdown versus February 2020 levels

Investment outlook remains strong

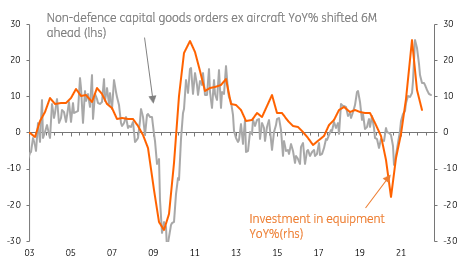

Meanwhile, durable goods orders rose 1.6% versus the 1% rate expected and there was a massive upward revision to December from -0.7% to +1.2%. The core measure, which the Federal Reserve follows for a guide to capex (non-defence capital goods orders ex aircraft) rose 0.9% MoM versus 0.3% expected while December was revised up a tenth of a percentage point. This suggests that we could see an acceleration in private sector capital expenditure in the current and upcoming quarters.

Non-defence capital goods orders suggest upside potential for capital expenditure

Private income growth continues to offset to decline in government support

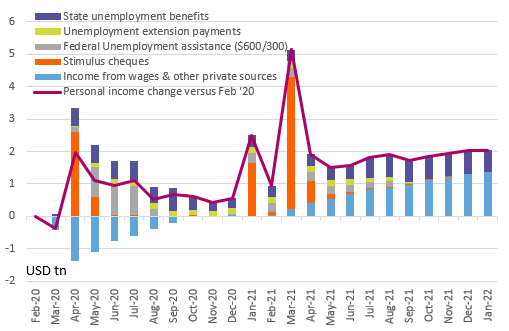

Given consumer spending and investment are the two dominant drivers of GDP growth, this shows that the Omicron wave did not dent the US economy. Consequently, these early figures suggest we can look forward to 1Q GDP growth in the 1.5-2% range after expanding 7% in 4Q. This is much better than the 0-1% growth we had initially been thinking at the end of January. Continual rises in wages and salaries (light blue bar in the chart below) also offer encouragement that household incomes will keep spending robust and facilitate a switch to more spending on services and away from physical things without the prospect of spending falling overall.

Household income change versus Feb 2020 by composition (USD trn)

Fed hawks have more ammunition

Also note that the Fed's favoured measure of inflation – the core personal consumer expenditure deflator – rose to 5.2% year-on-year from 4.9%. This was as expected, but the combination of strong growth and elevated inflation will give the Fed hawks more ammunition to push for an aggressive series of rate hikes. Our current expectation of five Fed rate hikes this year is looking a little too cautious, even in light of Russia's military advance into Ukraine.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more