Nickel: We’re cautiously optimistic, short term

Strong stainless production from China is the key support to nickel’s rally. Lower ore inventories at ports are also fuelling concerns over domestic NPI/FeNi supply. The actual impact is still to be quantified and there are certainly more curveballs to come

Strong recovery in nickel-rich stainless production

Stainless steel production from the world's largest producer, China, has been growing quickly, in particular, 300-series nickel rich stainless productions are standing out with a relatively better margin. Production of this series has been maintaining an average of 8.5% YoY since June, and the current high operating rate at mills suggests that there's potential for further upside in August.

Strong stainless production growth in China drives up nickel demand

Elsewhere, Indonesia has seen strong production due to its newly commissioned mills in recent years as the country is aiming to develop further downstream instead of relying on ore exports. Mills in Europe and the US have also been resuming production, but the market for stainless remains weak as demand recovery is still very slow.

Stainless production and prices by region

Ore tightness starts to bite, fueling concerns over domestic raw material shortage

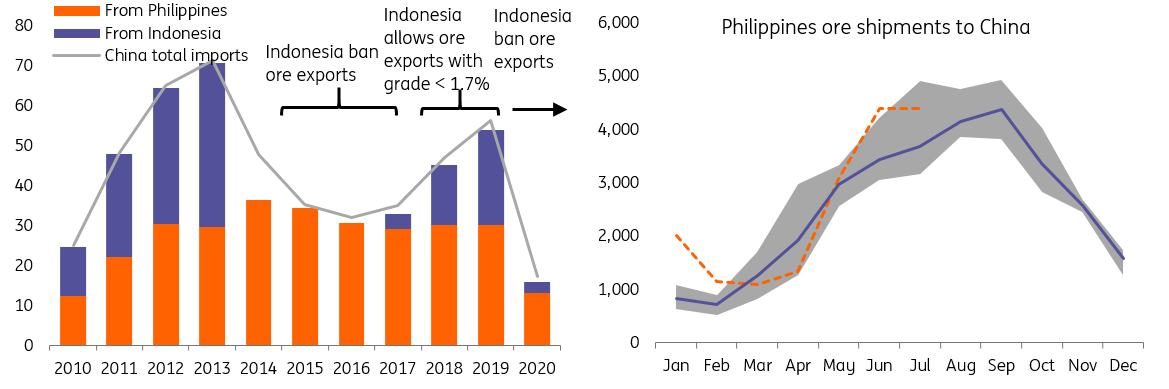

Nickel literate ore exports from Indonesia have exited the market following the country's policy to ban ore exports which began and the start of the year. The Philippines is left to do the heavy lifting as the single largest supplier of nickel ore to China.

Nickel ore shipments to China from Indonesia and the Philippines

Multiple factors, not least Covid-19, impacted production during the first quarter of 2020; bad weather has also led to ore production falling significantly. Coupled with disruption to shipments, exports to China were lower than the same periods last year and they only started to accelerate from June. Traditionally, ore shipments from the Philippines follow a strong seasonal pattern. The market is inclined to expect a reduced supply from the country from October as the rainy season starts. However, ore inventories at Chinese ports have already been running lower, and recent ore prices have been rising fast.

Higher ore prices along with lower ore inventories

The implications to NPI/FeNi

The ore tightness could potentially lead to further losses in Chinese domestic NPI (nickel pig iron), although that's yet to be confirmed. If it does happen, it should add renewed pressure to squeeze Chinese production market share versus Indonesia supply. One of the key themes in the nickel industry in recent years has been a fast-rising Indonesia NPI capacity and expected large flows into China's market to feed the nation’s huge stainless capacities.

The increased consumption of NPI by stainless mills has been at the sacrifice of class 1 nickel supply over the years. The structural shift comes amid a widened discount of NPI to Class-1 nickel (cathode etc.). Geographically, the fast development of the NPI business in Indonesia, riding an abundant on-site ore supply, saw rising flows of NPI to replace ore into the Chinese market, squeezing market share from local Chinese producers. A collapse in NPI margins has seen a collective cut of 100kt Ni among Chinese NPI producers so far this year.

Things have only improved slightly for Chinese NPI producers recently as implied margins have improved over the last couple of weeks. Strong demand from stainless mills have helped to give an uplift to the NPI prices, and the discount to Class-1 nickel has narrowed.

Restoring Class-2 discount and Chinese margins

Rising Indonesia NPI supply to hit the China market, sooner or later

Strong demand from the stainless sector coupled with an issue with the ore supply looming in Chinese NPI production mean that things look constructive for the nickel market in the short term.

There are two remaining questions as to whether nickel's rally is sustainable. First, can the fast growth in stainless production be maintained? At least in the short term, this could be true. Expectations are that demand is usually more robust during September/October fowling a seasonality pattern and that also applies to the rest of industrial metals. Secondly, how soon could Indonesia boost their NPI exports to China, offsetting the potential supply losses from their local producers if ore tightness is really an issue?

With many new capacities being commissioned during 2Q20-3Q20, the market had previously expected rising exports to hit the Chinese market sooner. It could be that this has only been delayed rather than having disappeared.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).