NAFTA: A ray of hope

President Trump’s 'win' on tax and strong lobbying from NAFTA supporters is helping to soften the White House's opposition to the trade deal. We believe NAFTA has a future, but major concessions will still be needed as talks resume next week

NAFTA – Trump’s perspective

For 24 years the North American Free Trade Agreement (NAFTA) has boosted trade, investment and jobs while increasing consumer choice right across the North American continent. This hasn’t stopped Donald Trump criticising what he sees as the “worst trade deal ever”.

He continues to argue that American workers have been displaced by a cheaper Mexican workforce with businesses exploiting this for their own gain. Competition from Canada is also perceived to have cost US jobs, as more expensive American made products have been substituted for “cheap” imports. As such, US Trade Representative Robert Lighthizer has “certified” that “at least 700,000 Americans have lost their jobs due to changing trade flows from NAFTA” and that NAFTA has increased the US trade deficit.

The obvious rebuttal to this is that it is the Chinese manufacturing boom and technological advances that have cost US manufacturing jobs, with increasing numbers of workers replaced by robots, particularly in the auto industry. In fact, the Council of the Americas argues that NAFTA has been good for jobs with 14 million US jobs directly dependant on trade with Canada and Mexico.

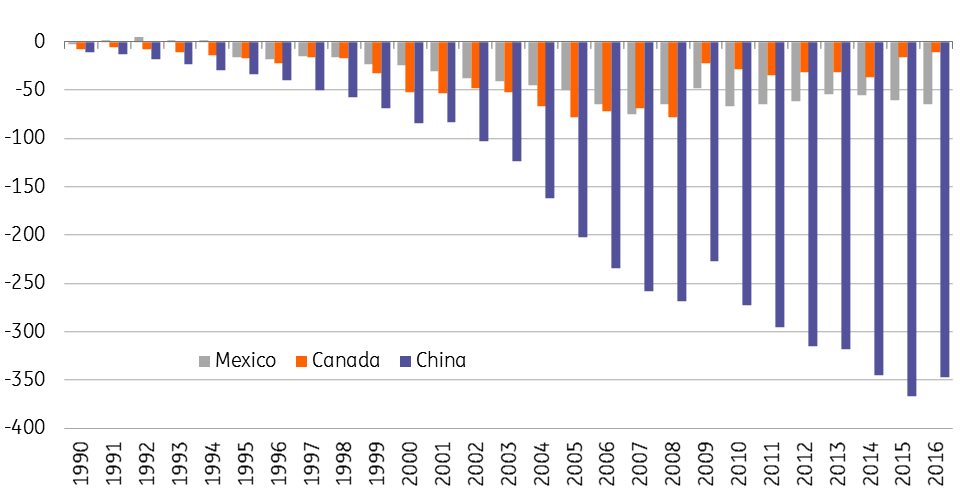

As for the influence of NAFTA on the US trade balance, the deficit with Canada has actually narrowed sharply in recent years while the amount of business done has increased dramatically. Admittedly, the US has gone from running a trade surplus to running a deficit with Mexico during NAFTA’s lifetime, but the size of the move is very small when compared with what has happened to the deficit with China, where there is no free trade agreement. Moreover, Canada is the number one or number two export destination for the output of 41 US states while Mexico is the number one or number two export market for 28 states. Ripping up NAFTA would raise trade barriers and hurt all three countries.

US trade balances with Canada, Mexico & China (USD bn)

What does Trump want?

Trump feels that the US has not benefitted as much from NAFTA as Mexico and Canada and so is seeking a number of changes, including:

· Rules of origin - raising the proportion of North America made material and parts in a car or light truck from 62.5% to 85% with a minimum of 50% coming from the USA. Anything less and the vehicle would not qualify under the NAFTA deal

· A “sunset” clause so NAFTA has to be re-approved every five years

· End the dispute resolution panel

· Eliminate unfair subsidies

He believes this would make things “fairer” for the US and if he doesn’t get them he has threatened to invoke NAFTA’s Article 2205, triggering a six-month notice period before withdrawal. Unsurprisingly, the combination of such radical proposals and an aggressive stance has not gone down well with Canada or Mexico.

Domestically, President Trump had clearly hoped that tax reform would boost his popularity and give the Republican Party a lift ahead of the mid-term elections. This hasn’t happened. He has seen the Republican majority in the Senate reduced following defeat in Alabama’s special election. His personal ratings remain the lowest of any President at the same stage in his Presidency and the Republican Party is languishing in the polls too. As such, there is the clear risk he chooses to appeal to his base and carry through with his threat should Mexico and Canada refuse to acquiesce.

Consequently, officials from Mexico and Canada have been sounding pessimistic on a deal, with Reuters citing unnamed Canadian officials as saying they were increasingly convinced Trump would pull out of NAFTA. These have since been denied, but it is adding to concerns of failure ahead of the sixth round of talks starting January 23rd.

Support for NAFTA remains strong outside The White House

If NAFTA is torn up, businesses in all three economies would experience higher costs and disrupted supply chains while consumers would be faced with higher prices, particularly for cars, clothing food/agriculture and medical devices – areas where tariffs and non-tariff barriers to trade tend to be highest.

Consequently, we are seeing a growing number of politicians within the Republican party warn that ripping up NAFTA would not be in the US’s own interest. 72 members of the House of Representatives wrote a letter in November questioning Trump's handling of negotiations while several Senators have expressed concerns. Even the Republican Governor of the key automaker state of Michigan has warned that ripping up NAFTA “would be a negative for all three countries”. Business lobbies have been making similar arguments.

Significantly, the electorate feels similarly. A survey by the PEW research centre conducted at the end of October shows that most Americans (56%) think NAFTA has been good for the US with just 33% saying it has been bad. The response is highly partisan – 72% of Democrat-leaning voters back NAFTA versus 35% for voters leaning Republican, but it hardly suggests that ripping up NAFTA is going to be a major vote winner at the November mid-term elections.

Compromise still likely

Given this support for NAFTA, there is a growing sense that Trump could pull back from the brink. There have been media stories suggesting that he acknowledges that ending NAFTA could hurt US corporate profitability, which would have a negative impact on US equity markets. Trump views the stock market's performance as an important barometer for how well he is doing and is wary of personally triggering an equity correction ahead of the mid-term elections.

It is also important to remember that US farmers are one of the major winners from NAFTA, exporting in excess of $20 billion to Mexico in 2016. They are politically powerful and key supporters of Trump, hence why the President recently told Nashville farmers that “I’m working very hard to get a better deal for our country and for our farmers and for our manufacturers… it’s not the easiest negotiation, but we’re going to make it fair for you people again”.

There have also been a spate of announcements from companies regarding job creation and investment in the US, including Fiat Chrysler last week and Apple this week while Wal-Mart has claimed it is raising pay rates directly due to tax cuts. His tax reforms may incentivise more of these moves so imposing trade barriers that could hurt US exports would seem a counterproductive move. With businesses and US politicians lobbying hard, we remain hopeful of a deal.

Indeed, we believe that Trump is taking a tough line to give him the best chance of winning concessions. He knows that the US has the strongest hand given that NAFTA trade is far more significant to the Canadian and Mexican economies. As the graphic below shows, the value of trade between the US and Canada was equal to just 2.7% of US GDP in 2016, and trade between the US and Mexico was equal to 2.6% of US GDP. The same trade flows were equal to 32% of Canadian GDP and 45% of Mexican GDP.

NAFTA trade flows

It is also important to point out that the relative size of bilateral trade flows hide the full extent of the potential costs to jobs and consumers from trade barriers being raised, which may determine the extent to which pragmatism wins out in the negotiations. In the example of a car produced in Mexico that uses parts produced in the US, in turn using sub-components produced in Mexico, an increase in tariffs by either the US or Mexico, even if not reciprocated, would increase the costs within the supply chain of the car, threatening jobs on both sides of the border. (This is also a reason why imports from Mexico and Canada are not automatically a negative for the US economy). An additional effect to consider is that consumers are not usually also importers: instead, final goods are imported by companies that sell them to consumers. A tariff on imports of Mexican goods may threaten jobs at the US-based companies importing those goods in order to sell them to US-based consumers.

Economic pragmatism

Our central case remains that national pride ends up giving way to economic pragmatism, with Canada and Mexico prepared to “give some candy” in the negotiations, as demanded by Trade Representative Lighthizer. Judging by recent official statements, Mexico seems prepared to agree to “strengthen” regional minimum content for the auto sector. Softer language for the sunset clause, to something closer to periodic review rather than automatic termination, also seems plausible, while the parties also appear to be closer on the dispute resolution framework, with Mexico offering the possibility of an “opt-in and opt-out” mechanism for arbitration of trade disputes. But given that Mexico’s counteroffers are likely to meet the US only halfway, it is unclear if they would be sufficient.

An alternative scenario, in which all the parties agree to postpone negotiations, until after July’s Mexican election, would probably be well-received by some investors, seen as evidence that the US is committed to eventually reaching a deal. Others may see a delay in a less favourable light, however, as Mexico’s negotiating stance could change after the elections. The Peña Nieto administration appears better-positioned to negotiate a compromise solution considering the more nationalistic focus of Andres Manuel Lopez Obrador (AMLO), the leading contender in Mexico’s presidential race.

What if we are wrong?

While we feel that the end game will be Mexico and Canada reluctantly agreeing to a watered down version of Trump’s demands, this is not guaranteed. If NAFTA does end, US financial markets are likely to react negatively, with stock prices of affected companies coming under pressure – just as we saw when the initial (incorrect) story broke citing Canadian fears that talks were about to collapse. Treasury yields may also rise slightly on inflation fears given the prospect of supply chain disruptions and the imposition of some tariffs pushing up prices.

The Federal Reserve will be concerned about some short-term disruptive economic effects, but the relatively modest hit to US sentiment/economic activity may be offset by potentially higher inflation. Nonetheless, we would likely remove one of the three rate hikes we are currently forecasting for the Fed this year. Such a development could accelerate the EUR/USD moves we are forecasting. Our year-end 1.30 target could be brought forward to Q3 and it could increase the chances of a 1.40 reading in 2019.

If NAFTA ends, the implications for Mexico would be much worse than they are for the US and Canada. US-Canada trade may revert to the 1988 Canada-US Free Trade Agreement, which would preserve tariff-free trade, but there still would be implications in terms of rules of origin and minimum content for products to qualify. The Bank of Canada has just hiked interest rates again (January 17), but the potential for economic disruption would mean that there would be a prolonged pause, possibly through the rest of the year. The Canadian dollar would likely come under downward pressure – our FX team target 1.30 versus USD in such a scenario, which would add to the upside risk for inflation and squeeze real household income growth.

Within Mexico, the auto sector is particularly vulnerable, given the complex supply chains, but other Mexican corporates seem more at ease with prospects of a return to WTO rules. The primary concern would be the risk of a potential escalation by the Trump administration, with the imposition of extra tariffs or non-tariff trade-barriers, beyond the scope of the WTO.

The USD/MXN would return to the 20-21 range but we don’t expect the currency to overshoot to the near-22 high seen one year ago. Thanks to the ongoing adjustments on the monetary and fiscal policy fronts, especially the sharp 425bp rise in interest rates so far, Mexican assets should be somewhat more resilient than in the past. But, in any case, the peso would weaken materially, giving Banxico no choice but to maintain a hawkish stance throughout this period. We expect the bank to hike again at its next meeting in February, while additional hikes would be conditional on the outlook for the peso, which should depend in large part on the outlook for NAFTA and the US Fed.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more