UK: Strict shutdowns to give way to sustained spring recovery

While we expect strict lockdowns to trigger a 3% fall in UK GDP in the first quarter, the more optimistic outlook for vaccinations means a sustained recovery could start in the spring. The longer-term recovery will depend on how quickly government wage support is removed, but also on the drag from lower investment and hiring as a result of new UK-EU trade ties

The short-term outlook

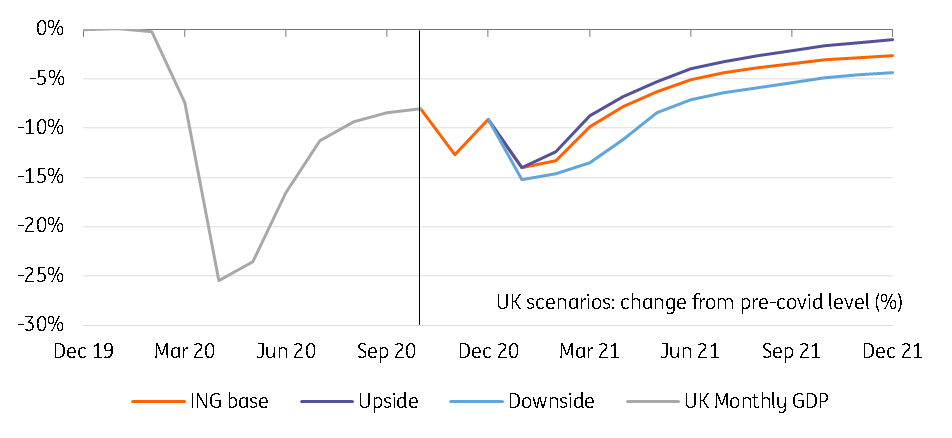

The new, more transmissible Covid-19 strain means the new strict UK lockdown is here to stay for some time. And this inevitably means a negative first quarter for GDP - perhaps in the region of -3%. The upside to that appears limited, given that we know the current lockdown will last until at least mid-February.

That said, the dip is unlikely to be as bad as the first lockdown. Sectors that are able to operate, even partially, are better geared up. And a wider range of industries, including construction/manufacturing, are able to continue operating. Economic activity looks poised to drop to around 15% below its pre-virus level, compared to -25% in the first wave.

The clear downside risk to this comes from Brexit. There are a growing number of reports of firms struggling to move goods across the border now the transition period has ended. The vast majority of hauliers that operate on the key Dover-Calais route are EU-based. The pre-Christmas chaos at the ports appears to have left many reluctant to take UK-bound deliveries, while new customs and VAT processes are adding further complexity.

Our new UK scenarios for 2021

The vaccine effect

The UK expects to vaccinate all over 70s (and some other high-risk groups) by mid-February. This may prove over-ambitious, but given the anticipated supply of Oxford/Astrazenica doses, a weekly pace of one to two million doses appears achievable within the next few weeks.

Realistically that could enable a very gradual removal of restrictions from March, and more meaningfully beyond Easter. By then, the hope will be that the hospitalisation risk will have fallen significantly, although the government may feel compelled to reduce wider community transmission further if cases are still high. Our base case is that most, if not all, restrictions have largely gone by the summer months. Like elsewhere, a key risk is that a new variant disrupts the vaccination programme, requiring a tweaked vaccine to be rolled out at speed.

The strength of the recovery

Pent-up demand is likely, given the savings that have been built up on aggregate through lockdowns. But the more important question is what happens to government support - chiefly wage subsidies. If these are phased out before the worst-affected sectors are back on their feet (think events, travel etc) there is a risk of another increase in unemployment through the middle of the year. An element of this is inevitable, and we think this will prevent a return to the economy's pre-virus size this year or indeed, most likely, for most of 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 January 2021

Seriously, keep the faith! This bundle contains 10 Articles