Energy outlook 2023: The growth in renewables, batteries, CCS and hydrogen infrastructure

In 2023, we expect key technologies, including wind, solar, batteries, CCS and hydrogen infrastructure, to continue growing. Headwinds from supply chain disruptions and higher interest rates will likely persist, but policy support and company climate commitments suggest positive capacity growth

The share of fossil fuels in the global energy mix has been stubbornly high, at around 80%, for decades. According to the International Energy Agency (IEA), this share needs to come down to 22% by 2050 in a net-zero economy. This requires an energy system based on new energy technologies, and here's what we can expect next year.

Flat growth potential for solar and wind

Predicting the future is never exactly easy, and the 2023 forecast for renewables is no exception as there are opposing factors at play.

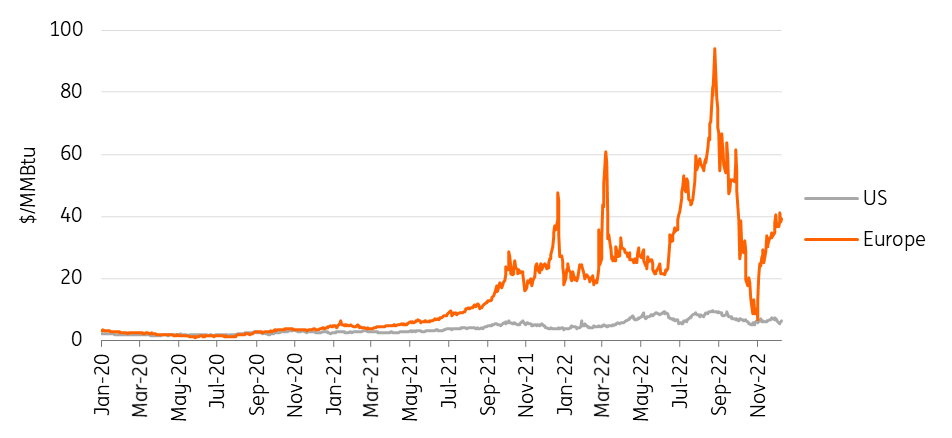

On a positive note, solar and wind benefit from high energy prices, in particular in Europe. Increased demand by governments, businesses and households in their efforts to become less dependent on high gas and power prices from a fossil-driven energy system all help too. The US is less affected by the energy crisis, but a more volatile energy market will indeed trigger more renewable buildout. The Inflation Reduction Act (IRA) gives a huge boost to renewable project development, but the effect will likely kick in after 2023.

High energy prices are a push for renewables, particularly in Europe

Natural gas price in $/MMBtu

However, both wind and solar continue to struggle with supply chain disruptions and high input costs for steel, rare earth elements and in some markets, labour. Financing costs have increased on the back of higher interest rates. So have shipping costs and while they have come down a lot recently, they could easily go up again given the highly-charged geopolitical situation right now.

The economic environment is also uncertain, and policy risks have increased as governments impose price caps with or without windfall profits.

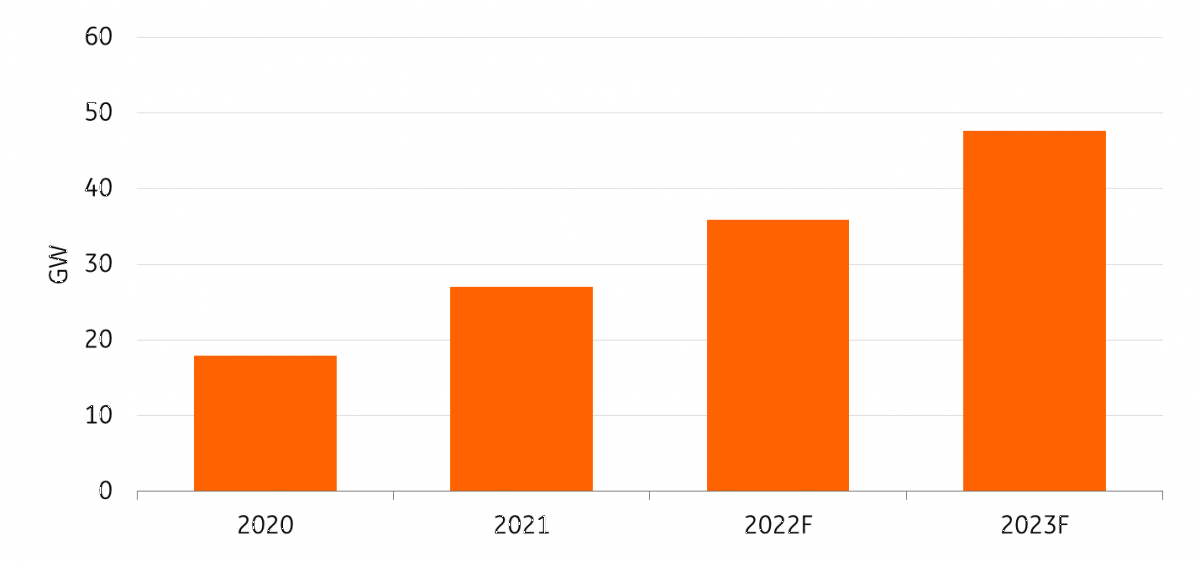

Growth in solar outpaces growth in wind

Yearly installed capacity additions for solar and wind energy in Europe and the US in gigawatt (GW)

In this environment, we don’t expect strong growth in solar and wind capacity, which has been a feature of the renewable energy market in the past few years, particularly in Europe.

Overall, we see about the same capacity additions as in 2022, both for Europe and the US. Solar additions should increase, notably due to a strong uptake in rooftop solar panels. Growth in wind capacity is somewhat lower as governments fail to speed up permitting procedures significantly, despite good intentions. It also takes time for market participants to adjust to the new normal of high and volatile power markets and price caps, particularly in Europe. The disappointing outcome of a Spanish renewables auction is a case in point, where the €47/MWh cap was too low for market participants to cover higher costs and increased risks. As a result, only 46 MW of the 3.3 GW tender was awarded.

Finally, grid congestion is increasingly becoming a barrier to strong renewables build-out, and grid enforcements don't happen overnight. In fact, in many regions, grid limitations are the big elephant in the room for future growth in renewables.

All in all, we expect to see 58 GW growth in the combined wind and solar market in Europe and 32 GW in the US in 2023. This equates to roughly €70bn of investment in Europe and €37bn ($35bn) in the US.

CCS is growing but a fast scale-up will take time

With more companies in hard-to-abate sectors committed to decarbonisation, as well as governments showing increasing policy support, Carbon Capture and Storage (CCS) technologies will continue to gain momentum in 2023.

Moreover, the UN's Intergovernmental Panel on Climate Change (IPCC) emphasised in a report that realising the Paris Agreement requires substantially more use of carbon removal technologies. Against this backdrop, 61 new CCS projects were announced worldwide from January to mid-September 2022. Global commercial CCS capacity that is operational or under development is set to grow by 44% this year to 244 million tonnes per annum (Mtpa).

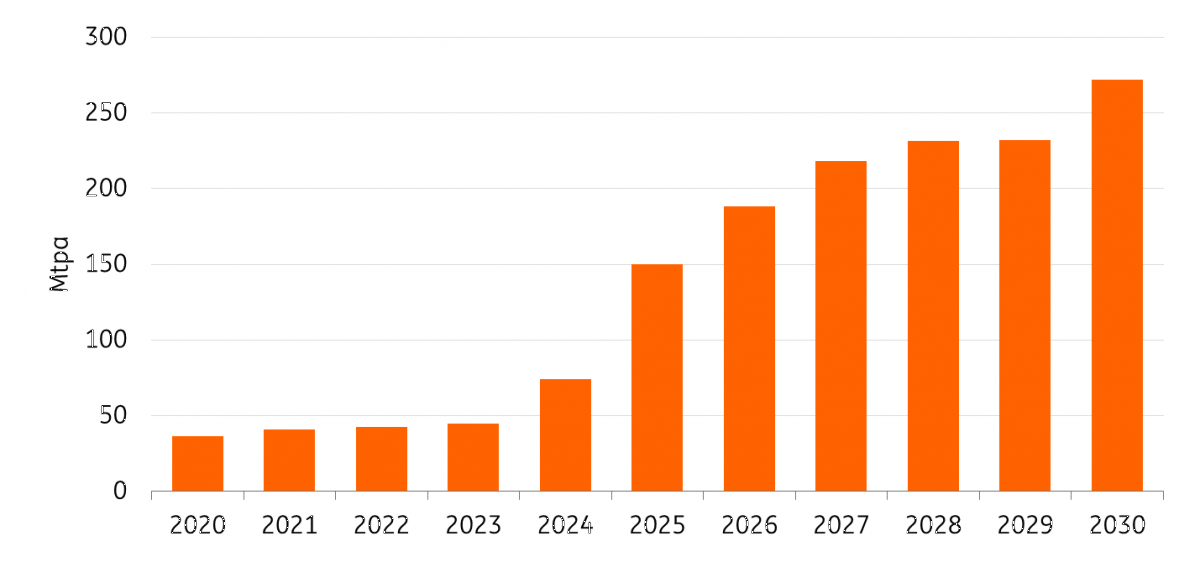

Yet of the projects under development, only three—two in China and one in Australia—are expected to commence operation in 2023, bringing the total operational capacity up by 2.3 Mtpa to 44.9 Mtpa. The fast growth period will arrive in 2025 when the completion of more projects is forecast to triple the current capacity.

CCS is expected to scale up significantly after 2023

Global CCS capacity in Mtpa, forecast based on current announcements

- Policy support

Several trends stand out behind this projected growth. The first is enhanced policy support. In the US, the IRA is raising Section 45Q tax credits from $50/tonne to $85/tonne of CO2 captured and stored, and the value has increased to $180/tonne for direct air capture, a more costly technology which directly removes CO2 from the atmosphere and is gaining higher popularity.

- Infrastructure investment

Additionally, the Infrastructure Investment and Jobs Act invests $11bn in CCS demonstration and networks. These policies will together boost project revenue streams, incentivise technological advancement, enhance related infrastructure, and cement the US’s leading position in the technology.

In Europe, funding has been made available to facilitate the development of CCS. The EU Innovation Fund, which was created in 2020 to help realise the bloc’s climate targets, has supported more CCS projects this year. The Netherlands’ Sustainable Energy Transition Subsidy Scheme (SDE++), part of which is dedicated to funding CCS projects, has been increased from €5bn to €13bn. In the UK, the government has established the CCUS Innovation Programme to advance related research and the CCS Infrastructure Fund to develop CCS networks.

- A more diverse mix

We are going to see CCS technologies being applied to more sectors. Traditionally, CCS is predominantly used in natural gas processing, where the CO2 separated from purified natural gas is captured. But under the urgency of decarbonisation, CCS is being extended to other sectors such as hydrogen, power, cement, iron, and steel. This trend is set to continue among projects that are going to be announced in 2023—which will eventually lead to a more diverse mix of CCS applications by 2030.

In parallel, there will be more projects that can permanently store and capture CO2, as opposed to only using CO2 for processes such as enhanced oil recovery. This will lead to more emissions reduction from CCS.

CCS is being applied in more sectors and with different CCS technologies

2023 will also see the further materialisation of CCS hubs globally. Over 40 Mtpa of capturing capacity have been proposed under hubs in the EU and UK, mostly near the North Sea. In the US, 90 Mtpa of hubs are planned, the majority of which is concentrated in Texas and the Midwest. More CCS hubs will enhance the spillover effect of technology know-how, increase the sharing of pipeline and storage infrastructure (and thereby cutting costs), and raise the chances of projects collectively receiving government funding.

Hydrogen policies trigger investment in hydrogen infrastructure

A growing number of corporate leaders are now fundamentally rethinking their climate strategies and are aiming to become net-zero emitters by 2050, according to the Science Based Target Initiative. Hydrogen provides them with a tool to radically green their business and reduce future emissions, particularly in manufacturing, shipping and aviation. This trend will continue in 2023.

The energy crisis puts hydrogen on the short-term agenda too, as it provides politicians and corporate leaders glimpses of what a future may look like in which they are less dependent on fossil fuels. That's true particularly in Europe as the continent is committed to weaning itself off Russian gas. But, the energy crisis has worsened the business case for hydrogen, so the economics of this transition are far from easy.

Hydrogen is still in its infancy, with most projects being in the development stage rather than the construction phase. Europe has more electrolyser projects in development to kickstart the production of green hydrogen. The project size is also bigger with several projects of +100 MWe in development. In both Europe and the US, electrolysers are powered by large solar fields, on and offshore wind farms, and with power from the grid. The US is also developing projects that run on nuclear power.

Both continents also have schemes for blue hydrogen in development. However, the Netherlands faces an important setback now that the permitting process for its Porthos CCS project has been delayed due to legislation on nitrogen emissions during the construction phase.

Green hydrogen: Europe has more electrolyser projects in development compared to the US

Electrolyser project pipeline in Megawatt electricity (MWe)

Actual investment volumes are expected to be higher for hydrogen infrastructure, which is a prerequisite for a hydrogen economy. For example, the US and the Netherlands aim to build hydrogen hubs that can facilitate hydrogen trade flows. That would be a major difference from the current situation where hydrogen is often produced and consumed within the same industrial site.

Batteries: Rapid increase in demand calls for more supply

A sustained energy transition requires more batteries to be built. In 2023, the demand for batteries will grow strongly.

In the power sector, batteries are essential to enhance grid flexibility, as they can store renewable electricity and serve at peak demand hours, especially in markets with high renewable penetration. Global installed battery capacity is projected by the IEA to grow between tenfold and sixteenfold by 2030. If that does become the case, we expect battery storage to grow to 48GW in 2023.

In the EU, the bloc aims to raise renewable energy generation capacity to 1,236GW by 2030 in order to reduce reliance on Russian gas. Although this does not include storage the target will bring tremendous growth potential to battery storage in the region. In the US, the IRA has made investment tax credits available for grid-connected stand-alone batteries – previously batteries needed to be coupled with renewable energy to qualify for federal tax credits.

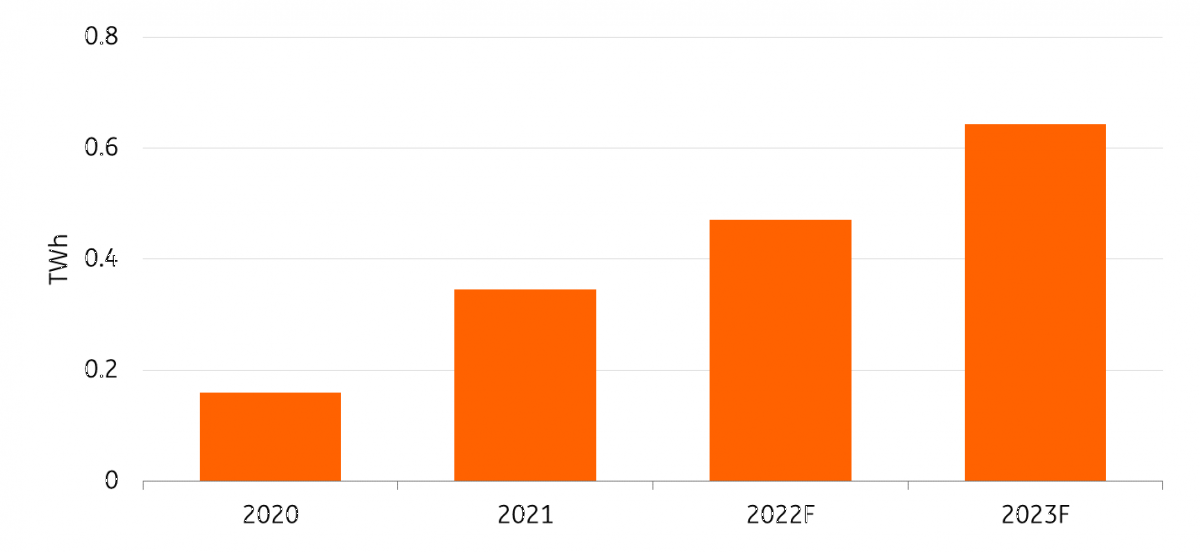

Global stationary battery storage forecast

In the transport sector, renewed policy support in major jurisdictions and automaker climate ambitions point to higher demand for electric vehicles and hence for batteries to power EVs. Global battery demand for EVs doubled between 2020 and 2021 to roughly 0.3 TWh/year, and we expect that this number will grow to 0.6 TWh/year in 2023.

Global EV battery demand forecast

However, metal prices, especially those of lithium, are adding headwinds to faster EV battery production to meet surging demand. One factor driving metal price rises is supply chain risks. Just as rare earth metal production started to pick up pace again after the pandemic, the Russian invasion of Ukraine has led to supply limitations of Class 1 (high-purity) nickel, where Russia accounts for a little less than 20% of the global production. Another factor is structural underinvestment in metals in the several years pre-pandemic as a result of low metal prices back then. In 2023, we expect metal prices to stay elevated, despite some relief from their highest levels, due to the ongoing war and an uncertain economic environment in China, which dominates the world’s EV battery production.

Consistently high metal prices could prompt battery makers and automakers to switch to fewer batteries which use fewer metal materials, such as lithium iron phosphate cathode chemistry (LFP) batteries, as they do not need nickel or cobalt as an input. Global LFP EV battery production has more than doubled since 2020, largely driven by technological advancement in China, and this trend is expected to keep growing in 2023. Some companies are also looking into developing sodium-ion (Na-ion) batteries, but the production of these kinds of batteries will not become largely commercially available in the short term. Companies outside of China are also working to form new supply chains to reduce dependence on the country, but we will not see any substantial change in 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

20 December 2022

Energy outlook 2023: From power to utilities to renewables This bundle contains 4 Articles