National Bank of Hungary Preview: Defining decisiveness

The central bank of Hungary switched to a decisive tightening cycle, but it’s everyone’s guess what it means nowadays, when 75-100bp is the new 25bp hike. EUR/HUF still flirts with 400 and rate hike expectations by the market are very high. So, the bar is low for a disappointment next week, bringing more volatility to the table

| +125bp |

ING's callChange in the base rate |

The rationale behind our call

The National Bank of Hungary has switched from “gradual” to “decisive” when it comes to hiking interest rates. At its last two decisions, the central bank delivered a total 385bp increase in the base rate and 250bp (effective) tightening in the 1-week deposit rate. With these moves, the base rate and the 1-week deposit rate sits at the same level at 9.75%.

The big question for next week is what “decisive” tightening means in the recent environment, where the major central banks (eg, Fed, Bank of Canada) are hiking by 75-100bp, and setting a new norm. But not just the external monetary policy what matters, but also the changing fiscal policy is in play.

The latest decisions by the government mean fiscal tightening worth of around HUF1,000bn (or 1.6% of GDP) according to our estimation (HUF600-700bn related to utility bill scheme changes and HUF250-300bn related to changing the small taxpayers’ itemised tax) and increases the chance of a technical recession during the coming quarters.

On the contrary, inflation readings in the eurozone and in the US caused upside surprises, meaning higher imported inflation and worsening price pressure outlook. EUR/HUF is still gravitating to the 400 level, giving no permanent relief in the short-term inflation picture. Moreover, the recent fiscal measures might translate into further rise in prices as well (due to technical reasons and repricing), moving our CPI peak forecast to 16% year-on-year in the autumn.

In our view, the NBH might look through the fiscal-related inflationary impact seen as a temporary one, while more into account the FX and external inflation and monetary policy changes. In this regard, we expect a 125bp hike at the next meeting, moving the base rate and the one-week deposit rate to 11%. This 125bp would equal to the average effective tightening of the past two meetings (50+200).

The forward guidance will remain unchanged, in our view, suggesting the continuation of the interest rate hikes at least until inflation peaks. In reality, this could mean a November-December stop in tightening at the earliest. However, as recession fears will grow deeper going into the third quarter, we see the NBH (like the Fed and the European Central Bank) slowing the pace of tightening from September, pointing to a terminal rate at around 14%, according to our estimation.

ING's inflation and base rate forecasts in Hungary

What to expect in rates and FX markets

Rates have again moved closer to their peak but in the short term we believe there is still room to go higher especially at the short end of the curve, resulting in curve flattening once again. Additionally, even if the market peaks, we do not expect a clear trend reversal due to the upcoming CPI prints which will keep elevated expectations of hikes for a longer period of time. Of course, the situation is not helped by the summer's almost zero liquidity. So overall, the trades are shifting to a more tactical strategy. Short-end payers concentrated around 2y still makes sense to us for the NBH meeting next week but given the high volatility we prefer flatteners 2s10s.

On the bond side, the latest measures to improve the fiscal balance and the strong willingness shown by the Hungarian government to settle the Rule of Law dispute with the EU will continue to lower the risk in excessive financing needs. Though we wouldn’t rule out further bad headlines about protests against tax changes and about ongoing talks with EU, we see these as good entry point for long-term holders. To support our view, in general we see an increasing confidence in adding to long Hungarian government bond positions.

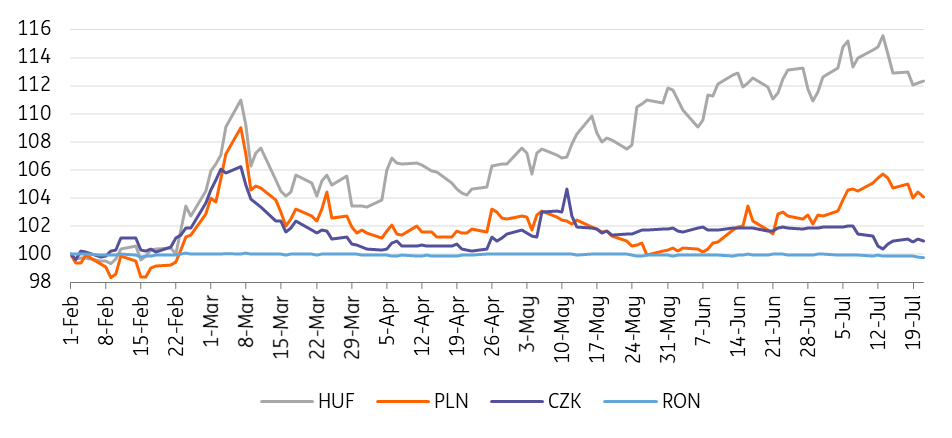

Hungarian yield curve

Forint remains tied to global sentiment and political news in the near future. Up until we won’t see a deal sealed between Budapest and Brussels about the EU funds, the gravity line for EUR/HUF will remain at the 400 level. With rate hike expectations being quite aggressive (1x4 FRA at 12.25, 3x6 FRA at 13.17), showing an extremely frontloaded further tightening, we see the bar low for the market to feel disappointed after next week’s rate decision. This could push EUR/HUF back in the 405-410 range in the shallow summer trading periods. It seems hard to see a sustainable rally in the forint until either the external environment improves (unlikely this summer) or Hungary settles the Rule of Law dispute for good. In our view the best chance to see that comes in September.

CEE currencies vs EUR (1 Feb = 100%)

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more