Mexico’s Banxico to reinforce the monetary anchor

Local assets have been under pressure since announcements by the new administration triggered a surge in policy uncertainties. Risk of departure from pro-market policies increased the risk of fiscal slippage, lower growth and higher inflation. For the central bank, this means: proceed with caution and, at least, match the US Fed's rate policy action

In times of heightened uncertainties, monetary policy to follow a well-trodden path

Mexico’s monetary policy committee meets again next week and we expect bank officials to follow their current hawkish guidance and raise the policy rate, from 8% to 8.25%. We also expect policy guidance to remain hawkish and clearly open to further rate hikes.

| 8.25% |

Mexico's policy ratemonetary tightening continues |

Banxico’s decision should follow a decision by the US FOMC, on December 19, to implement another 25 basis point rate hike, as broadly expected. A dovish surprise (ie, a pause) by the FOMC could alter Banxico’s decision, but we suspect this would not be a sufficient condition for the bank to pause the tightening just yet.

The yearly inflation rate continues to fall, thanks to favourable base-effects and decelerating energy prices, but it remains high (4.7%) and the pace of convergence towards the 3% target has been slower than expected.

The more policy-sensitive core/services components of the basket have remained well behaved but, thanks to higher fresh food prices, recent CPI prints have surprised to the upside. Expectations of a permanently weaker peso and rising inflation expectations have also added material upside risk to inflation dynamics.

On the activity side, the economy continues to operate at full employment, despite moderate growth prints, averaging 2% in the past four quarters, characterizing a late-stage recovery cycle that could well accommodate a tight monetary policy stance.

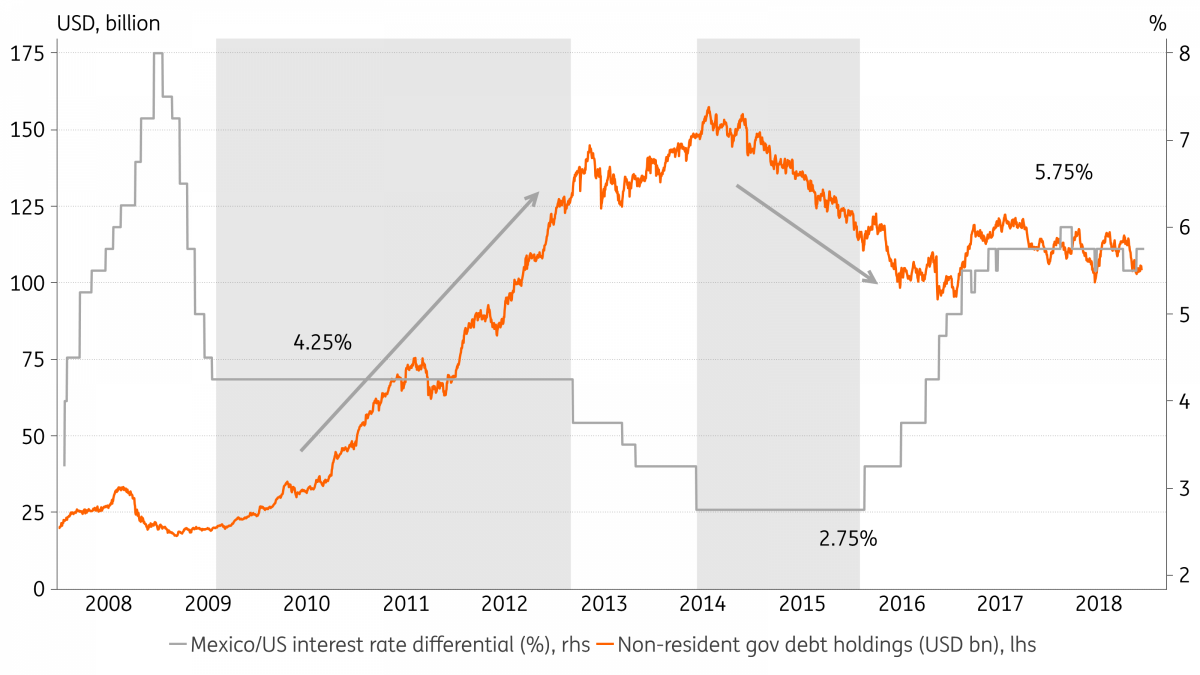

Perhaps a more important consideration for central bank officials at this juncture is the fact that monetary policy remains the most important anchor of stability for local financial markets, at a time of heightened external and domestic uncertainties. Given the large presence of non-resident portfolio holdings in the local market, Banxico is likely to continue to conduct monetary policy with a special focus on ensuring that the US/Mexico interest rate differential remains attractive enough to prevent sustained outflows.

As the chart below illustrates, the strategy appears to be working, with non-resident holdings remaining largely stable over the past year. In the region, Mexico’s financial market remains one of the most vulnerable to large-scale portfolio outflows by foreign investors.

A hawkish stance by Banxico is warranted also because recent announcements by the upcoming administration call into question its commitment to fiscal prudence. The 2019 budget should be unveiled this weekend and we expect a lukewarm and slightly sceptical market reaction. Investors will be watching for optimistic revenue assumptions and rising expenditures, with the creation of new social programs and the renewed focus on boosting government spending in energy and infrastructure investment.

Uncertainties call for a more data-dependent policy guidance in 2019

Beyond this meeting, we suspect that another rate hike in 1Q19 remains likely, but any confirmation of a pause by the US Federal Open Market Committee (FOMC) in March may be sufficient to keep Banxico on hold as well.

After 1Q, policy decisions may become more data-dependent, with FX once again serving as the best gauge of the policy flexibility Banxico would have in the implementation of its rate policy.

Any surprise development vis-à-vis the government’s negotiation with bond-holders that financed the cancelled airport project or the approval of NAFTA agreement, now renamed US-Mexico-Canada Agreement (USMCA), in local legislative bodies (US/Mexico) could also affect local assets, but the risk seems relatively contained.

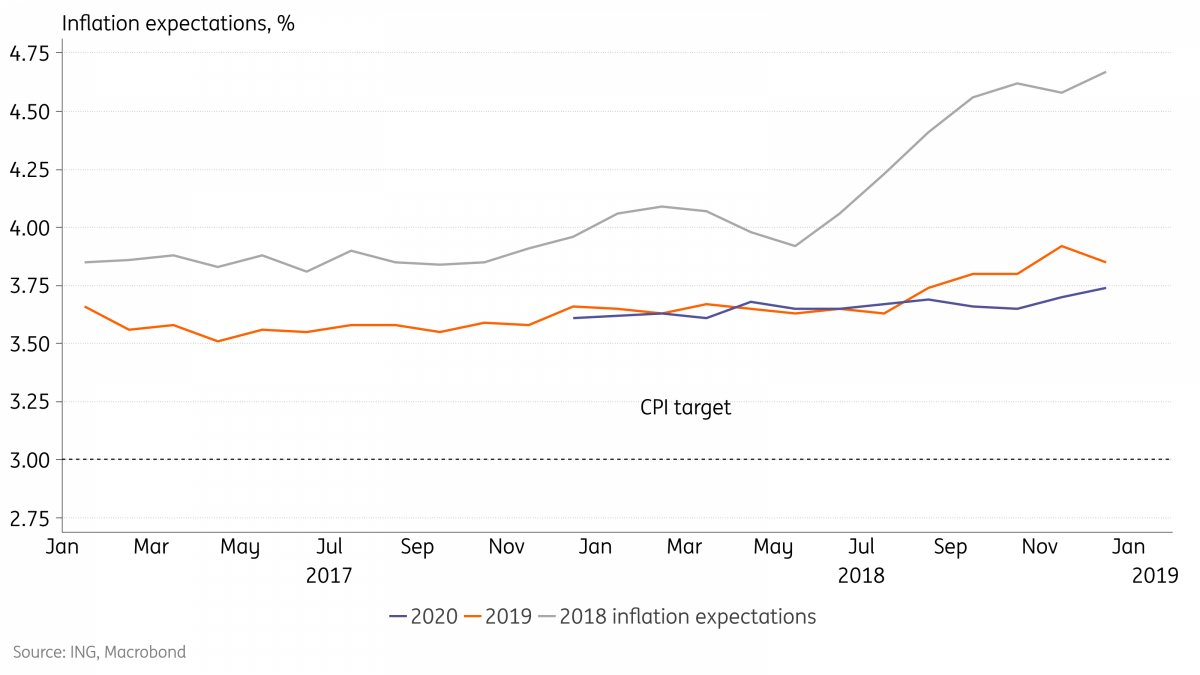

Another consideration for investors should be the change in the central bank’s board composition, which is seen as becoming less hawkish with the replacement of two of the five board members with Lopez Obrador appointees. Inflation expectations have been rising, as seen in the chart below, and any evidence of political interference on monetary policy should be carefully monitored by investors, and potentially trigger further deterioration on the expectations front.

If Brazil’s recent experience is any indication, that risk could increase if economic activity disappoints sharply in the coming years. Right now, tighter financial conditions, falling business confidence, a cautious banking sector and slower US demand suggest that Mexico should experience a mild economic slowdown next year. Our current forecast is a deceleration from 2.1% in 2018 to 1.9% next year, but the balance of risks is skewed to the downside.

Longer-term, as inflation re-enters the 2-4% targeted range, during 2H19, the arguments for Banxico to start considering rate cuts should gain traction. Having said that, room for cuts is relatively limited. Assuming that the US Fed should aim to hike its overnight rate towards 3%, we suspect the need to bolster FX stability should prevent Banxico from cutting rates below 6.5% in the foreseeable future.

Overall, the new administration appears to consider that Mexico’s economic problems represent a failure of pro-market policies and the proposed solution involves, necessarily, a stronger state-presence in the economy. Investor reaction can be characterized as sceptical, amid concerns that new policies could result in a gradual deterioration in Mexico’s long-term outlook. The reversal of the pro-market policies in the energy sector is particularly consequential, and its wide-ranging implications, from growth to fiscal and external accounts, could eventually help trigger a credit-rating downgrade.

The more immediate implications of the policy shift are a more hawkish-than-expected monetary policy, a weaker peso, higher inflation, and a gradual deceleration of economic activity, as private sector investment moderates. So long as the central bank operates with independence, any fiscal easing should be partly offset by tighter monetary policy, to ensure a more balanced policy mix. In this case, risk of excessive volatility in local financial markets should remain contained.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).