New Zealand’s central bank is starting to feel the hawkish pressure

The New Zealand government has amended its central bank’s remit to include house price considerations when setting monetary policy. This doesn’t only rule out any more rate cuts but also suggests the central bank may be one of the first to tighten policy in the G10 space, reinforcing our view that the NZD will outperform AUD on the back of policy differential

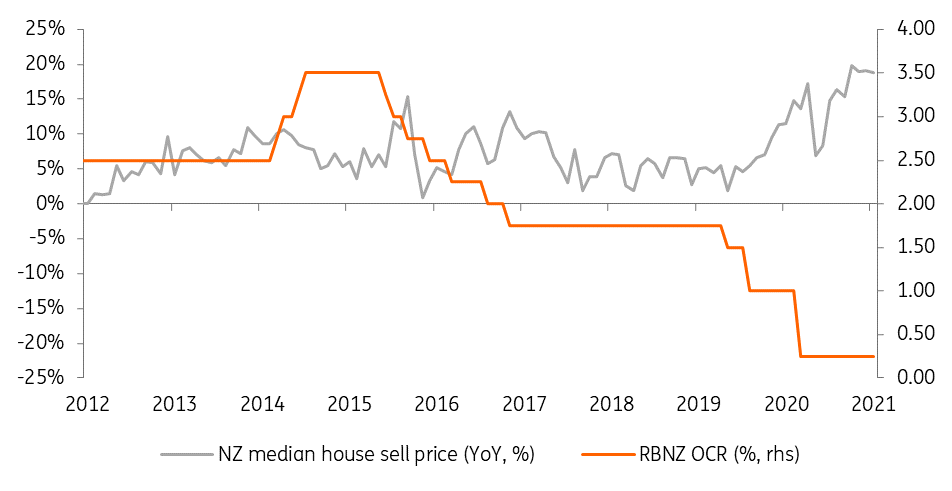

Amid the overall successful response to the pandemic, New Zealand has seen its longstanding house affordability issue worsen, which has been central to prime minister Jacinda Ardern’s political rhetoric. Despite the economic slump, house prices have jumped as a result of the ultra-loose monetary policy by the central bank as it reduced mortgage rates. Fig-1.

Fig -1 Housing prices surged as monetary policy was eased

Government piles pressure on the central bank

Late in 2020, the government had asked the central bank to take the surge in housing costs into account when making monetary policy decisions, and - despite the central bank's response restating its independence – it poured cold water on the market’s negative rate expectations.

Yesterday, Grant Robertson, New Zealand’s finance minister, announced that the central bank remit will officially be amended to include the goal of supporting “more sustainable house prices, including dampening investor demand for existing housing stock”.

New Zealand’s finance minister, announced that the central bank remit will officially be amended to include the goal of supporting “more sustainable house prices

This confirms that negative rates (which already looked unlikely) are completely off the cards. At the same time, it suggests that the central bank will face more pressure than other developed central banks to hike rates before previously intended. The combination of rock bottom rates and economic recovery in the coming months may well generate even more unwanted upside pressure on house prices.

The central bank has tried to address the housing issue without touching its monetary policy plans, by moving to reinstate the loan-to-value ratio restrictions (to limit high-risk lending), which was suspended as the pandemic hit. While this measure may help avoid a fully-fledged housing bubble, it would hardly be able to effectively mitigate the government’s housing affordability concerns, where monetary policy may well be needed.

Policy normalisation may come earlier than other central banks

The RBNZ governor, Adrien Orr, responded to the change in the Bank’s remit by stressing that macro-prudential measures will remain the main route to address housing concerns and that the monetary policy direction will remain driven by inflation and employment targets. This reaction is not surprising, given that the governor has hardly any interest in sounding unduly hawkish now and was probably just defending the Bank’s independence.

Still, the RBNZ may soon (or at least sooner than other major central banks) face the question of unwinding its monetary stimulus, and at that point, the housing factor will indeed come into play as an incentive to normalise policy.

After all, New Zealand is faring better economically than most other developed countries thanks to its low Covid-19 cases that have enabled lax movement restrictions.

Also, inflation is at 1.4%, which is not very far from the 2% target mid-point. The central bank is estimating inflation to be back at 2% only in 2023, but that may look a bit conservative and implies that New Zealand borders will remain shut until the end of 2021, which may not be the case if global vaccine roll-out programmes gather pace.

NZD to benefit from tightening expectations

Markets moved after Thursday’s news and priced in some monetary tightening in New Zealand in the medium term, with a 25 basis point rate hike now fully in the price for 2022. We suspect that speculation for an even earlier or a more substantial policy normalisation cycle will continue mounting for the rest of the year.

Markets are clearly moving towards higher inflation expectations and the global bonds sell-off is a clear testament of this. New Zealand bonds have been the most heavily impacted in the G10space, with 10-year government yields rising by approximately 95bp since the start of 2021. Fig-2.

We suspect that speculation for an even earlier or a more substantial policy normalisation cycle will continue mounting for the rest of the year

Bond purchases on longer maturities are proving to be blatantly unsuccessful in keeping yields checked in Australia and Canada given the high correlation with US Treasury yields, so that may not be a viable option for the RBNZ. An excessively steep yield curve on the back of rising back-end yields may well add fuel to the speculation of an early rate hike.

Fig -2 New Zealand bonds sold off more than others in G10

From an FX perspective, higher chances of a tightening in New Zealand before other major economies bodes well for NZD prospects. In particular, we continue to expect the monetary policy divergence between New Zealand and Australia to remain wide and favour NZD over AUD.

For now, AUD has been sustained by rising iron ore prices, but our commodities team has been highlighting how the current levels in iron ore do not look sustainable, and the risk of a downward correction appears rather material.

We expect AUD/NZD to start realigning with its short-term yield differential (Figure 3) which mirrors the less dovish RBNZ compared to the RBA. We see the balance of risks for AUD/NZD as still tilted to the downside in the coming months, and see room for a move to the 1.04 region.

Fig -3 AUD/NZD rate differential suggests downside for the pair

The risk to this scenario remains any explicit aversion of the RBNZ to a strong NZD. However, with limited options to ease policy further, FX interventions may remain the only alternative. But plenty of potential negative implications (we discussed some in this piece from August 2020) may suggest the RBNZ is unlikely to undertake the FX intervention route with a light heart.

Incidentally, Governor Orr recently referred to NZD as "fairly valued" according to most widely used models, which would suggest no immediate plans to intervene in the FX market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 February 2021

Good MornING Asia - 1 March 2021 This bundle contains 4 Articles