Monitoring Bulgaria: Political tensions rise as country waits for euro green light

Bulgaria is set for decent growth in 2024. It's due to adopt the euro next year, but political and inflationary concerns remain and it's still waiting for a final decision to become part of the eurozone club

At the time of writing, we are still unsure whether there'll be an imminent snap election in Bulgaria. Our base case remains that political stability will prevail, and this will ensure that the country remains on track to join the eurozone in 2025. The main obstacle, besides politics, remains the inflation criteria. We believe that by mid-year, this will look good enough for the country to get the green light from the European Council.

Growth-wise, the economy should accelerate this year as public fixed investments make a comeback and private consumption remains strong. However, sluggish external demand will ensure that growth remains slightly below potential. We believe that fiscal spending will remain close to but still below 3.0% of GDP in 2024 as social, military and investment spending pressures are set to increase. Financing for the deficit (approx. EUR3bn) is likely to come predominantly from external markets. The anticipated decision of being accepted in the eurozone should come with quasi-automatic rating upgrades, and issuance could therefore be tilted into the second part of the year.

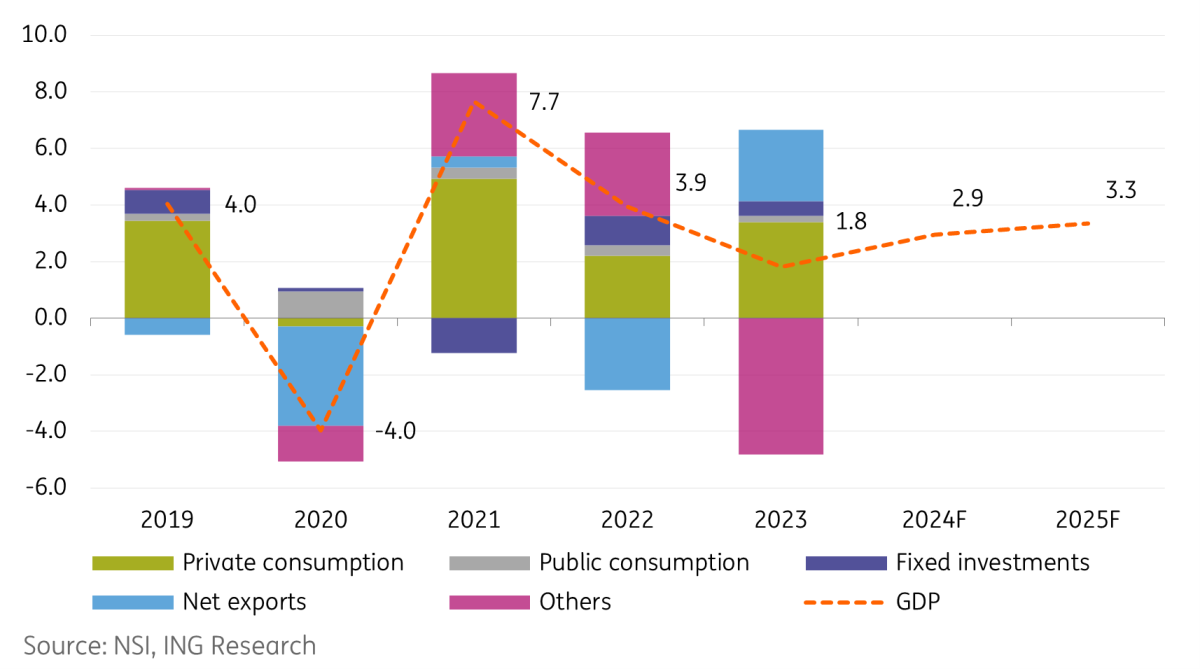

GDP growth on an improving path

Annual economic growth slowed visibly last year to 1.8%, down from 4.0% in 2022. Weaker investments and public spending took their toll on output, as drawn-out political instability weighed on public projects’ approval and the absorption of EU funds in the first half of last year. That said, private consumption picked up in 2023, accounting for the lion’s share of the positive contribution to growth. It was boosted by the recovery of real wages.

Net exports also contributed positively. However, it was not for the right reasons, as the cooling of exports was simply outweighed by the drop in import demand. Key contributors to the trade dynamics were the struggling industrial sector, declining mineral fuels trade, slowing retail trade, and a lacklustre performance of key trading partners.

Private consumption and net exports contributed the most to economic growth in 2023

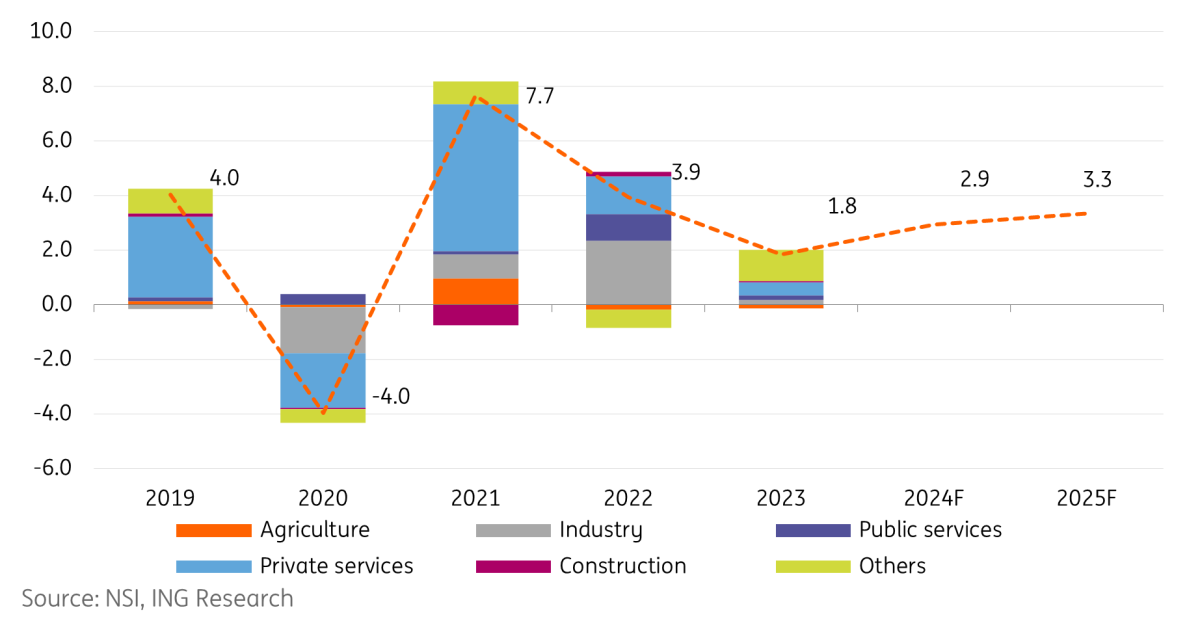

On the economy's supply side, significant slowdowns in mining, manufacturing, construction, financial services and public administration services – as well as contractions in professional and entertainment activities – proved a drag on output. There was a positive contribution from a pick-up in trade and services such as auto repairs, transportation, and hospitality, coupled with a smaller contraction of agriculture.

Decelerating growth visible across the board on the supply side

Our growth outlook

Overall, we think that growth will continue to pick up in the next two years as private consumption improves, EU money continues to fund higher rates of investment and external demand gradually recovers. We forecast 2.9% GDP growth in 2024, with a key upside risk coming from a stronger-than-expected response of consumers from recent wage gains.

Downside risks come from a potentially slower-than-expected EU funds absorption, new political frictions and, as far as trade is concerned, the failure to produce and export the same levels of refined oil after a recent ban on crude Russian oil. On the supply side, the gains from recent and future investments are set to feed their way into growth, although most likely in an asymmetric manner; firms integrated into the construction, transport and engineering supply chains are set to benefit the most in the short to medium term.

Industry: prolonged weakness

Manufacturing continued to suffer in 2023, in line with external demand. The downturn in Germany and the slowdown in Romania—Bulgaria’s key trading partners—weighed on the external sector, negatively impacting manufacturing, especially in the second half of last year. The strongest declines in production happened in the wood and furniture manufacturing sectors, as well as textiles and tobacco production. Moreover, the output of both the mining and energy sectors contracted, adding to the headwinds.

In the mining industry, plans to phase out coal power plants (extended to 2038) are already taking a big toll on coal and lignite mining output, which fell 46% in 2023. Bulgaria will receive EUR 1.2bn under the European Commission’s Just Transition Fund as grants for shutting down mines and turning the country’s three coal regions towards less polluting activities. Green projects are currently under evaluation, with the aim of replacing the coal industry's lost output, which used to generate around a third of the country’s electricity. Last year brought a 26% decline in energy goods production.

Industrial activity should improve somewhat this year, backed by domestic consumption and investments and somewhat better external demand.

Local manufacturing feeling the pain of lower external demand

Tourism should remain growth supportive in 2024

Tourist arrivals continued going up last year and returned to their pre-pandemic levels, providing a boost to the services sector. Turkish, Romanian, Ukrainian and Greek tourists topped the rankings in terms of total numbers. Given that another year of sharp real wage growth is likely in Romania, coupled with the still lacklustre performance of the eurozone economy, which could increase the appetite for cheaper holiday alternatives, we expect tourist levels to continue to increase this year.

Tourist arrivals returned to pre-pandemic levels in 2023

Investments are making a comeback

Fixed investment annual growth slowed from 6.5% in 2022 to a still robust 3.3% in 2023. What really stood out positively were the investments related to public administration and services, which improved by a whopping 122% in 2023, reaching around EUR 2.5bn. Here, the fourth quarter of 2023 alone defied all odds, bringing in around EUR 1.5bn of such investments, representing 36% more than the whole of 2022.

At a broader level, public administration and public services investments now represent 17.1% of total fixed investments (2022: 8.1%), pushing them up from fifth to third spot in the investment rankings dominated by industrial and trade sectors. We expect investments to continue to pick up this year, in line with EU funds' inflows.

Trade and the balance of payments: geopolitics at play

Last year’s trade deficit was 31% lower compared to 2022, reaching EUR 5.3bn, despite demand for Bulgarian exports being consistently weaker across its major trading partners. A stronger decline in imports came into play, although the picture was mixed. While some trading partners demanded more Bulgarian products, the key contributor to a smaller deficit was by far the decline in Russian energy imports, particularly gas.

In early 2023, Bulgaria’s Bulgargaz signed a 13-year agreement with Turkey’s Botas, accessing its energy network and LNG terminals, providing alternatives to the busy Revithoussa terminal in Greece. Although fears about masked Russian gas inflows unproperly covered by the deal with Turkey have persisted, imports from Russia should continue to decline in 2024 as the effective ban on Russian oil imports comes into play as of 1 March 2024. That said, upside pressures on the trade deficit from oil imports could still continue as the replacement with oil from Kazakhstan, Iraq and Tunisia will likely be more costly.

Elsewhere, the swift recovery in real wage growth throughout 2023 will support imports as consumers start to gradually act on their gains. On the other hand, our view on exports is rather gloomy: out of Bulgaria’s key export markets, only Romania’s economy is set to accelerate this year. As such, at least a partial reversal of last year’s trade deficit improvement is likely in 2024.

Here's a final bonus trade fact: Last year, Bulgaria’s exports to Singapore more than quadrupled in annual terms, reaching EUR 136mn.

Lower exports across the board in 2023

Visible decline in Russian imports in 2023

Turning to the goods classification breakdown, a few things stand out in the trade balance evolution. Firstly, the large improvements in both mineral fuels and other crude materials, in line with the decline in Russian imports and the energy geopolitics at play.

Secondly, it’s the contrast between the total trade balance improvement and the significant worsening of the trade balance with the EU during the same period, with the latter being chiefly driven by deteriorating trade balance across some key sectors: machinery and transport equipment, manufactured goods and animal and vegetable oils. Overall, these developments go hand in hand with the significant struggles experienced by the local industrial sector last year.

Worsening trade balance with the EU

As to the current account more broadly, while healthy increases in tourist arrivals brought some tailwinds for the services sector last year, a smaller deficit in goods trade also made it possible for the current account balance to get back into positive territory after two years of deficits. Last year’s surplus summed up to EUR 273.7mn.

In 2024, the current account should benefit from another likely increase in tourist levels. Strong real income gains in Romania should boost the revenues of the country's resorts, while the stagnation of the European economy could, at the margin, lead more Western tourists towards less expensive holiday alternatives, like Bulgaria. As such, services exports gains should continue to go at least partly against the increase in the trade deficit predicted above.

As for the other balance of payments categories, secondary income and the capital account should start benefiting more from the absorption of EU funds, conditional on the country’s governance not stumbling into another crisis. This will also set the stage for more Foreign Direct Investments to enter the country in the years to come.

Inflation: unlikely to be a showstopper for eurozone accession

We expect inflationary pressures to continue to moderate in the near term before picking up towards the end of the year and remaining slightly above 4.0% throughout 2025. We think inflation will end this year at 3.8% and next year at 4.1%. The key contributors to increasing price pressures are the pick-up in real wages and internal demand, a tight labour market, and the probable euro adoption in 2025.

On price pressures resulting from demand, we think that a boost will come from the recent rise in minimum wage and the overall lagged effects of last year’s rebound of real wage growth towards its historical levels. With an emerging market growth dynamic at play, where multiple infrastructure and modernisation projects will also be executed simultaneously, the impact on spare capacity and firms should be consistent with upside pressures on inflation. Moreover, in the labour market, this boost to growth should stimulate the demand for both blue-collar and white-collar workers. This should at least moderate the recent rise in the unemployment rate (5.8% in January – still low in historical terms) and keep it tight. We expect this to continue to support a still-healthy real wage growth until 2025 at the earliest and as long the government manages to absorb EU funds and kick off new investment projects.

On the fiscal front there are noteworthy developments too. The recent increase in large corporates' taxation and the removal of previous VAT cuts throughout the year should, in principle, also stimulate price pressures, especially as they will catch the economy in an acceleration phase. More specifically, the Covid-inspired cuts in VAT rates for tour operators and sports events (from 20% to 9%), as well as a zero VAT rate for bread and flour, will end on 30 June this year. That will bring stronger price pressures in the second half of 2024. Likewise, the removal of similar VAT reductions for restaurants and catering services is set to end on 31 December, so fuelling service inflation into 2025.

As for international markets' developments, one key difference between the National Bank of Bulgaria's (NBB) assumption and ours is related to the oil price. In its last report, the NBB was counting on a decline in oil prices this year. We're still assuming that prices will stay at current levels on average throughout the year.

Finally on inflation, you can't rule out some forms of price gouging as the official euro adoption date nears. Indeed, the long-standing peg of the lev to the euro, the government's initiative to implement mandatory dual pricing in shops and the fall in currency conversion costs for businesses brought by euro adoption should, in principle, keep prices in check. However, the overall growth acceleration and higher taxation context described above could provide the necessary confidence for at least some firms to seize the opportunity and revise the whole ‘menu’ up - in both LEV and EUR, thus in line with the dual pricing law.

Altogether, we think that these drivers combined will keep price pressures higher than what the consensus and BNB envision.

Fiscal: capital expenditure to continue

In 2023, revenues amounted to EUR 20.3bn while expenditures and transfers were EUR 22bn and the contribution to the EU budget was EUR 0.9bn, leading to a deficit of EUR 2.7 bn, which represents 2.9% of GDP, the same as last year. The strongest revenue increase came from entrepreneurial and property income, followed by VAT and income tax gains. Expenditures and transfers grew from higher public sector wages and capital expenditures.

As for transfers, stronger net flows towards social insurance funds and municipalities stood out. On the other hand, a sharp decline in subsidies put less pressure on expenditure, likely as the government began to phase out energy subsidies for the private sector, which is in line with EC recommendations.

In 2024, we expect capital expenditure to continue to increase in line with the government’s contribution to NRRP investments. Public sector wages are also likely to increase spending pressures. On the other hand, more EU funds inflows and a stronger economy should boost revenues. We have pencilled in a 2.8% deficit this year, with the budget execution likely to be again tilted towards the second part of the year.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more