Home building, not rent cuts, holds the key to solving Netherlands’ housing shortages

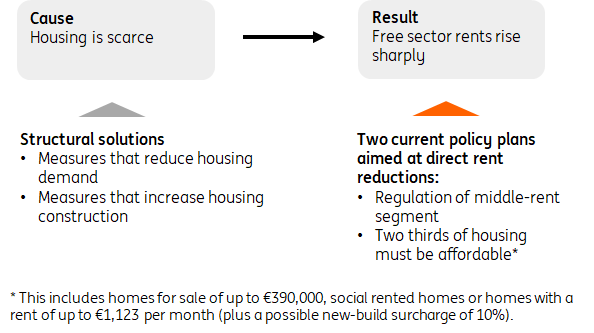

The Dutch government plans to improve housing affordability for middle-income earners by expanding existing rent regulations and introducing a rule that two-thirds of housing construction must be affordable. However, these two policies are expected to slow down housing production, which will ultimately increase the housing shortage

Middle-income earners are struggling to find housing

It is currently proving increasingly difficult for middle-income house hunters to find suitable housing. Because of their income, this group of households is more likely to rely on the private rental market than high and low-income earners; they earn too much to qualify for social housing and regularly lose out on the owner-occupied market to more affluent homebuyers.

In the last few years, large rent increases in the private sector have damaged housing affordability for middle-income earners. For instance, since 2018, the more than 9% increase in rents at occupancy change - in the regulated and private rental sector - was well above the average annual wage growth over the same period of +3.4% (gross earned hourly wage).

Middle-income earners best helped by reduction of housing shortage

Middle-income earners, who are currently struggling to find housing in the Netherlands, are ultimately best served if the housing shortage abates. In the end, the housing shortage is the root cause behind the poor accessibility of the private rental sector in the Netherlands.

This calls for measures that facilitate both market players and housing associations to speed up housing construction, for example by reducing building requirements, and measures that slow down housing demand by providing tax incentives for house sharing, for example.

Cabinet aims to quickly improve affordability in housing market

In its recently announced housing policy measures, the cabinet partly focuses on achieving direct rent reductions in the private rental sector as a solution to poor affordability. There is, for instance, a plan to regulate rents in the middle segment of the private rental sector (this bill is currently being considered by the Senate) and a proposal to set a national requirement that two-thirds of new construction should be affordable. This includes homes for sale of up to €390,000, social rented homes or homes with rent of up to €1,123 per month (plus a possible new-build surcharge of 10%).

Although the government’s focus on quick solutions is understandable in light of the great social pressure to improve the affordability of housing for middle-income earners, the policy focus on affordability is likely to backfire, in our view.

Policy focus on affordability ultimately backfires

The expected effects below show how middle-income households in the housing market are ultimately not helped by the plans to regulate rents in the middle segment or the national requirement for two-thirds affordable housing construction:

- Housing production slows down: the financial viability of housing plans will be reduced by both policy plans, as they lower the expected rental income and therefore investor returns. Property developers will likely try to modify existing housing plans to improve expected returns (by, for example, building smaller homes). This will, however, delay housing construction, implying that middle-income house seekers will continue to suffer from the tight housing market.

- The rental housing stock will decrease: regulating rents in the middle segment puts downward pressure on the expected investment return from existing housing rentals. As a result, landlords are expected to sell existing homes into the owner-occupied market more often after a lease expires. While this increases housing supply in the owner-occupied housing market, it reduces supply in the rental housing market by the same number of homes. Middle-income housing seekers dependent on the private rental sector are thus worse off due to this shift.

- Demand for rental housing increases: lower rents are expected to increase interest in vacant rental housing. For instance, young people living in their parental home with no immediate desire to move are more likely to become active in the rental market due to lower rents. Middle-income housing seekers who rely on the private rental sector will experience more competition as a result.

Small group benefits from lower rents

Although the policy plans will also see households benefiting from lower housing costs than they would have without the policy, the existing housing shortage is expected to increase further. Time will tell to what extent the households that do benefit are middle-income households.

Housing associations unable to ramp up housing production as a counterweight

Housing associations are unable to quickly ramp up the construction of (mid-rent) housing to counterbalance the lower housing production by market players. This is firstly because housing corporations already lack financial resources for their operational activities in the social segment, which is the core of their raison d'être. Secondly, offering rental housing in the middle segment has lost strategic priority within most housing associations. This is to an important extent due to previous policy changes that forced the sector to focus more on activities in the social segment. As a consequence, housing associations have lost some of the knowledge required to develop and operate mid-rent.

Dutch housing policy partly focused on symptom relief

Main price dynamics free sector rental market and possible policy responses

Focus housing policy on reducing the housing shortage

Middle-income earners in the housing market are thus best served by reducing the housing shortage. This calls for policies that enable both housing investors and housing associations to build housing faster. In addition, the government can aim to reduce housing demand. Structural solution directions are therefore:

- Improve the investment climate for residential investors: this requires, among other things, pursuing predictable policies in the housing market. Reducing municipal building requirements also helps to improve the financial viability of housing projects.

- Increase the activities of housing associations in the middle-rent segment: a direct way to encourage the construction of mid-rent housing by housing associations is by allowing housing associations to borrow at advantageous rates to finance the development of housing in the mid-rent segment. The existing system that allows this for social housing could be extended, but this would require an adaptation of European legislation.

- Lower housing demand: by providing tax incentives for housing sharing, the government can aim to reduce housing demand. For example, by removing the cohabitation discount in state pension and welfare.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article