The eurozone economy is set to shrink in 2023

The expanding negative energy shock is likely to initiate a recession from the third quarter and we're likely to see a GDP contraction. Rising natural gas prices are also keeping inflation higher for longer. A more hawkish ECB is likely to raise rates again in September and October, but the recession should put a - temporary - end to the tightening cycle

Recession is coming

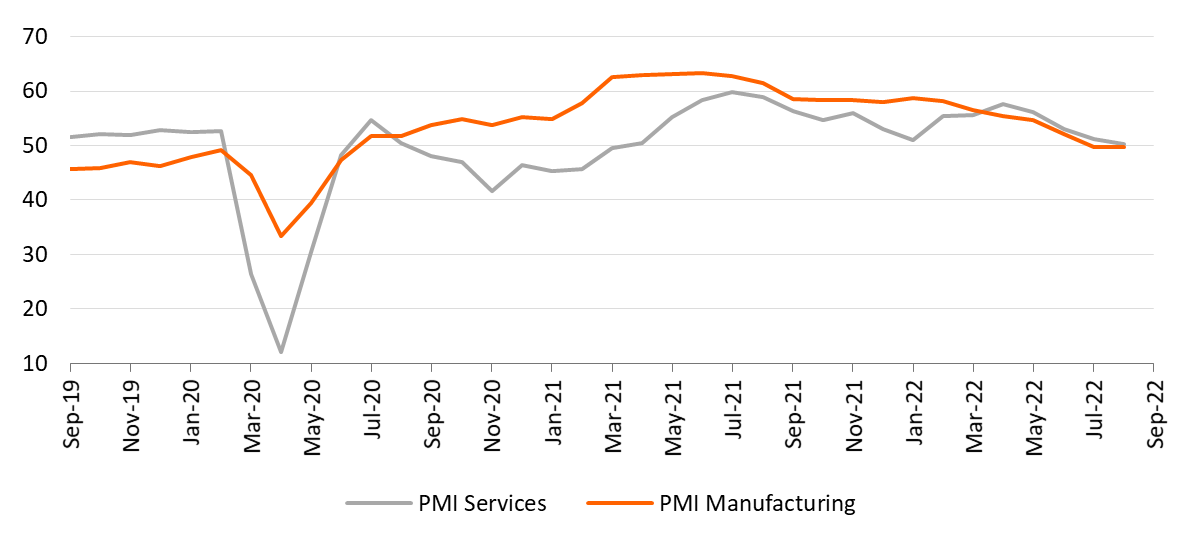

After a relatively strong second quarter (+0.6% quarter-on-quarter) after Covid lockdowns were largely stripped away, the eurozone has now probably fallen into recession. The Composite PMI indicator fell in August to 49.2, the second month in a row below the 'boom-or-bust' level. With the forward-looking new orders component also declining again, it looks as if it is only going to be downhill in the coming months. And the strong inventory build-up will add to production cutbacks.

Survey indicators are at recession levels

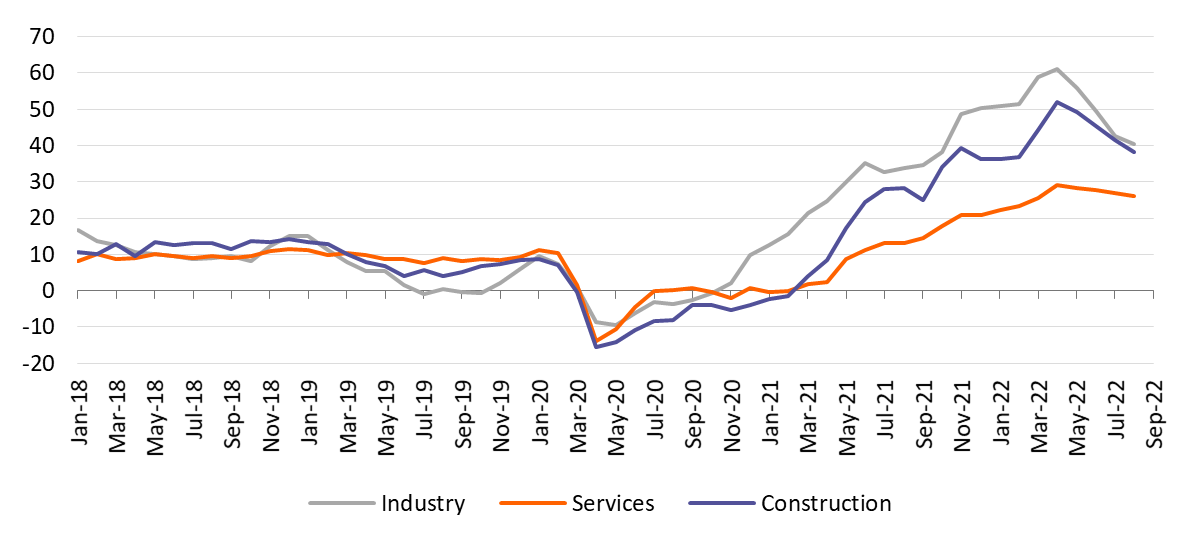

Energy shock erodes real incomes

The headwinds facing the eurozone are only increasing. The summer drought will not only hurt the agricultural sector, but the low level of the Rhine River is also distorting supply lines for German manufacturing, while in France the lack of cooling water is impacting nuclear power generation. This, however, is small fry compared to the breadth of the negative energy shock Europe is experiencing. Natural gas prices have more than tripled since June, pushing more energy-intensive companies to cut production or idle plants.

The hit to household purchasing power is massive; real wages are falling more than 5% year-on-year. With consumer confidence hovering at very low levels, chances are slim that households will delve into their savings to uphold their consumption expenditures. And as companies are equally hit by the energy shock, final demand is faltering and financial conditions are tightening and we see business investment falling back in the coming quarters. As we expect the energy market to remain very tight (and prices therefore high) we pencil in three consecutive quarters of negative growth, starting in the third quarter of this year. This still results in 2.6% growth in 2022, mainly on the back of a strong carry-over effect, while for 2023 we now expect a 0.6% GDP contraction.

Inflation to come down only very gradually

As for inflation, the higher cost of natural gas is only partially compensated by slightly lower oil prices. On top of that, a natural gas levy in Germany will add to inflation from October onwards. This will keep headline inflation close to double-digit levels in the next three months. At the same time, underlying inflationary pressures are bound to soften on the back of the economic slowdown.

In the business surveys, selling prices' expectations have now been moderating for a few months in a row, while supply chain tensions and shipping prices have also eased. And the second-round effects, popping up through higher wages, remain muted for now. As a matter of fact, negotiated wages only rose 2.1% year-on-year in the second quarter, according to the ECB. Putting it all together, inflation will only come down very gradually, although we see a return to the 2% level towards the end of 2023 as still feasible provided, of course, that energy prices don’t increase much further.

Selling prices' expectations are moderating

A more hawkish ECB

The European Central Bank has become somewhat more hawkish. In Jackson Hole, ECB Board Member, Isabel Schnabel, said that the uncertainty about inflation persistence requires a forceful policy response, a statement that was echoed by several members of the Governing Council. We therefore now expect a 50-basis point rate increase in September and another 25bp rise in October. Thereafter we still expect to see a long pause.

Let’s be clear about this: if the ECB is consistent with the risk scenarios it published in June, it should already forecast a recession in its September staff forecasts. While the bank might still pull off a rate hike in October, the necessity of tightening further after that, in the midst of a worsening recession, will probably not appeal to the majority of the Governing Council members.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 September 2022

ING Monthly September: Recession’s coat of many colours This bundle contains 14 Articles