What central banks are set to do next

Central bank rates are reaching their peak globally, and we're already starting to see rate cuts in certain regions. Here's what our team expects from policymakers across the world over the next few months. For more forecasts, find the full report here

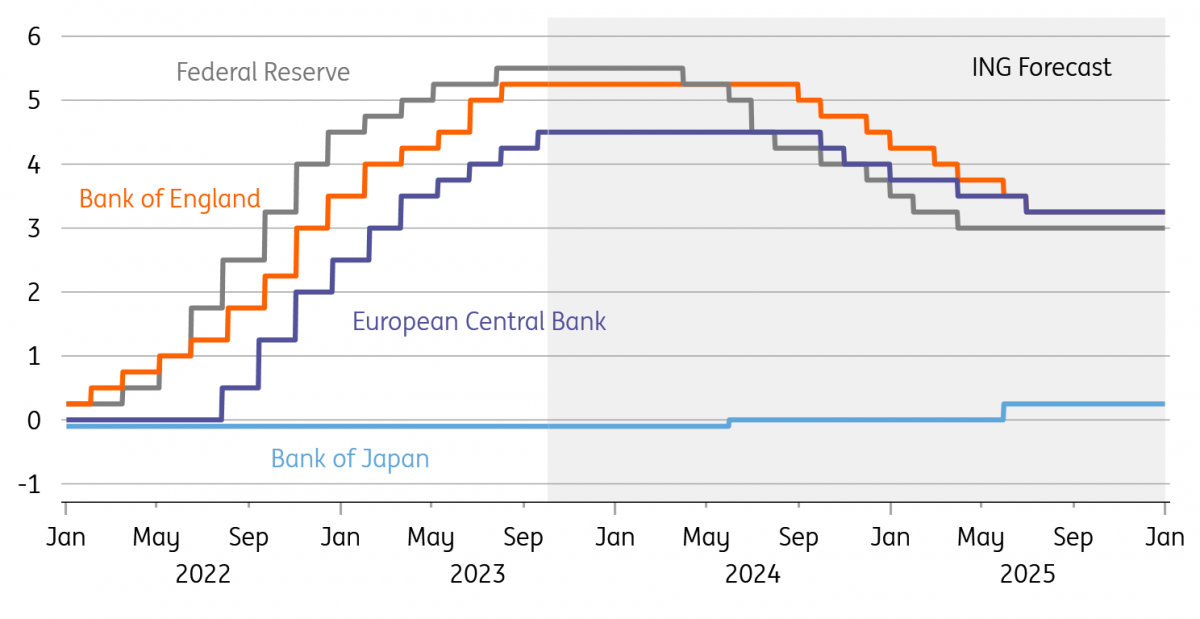

Major central bank forecasts

Federal Reserve

Our call: No further rate hikes with cuts starting from Spring 2024

Rationale: The Federal Reserve continues to signal the potential for a further rate hike this year, given that inflation remains above target, the jobs market is tight and activity has proven to be surprisingly resilient. Nonetheless, challenges will continue to mount, with real household disposable income slowing to a crawl just as student loan repayments are restarting, credit availability is drying up and pandemic-era accrued savings are being exhausted for many households. Encouragingly, key inflation measures are looking more benign, with the core personal consumer expenditure deflator posting three consecutive 0.2% or below month-on-month prints. Assuming this continues, the Fed will have the flexibility to respond to the slowdown in the economy we expect to see in 2024.

Risk to our call: A tight labour market and a US consumer that continues to spend could keep inflation higher for longer, especially if unions extract inflation-busting wage agreements that set a benchmark for broader pay deals. The Fed would have little hesitation in hiking further in this scenario. Alternatively, if financial distress re-emerges in the banking sector – most likely via the commercial real estate market – this will tighten lending conditions markedly and could prompt the Fed to cut interest rates more aggressively.

James Knightley

European Central Bank

Our call: No further rate hikes and the first rate cut in summer 2024

Rationale: Official European Central Bank (ECB) comments since the September meeting and rate hike suggest that the ECB is not done yet with its hiking cycle. However, we expect the eurozone economy to weaken further and faster than the ECB currently expects. Combined with more disinflation until the end of the year, there will be very few arguments in favour of further rate hikes at the late October and early December meetings. Once the Fed starts cutting rates, and assuming eurozone inflation remains around 3% next year, the ECB will be in a position to alter its monetary policy stance to one which is less restrictive but not yet accommodative.

Risk to our call: A more resilient eurozone economy coupled with the impact of the recent oil price surge could easily push the ECB to opt for at least one more hike before year-end. The ECB is clearly also concerned with its own inflation-fighting credibility and the fear of a de-anchoring of inflation expectations. The ECB’s very own dismal track record in predicting inflation could tilt the balance towards more hikes.

Carsten Brzeski

Bank of England

Our call: No more rate hikes and the first rate cuts from summer 2024

Rationale: The Bank of England (BoE) held rates steady at its September meeting, and there’s not a huge amount of data set to be released between now and the next decision in November which is likely to alter that calculation. Barring a big spike in services inflation or wage growth, we think the tightening cycle has finished. The BoE has been very clear that it is prioritising keeping rates higher for longer over hiking more aggressively in the short term. Still, with unemployment rising, it’s only a matter of time before wage growth starts coming down, though progress is likely to be gradual. Come next summer, the average rate on outstanding mortgage debt is likely to have gone from 3% now to over 4%, even without any more hikes. That suggests a gradual rate-cutting cycle can start from the middle of next year, taking rates to something closer to neutral.

Risk to our call: Large upside surprises to services inflation or wage growth unlocks another rate hike in November.

James Smith

Bank of Japan

Our call: Another tweak to the Yield Curve Control (YCC) policy but no change in the policy rate until the second quarter of 2024

Rationale: Recent data has shown inflation is proving to be more stable and sticky than expected. There are signs that some of it reflects demand pressure, with private service prices rising notably in recent months, helped by rising tourism. An additional nudge from monetary policy would also provide some support for the JPY, which has been under pressure given the higher for longer market view of the Fed. A change to policy interest rates will not happen earlier than we are forecasting because the Bank of Japan (BoJ) will need to see the outcome of the Spring Wage settlement in order to be convinced that the economy can withstand interest rate normalisation.

Risk to our call: Despite evidence to the contrary on inflation and wages, the BoJ seems extremely nervous about departing from its current approach and may stick with it for longer.

Min Joo Kang

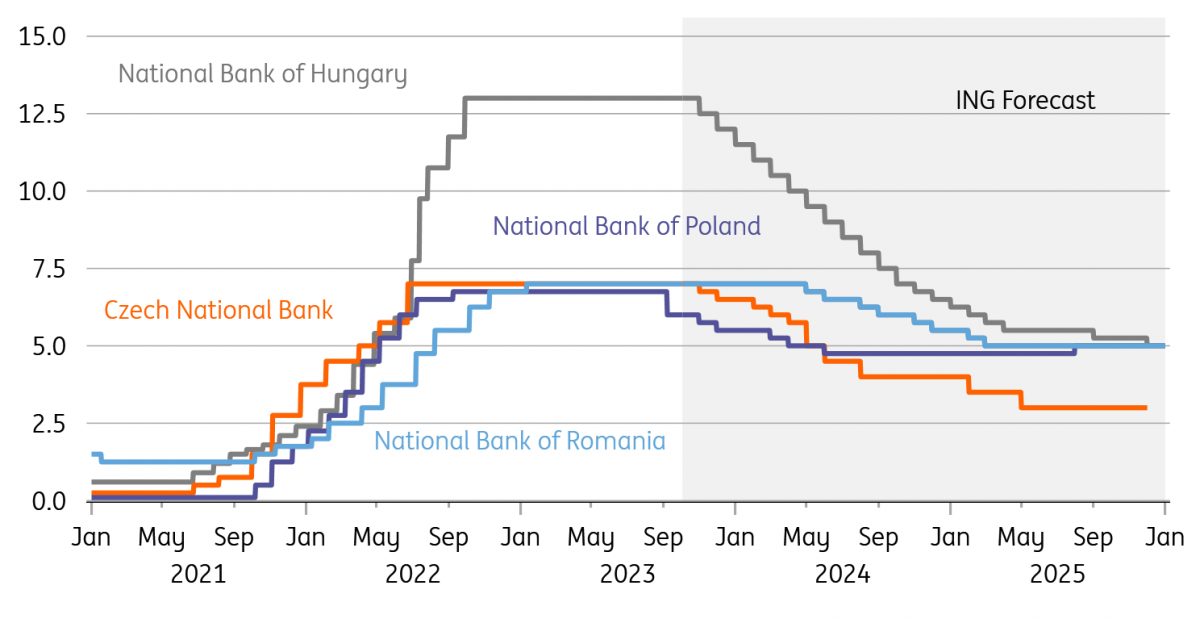

CEE central bank forecasts

National Bank of Hungary

Our call: Cautious easing with two 25bp cuts over the next couple of months

Rationale: According to our forecast, September headline inflation could be around 12.4%, clearly closing the door to a 75bp or a 100bp easing should the National Bank of Hungary (NBH) see a positive real interest rate (ex-post) after its October decision. What could also be a factor here is the EUR/HUF level and volatility. A lower-than-expected CPI print might reignite some dovish expectations, and as the NBH reaction function contains market stability, such a move in FX might call for a more hawkish stance. Against this backdrop, we stand pat with our call for a non-consensus 25bp (or perhaps 50bp) rate cut in October and November.

Risk to our call: The EU deal happening earlier than anticipated and lower September inflation will strengthen the HUF, allowing for a larger rate cut.

Peter Virovacz

Czech National Bank

Our call: First rate cut in November

Rationale: Inflation surprises to the downside, and thanks to base effects and seasonality, the headline rate will be close to the 2% target next January. The Czech National Bank (CNB) staff forecast has been indicating the need to cut rates for some time.

Risk to our call: Weaker FX or an upside surprise in inflation may be a reason to delay the first rate cut until the first quarter of next year.

Frantisek Taborsky

National Bank of Poland

Our call: The National Bank of Poland (NBP) has cut rates by 25bp at its October meeting, and the main policy rate is set to decline to 5.5% at the end of 2023. By the end of 2024, the NBP reference rate may decline to 4.75%

Rationale: Following a surprise 75bp rate cut in September, the Monetary Policy Committee switched to a more cautious approach in order to avoid further downward pressure on the PLN. We expect another 25bp cut in November. In 2024, we see room for an additional 75bp worth of policy easing as inflation is projected to continue moderating in the first half of the year.

Risk to our call: The CPI decline in September (to 8.2% year-on-year) was deeper than the NBP expected and may trigger more bold action from policymakers. If accompanied by ultra-dovish rhetoric from the governor then it may cause PLN weakness to resume, worsening the inflationary outlook – and that could require rate hikes in the second half of next year.

Rafal Benecki

National Bank of Romania

Our call: The key rate will remain at 7% until the first half of 2024 and reach 5.5% by the end of 2024

Rationale: Following a slight derailing of the disinflation path in August, significantly higher oil prices, and the likely upside pressures stemming from a higher fiscal burden in 2024, the first National Bank of Romania (NBR) rate cut now looks more likely to occur in the second quarter of next year rather than the first. That being said, with downside pressures on growth also likely to remain strong, we still expect 150bp worth of rate cuts by the end of 2024.

Risk to our call: Downside risks stem from a sharper-than-expected downturn in the German and eurozone economies – Romania's key trading partners – as well as from higher-than-expected oil supply levels from OPEC. Upside risks stem from wage growth remaining at very high levels, amplifying the stickiness of core inflation, as well as from oil prices remaining very elevated.

Valentin Tataru, Stefan Posea

Download

Download article

5 October 2023

ING Monthly: An inconvenient truth for central banks This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more