Nickel: Is the rally sustainable?

LME nickel has gained momentum from a rising number of supply disruption threats and exchange reported stocks continuously drawing down. However, we think the recent rally doesn't have a strong rational from underlying fundamentals and as such, we only see a moderate rally towards the end of this year and it will be a bumpy ride

Recent disruptions to supply

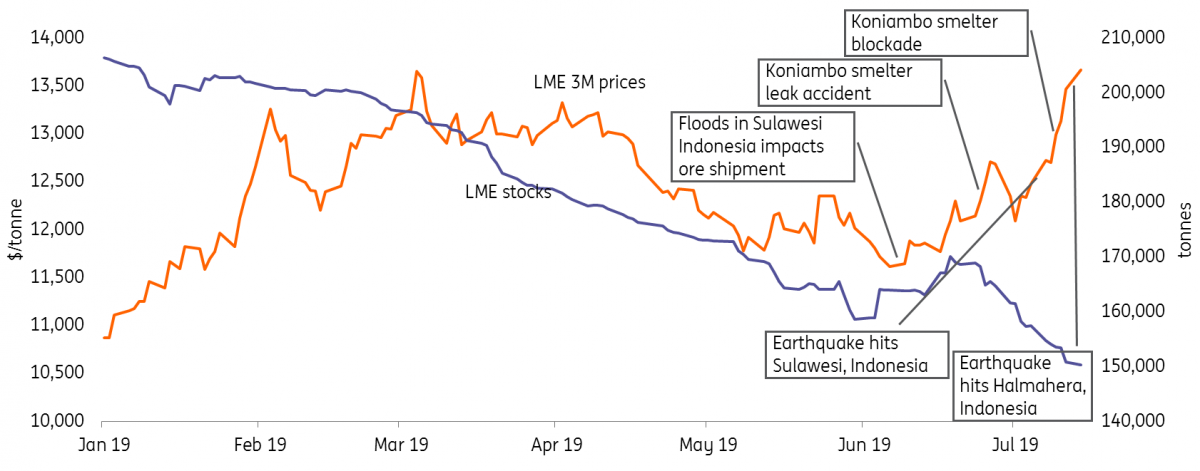

There have been quite a few threats to production in recent weeks. Glencore’s partly-owned Koniambo nickel smelter experienced a leak in June, which was followed by a brief blockade by protestors last week. Indonesia, the world’s most important nickel ore supplier and a hub to growing NPI (nickel pig iron) and stainless production, has also been a source of concern. Some areas of the country have experienced heavy rain caused by floods and landslides in June and two deadly earthquakes in July at Sulawesi and Halmahera, respectively. Both areas are important to nickel operations. Meanwhile, fears have also resurfaced in the market over whether Indonesia will resume its ore exports ban in 2022.

Mixed signals over different parts of the market

Looking at the recent performance of nickel on the LME and ShFE, we see mixed signals. LME inventory has trended down to its lowest level in more than six years although the time spreads don't seem to be implying an acute supply crunch. Moreover, off-exchange inventory remains opaque. The cash/3M has been caught in a range of $40-70 contango over the last couple of days. Still, ShFE inventory has surged to a 17-month high. In the physical market, there hasn’t been much improvement in the fundamentals out of China, although the global macro environment has been generally supportive over the past month.

The problem has not been resolved

The nickel market has long suffered from structural problems, being segregated into interlinked areas. The NPI, the preferred nickel input for stainless steel making, has been booming. Production has been growing quickly after some new projects were commissioned in both Indonesia and China. It also serves as a cheaper alternative to refined nickel. In the exchange-traded contracts, refined nickel has been punished by the bearish sentiment tied to supply pressures in NPI.

So far, there have been few reasons to be optimistic, although there is stainless steel capacity in the pipeline, which is expected to help nickel and NPI demand this year. There is also a wider expectation that downstream demand will pick up due to China's economic stimulus measures.

In the very short term, one cannot ignore the fact that LME stocks are running lower and in the background, there are threats to supply, which remain a bullish sign for nickel. However, we remain cautious because if prices continue to climb, it could potentially incentivise some off-exchange inventories to be switched on. And looking at China's market, we’ll need to see clear signs of a recovery, including stainless destocking and NPI supply pressures to ease, which would give a stronger rationale to become more bullish.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 July 2019

In case you missed it: Trump, Draghi and Johnson This bundle contains 12 Articles