National Bank of Hungary Preview: A nice occasion to slow down

We narrowly favour a 75 basis point hike at the National Bank of Hungary’s September meeting, taking the base rate and the one-week depo rate to 12.50%, although 100bp remains clearly on the table. We see a lot of arguments supporting our call for a slowdown to a less aggressive step size

| +75bp |

ING's callChange in the base rate |

The rationale behind our call

The announcement of a prolongation of the price cap measures in basic food and fuel from the government will lower the near-term inflation peak, somewhat limiting concerns about consumer inflation expectations becoming more extreme. Originally, these cap measures would have been ended from 1 October, but the government decided to keep caps in place until the end of 2022, as for now.

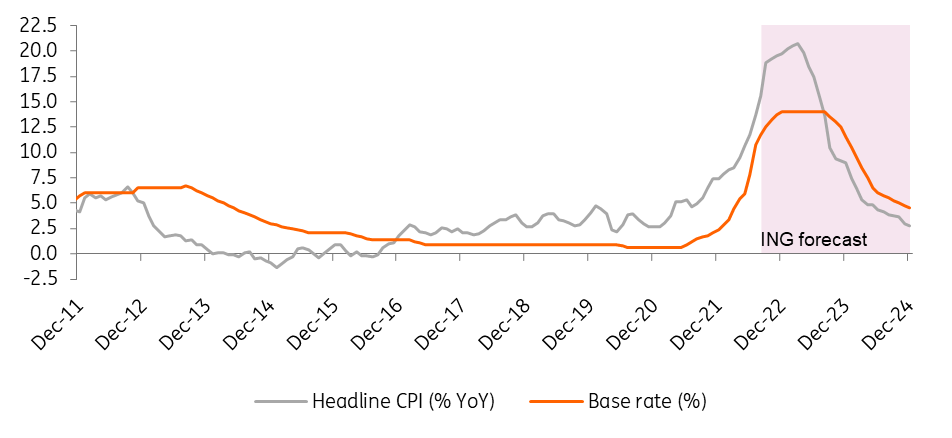

This leads us to change our inflation forecast profile and now we expect inflation to be a tad below 20% year-on-year in December. However, even if market prices of fuel will drop in the next three months, we see an end to these caps, giving a boost to the headline reading. This means we see the inflation peak in the first quarter of 2023 at close to the 21% level. The lowered hump during late 2022 means a downward revision (0.3ppt) to our full-year inflation forecast to 13.6%.

Besides the lowered peak in 2022, the introduction of liquidity draining measures and the expected improvement in the monetary transmission mechanism are also reducing the urgency to continue the tightening with a 100bp step size. The latest official communication which pointed out that the CPI peak might be near – which qualifies as a milestone in the fate of the tightening cycle – can also be a sign of a possible slowdown in the pace of hikes.

The National Bank of Hungary is going to reveal its updated economic outlook as well. We see the central bank revising its GDP outlook significantly downward in 2022 (to 4.0-5.0%) and 2023 (to 0.0-1.0%) providing another talking point for a lowered step size.

However, decision makers might be worried about the vulnerability of the forint and will also argue that the government’s latest support package which contains a prolonged mortgage rate freeze, energy bill and investment support to energy-intensive SMEs, investment support to large energy-intensive factories and a job protection action plan could increase medium-term inflation, given it reduces the risk of recession.

ING's inflation and base rate forecasts for Hungary

Against this backdrop we see next year’s average inflation at 15.4%, while we expect 2024 price changes at 4.5% on average. In this respect, we wouldn’t be surprised by a significant upward revision in the 2023-2024 inflation outlook by the central bank as well. If these arguments about the higher mid-term inflation will be considered with greater weight, we see a chance for a 100bp hike next week. That means the meeting is a close call.

If we’re right and the monetary council does move a bit more cautiously next week, then we expect another 75bp step in October, a 50bp hike in November and at least another 25bp tightening in December. This would take the terminal rate to the 14% area. Should the NBH stick with 100bp in September, then we see the terminal rate rather in the 15% area.

What to expect in rates and FX markets

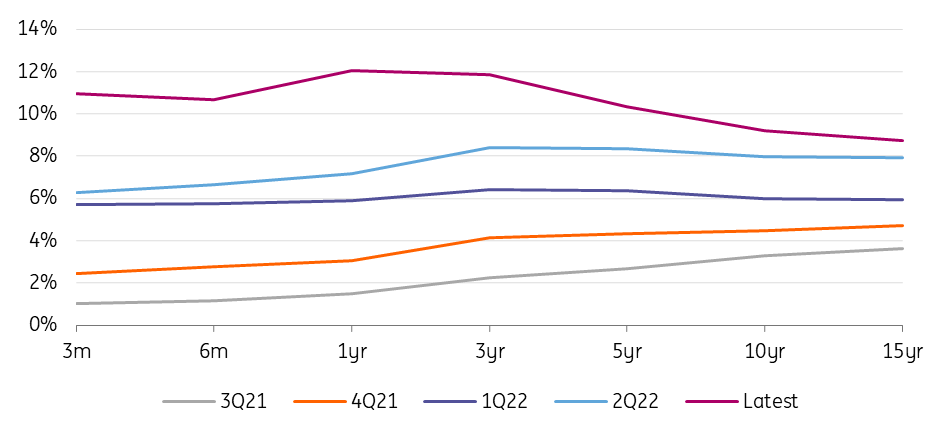

In rates space, market expectations have fallen significantly, especially at the short end of the curve since early September, resulting in a steeper curve. Thus, in our view, it will not be a problem for the NBH to maintain the hawkish tone that should restore market expectations. In any case, the HUF curve remains by far the most inverted in the Central and Eastern European (CEE) region, but we think it is too early for its normalisation. Therefore, we expect a flattening of the curve after the 27 September NBH meeting as we have seen in the case of the last five meetings. However, weak liquidity remains a problem in Hungary, and we have not seen much change in market conditions since the summer.

Hungarian yield curve

Hungarian government bonds (HGBs) have cheapened significantly in line with our expectations, but in asset swap (ASW) terms levels are still outside usual ranges and we still see room for further cheapening in both nominal and relative terms. Although HGB issuance should weaken by year-end given the positive budget outlook and secured issuance numbers, core rates are instead pushing long ends up across the CEE region. Therefore, we continue to like short HGB in ASW, but as with rates, liquidity is the biggest issue.

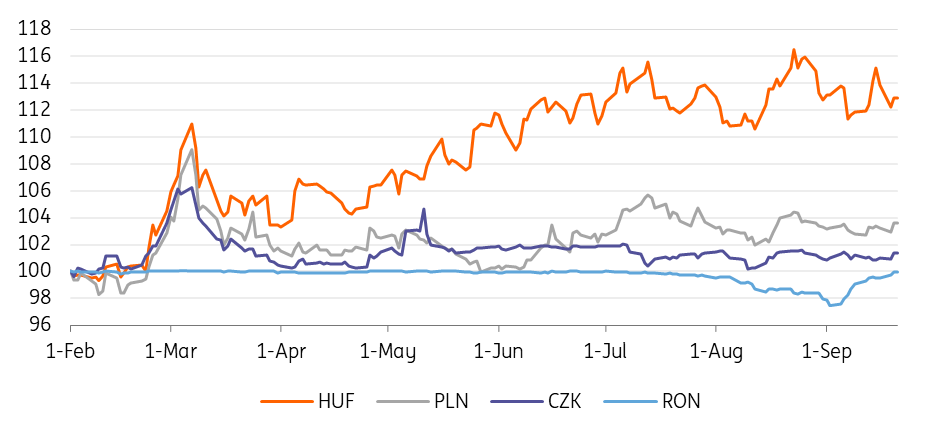

CEE currencies vs EUR (1 Feb = 100%)

The forint remains mainly driven by gas prices, as do all CEE currencies, and the headlines about the European Union story, making the situation even more complicated. We believe that the Rule-of-Law debate will find a solution in some form of a deal between the Hungarian government and the European Commission. But in meantime we can expect the forint to experience more pain from the EC, the possible deterioration of the geopolitical situation and the gas story, or the downgrade of the rating outlook this Friday from Moody’s. On the other hand, we should see some effect of the new NBH measures to drain liquidity, supporting the forint. Thus, we continue to believe that HUF has a lot of potential to move well below 400 EUR/HUF and thus temporarily weaker levels can serve as a good entry point, but the timing still needs more clarity on the situation in our view.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more