New Money IV: Will central banks go digital?

The cryptocurrency hype may be fading, but central banks look better placed to make use of blockchain technology

Tech creates new opportunities for central banks

The crypto-bubble may have burst. But one lasting effect has been to force central banks to have a fresh look at their core functions of issuing money and conducting monetary policy. In this article, we focus on the potential for central banks to use technology to issue new forms of money. We see an increased probability that central banks will issue their own ‘digital currency’ in the medium term – say within the next five to 10 years.

Peer-to-peer cryptocurrencies such as Bitcoin were often explicitly aiming to disrupt the existing monetary order – central banks will aim for an evolutionary approach. In many ways, central bank digital currencies (CBDC) would simply be the latest in a long line of technological upgrades that central banks have been through over the years.

We see an increasing probability that central banks will issue their own ‘digital currency’ in the medium term – say within the next 5-10 years.

What is CBDC?

Most money used today is issued by commercial banks. Only notes and coins are issued by central banks, but their use is declining in many countries, which has sparked a debate about about digital alternatives.

Central bank digital currencies (CBDC) could appear in many forms: accessible to the public or selected institutions only; administered as accounts or as tokens; anonymous or not; interest-bearing or without interest. Moreover, CBDC services provision can be partially or fully outsourced to private parties – as suggested by IMF Managing Director Christine Lagarde. Arguably, 'wholesale CBDC' is already a reality: commercial banks have been digitally keeping reserves at central banks for decades. In contrast to notes and coins, reserves are only tradable during central bank opening hours while central bank digital currencies are supposed to be 24/7 from the start.

CBDC: What could happen?

We foresee the first developments in 'wholesale CBDC' (with access restricted to financial institutions only) to upgrade existing “Real-time Gross Settlement” (RTGS) systems (such as Target2 in the eurozone and CHAPS in the UK).

This is not a game changer for domestic systems, which, despite their rather mature technology are efficient, and are being upgraded to 24/7 availability. Wholesale central bank digital currencies might make it easier to widen access to central bank funds to financial institutions beyond just banks – which may change the behaviour of interest rates and money markets, and so generate questions for monetary policy operations.

Internationally, the case for wholesale CBDC is more obvious, where it has the potential to improve cross-border settlement between banks – reducing the number of hoops required, taking away time zone impediments and speeding up transactions while reducing costs and scope for error.

The case for wholesale CBDC is more obvious internationally, where it has the potential to improve cross-border settlement between banks

Central bank digital currencies for all ('retail CBDC') could technically build on wholesale CBDC systems while being more revolutionary in economic terms. Allowing all citizens to have universal access to the central bank balance sheet would rewire the financial system, creating new possibilities but also raising some new challenges for central and commercial banks alike. CBDC could make use of “smart contracts” embedded in the ledger. It could also allow for the implementation of a negative rate, potentially widening the existing monetary policy toolkit.

The introduction of a retail CBDC would have to be thought through very carefully, making it a technical, economic and political issue simultaneously

Commercial banks and central bank financial stability departments may worry about the increased ease with which depositors could move their money out of the banking system. CBDC would, in effect, be a new 'risk-free asset' with overnight maturity and high liquidity. This would have an impact on the demand for government bonds, in particular, ones with short maturities of less than a year, and on the functioning of wholesale funding markets. One effect could be to raise the cost of borrowing for banks and governments.

Universal-access CBDC could also intensify cross-border flights to safety in times of crisis, especially if only a subset of central banks go live with CBDC while others don’t. This, in turn, would add pressure on foreign exchange markets. Imagine the next crisis and Switzerland issuing a universal-access central bank digital currency.

In sum, the introduction of a retail CBDC would have to be thought through very carefully, making it a technical, economic and political issue simultaneously.

A retail central bank digital currency could technically build on wholesale CBDC systems while being more revolutionary in economic terms

CBDC: Where could it happen?

Most central banks are looking at digital currencies in some way. The Bank of England, Bank of Canada, Riksbank and the Monetary Authority of Singapore appear furthest ahead.

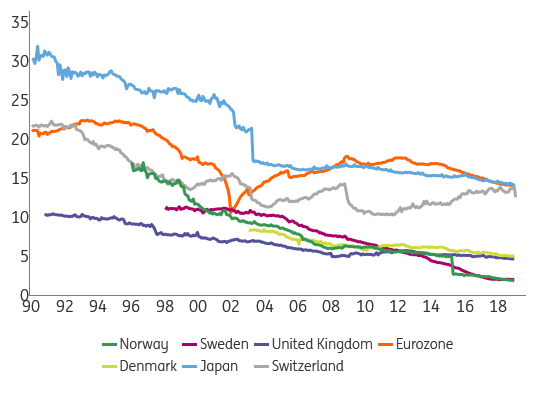

The thinking around retail CBDC may be furthest advanced where underground markets are problematic, or where the use of cash has dropped the most. On the latter, Norway, Sweden and Denmark come to mind. The circulation of cash, as opposed to bank accounts, has dropped to 5% or below in those countries as the chart below shows.

Cash in circulation as a percentage of M1

M1 is the sum of cash in circulation and current accounts. Redefinitions caused breaks in Japan in 2003 and in Norway in 2015.

CBDC: When could it happen?

We see five to 10 years as a realistic timescale. Obviously, there are all sorts of issues to solve first. On the one hand, there are difficult technical problems to address, especially given the need to ensure extremely high standards of reliability, alongside legal and political considerations.

Wholesale CBDC is more likely to come first, as this is largely within existing central bank mandates, and would only involve sophisticated institutions that, to a large extent, are already positive (at least in principle) about upgrading the existing settlement systems.

Retail CBDC is much trickier. Even where central banks are enthusiastic like the Riksbank, it will require political decisions (e.g. privacy is a thorny issue, and CBDC is only recently gaining traction outside monetary circles). Central banks may also like digital currency for the more precise monetary policy operations it makes possible (e.g. directly imposing negative rates on cash holdings). This, however, is the same reason why some citizens dislike the idea of CBDC. In any case, because it affects the whole population, CBDC will require an organisational and educational effort, aside from the considerable technical challenge.

Interesting times ahead

Universal access to central bank digital currencies raises a number of important questions that need to be researched thoroughly. This will take time. But wholesale CBDC may, both in technical and economic terms, be a relatively small step.

Its introduction may be only a few years away and could be considered a first step in the digital currency revolution.

Tags

New MoneyDownload

Download article21 June 2019

New Money: A new chapter for central banks and capital markets This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).