Mexico: Setting the stage for rate cuts

Inflation has, for two years now, forced Mexican policymakers to adopt a deeply hawkish monetary policy stance. But as inflation drops to the lowest level since 2016 this Thursday, amid persistent weakness in economic activity, the case for policy easing should strengthen. Our revised inflation path suggests rate cuts could start sooner than expected

Deceleration in economic activity increased the urgency of monetary easing …

The main highlight of the 4Q18 Quarterly Report released by the central bank last week was the sharp drop in the bank’s forecast for GDP growth. Banxico’s 2019 GDP growth forecast dropped 0.6ppt, and is now centered at 1.6%, in line with our own forecast. 2020 forecasts were lowered by 0.3ppt, centered at 2.2% now.

The adjustment follows disappointing results in a broad range of indicators in recent months, including industrial, retail and investment activities, unemployment and bank lending. It is also consistent with falling market expectations for economic activity, which intensified since the election of Lopez Obrador in last year’s Presidential election.

According to the central bank monthly survey, 2019 GDP growth forecasts dropped 70 basis points in the past 9 months, from 2.3% to 1.6% now.

Banxico also now estimates that the output gap (for the non-oil sector) has become negative and is going to continue to widen in the foreseeable future, as GDP growth remains below potential.

… which could gain traction amid a faster-than-expected drop in inflation

The central bank’s inflation forecasts have not changed much in recent months. Compared to the previous quarterly report, the most noticeable change is seen in the long-end of the forecasted range, 2H20, when inflation is now forecasted to drop below the 3% target.

The bank still expects the yearly inflation rate to re-enter the 2-4% targeted range in 3Q19, after trending slightly above 4% throughout 1H19. But the February inflation print to be released on Thursday could already show headline inflation at the 4.0% edge of that inflation-targeting range for the first time since December 2016, down from 4.4% in January. And our own forecast suggests that inflation could drop below 4% already in 2Q, increasing the risk of a sooner-than-expected improvement in inflation dynamics.

Inflation could be well-within the targeted range by the end of 2Q

The improvement in inflation trends reflect primarily falling non-core inflation, thanks to favourable base-effects and decelerating energy prices, although more recent downside surprises also reflect benign food price dynamics.

The fact that inflation expectations remain high is still a source of concern, but if inflation converges to the target throughout 2H19, as broadly expected, expectations should likewise improve somewhat later this year.

Timing the first rate cut

Overall, the perceived dovish shift in Banxico’s macro assessment is most evident in the deteriorating outlook for economic activity. Changes to the inflation outlook were minor, but this week’s CPI print should add a downside bias to near-term inflation trends.

Inflation has, for two years now, forced Mexican policymakers to adopt an increasingly hawkish monetary policy stance. As inflation concerns abate, arguments for Banxico to start considering rate cuts should become increasingly persuasive.

In fact, in our assessment, the yearly inflation rate is likely to re-enter the targeted range sooner than the central bank expects. If we are correct, this would increase the risk of a sooner-than-expected launch of the easing cycle, with a first 25 basis point cut possibly as early as at the June 27 policy meeting, and no later than 3Q, once inflation has firmly re-entered the targeted range.

How much easing can Banxico accommodate?

As we've discussed before, room for rate cuts is somewhat constrained. The neutral level for the nominal policy rate is likely close to 6%, but FX considerations will remain crucial in Banxico’s reaction function. As a result, a critical element in Banxico’s assessment of FX risks will be the level of Mexico’s interest rate differential with the US.

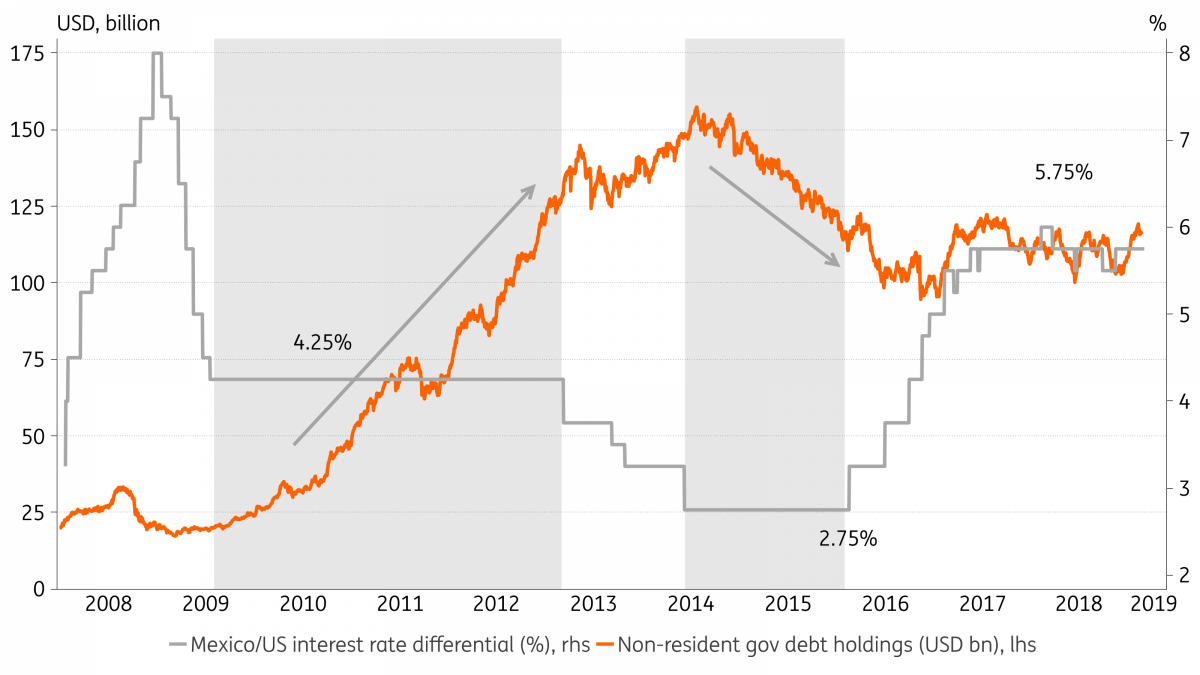

As seen in the chart below, Banxico increased that differential from a low of 2.75% to 5.75% now.

Banxico should remain sensitive to the US/Mexico rate differential, which is a crucial driver for FX dynamics

This relatively high differential has been in place for almost 2 years now, and we believe it has played a critical role in the stabilization of the MXN, keeping non-resident holdings in the local market fairly steady, over the past couple of years, as seen in the chart, during a period of heightened uncertainty north and south of the border.

It’s unclear if an “ideal” rate differential level exists. But, looking over the levels that prevailed over the past decade, two levels stand out to us. The first is 4.25%, which prevailed over a long stretch from 2009-13, and coincided with substantial foreign inflows and a largely stable peso.

The second is 2.75%, which prevailed from mid-2014 to early 2016 and was, arguably, seen as too small a differential that left the peso especially vulnerable, coinciding with substantial outflows and the subsequent FX sell-off.

As a result, in principle, we would expect Mexican officials to prefer to keep that rate differential in the 3.5%-4% range. And assuming that the US Fed should keep its overnight rate in the 2.5-2.75% range, we suspect the need to bolster FX stability should prevent Banxico from cutting rates below 6.5% over the next two years.

This compares with the curve pricing 42bp in cuts by yearend and another 30bp by the end of 2020. Analyst surveys show, meanwhile, a (declining) majority still expecting no cuts this year, with the first cut expected to take place in 1Q20.

Macro risks that could alter the start, the pace and the size of the easing cycle

Some of the risks that could force Banxico to proceed more cautiously and delay the first cut or slow down the pace of cuts include: 1) higher-than-expected inflation, 2) the return of a hawkish Fed, a non-negligible event that could trigger enough MXN weakness to interrupt the cycle, and, especially, 3) a faster-than-expected deterioration in Mexico’s (or PEMEX’s) fiscal accounts, which would increase the risk of sooner-than-expected credit rating downgrades.

Since Lopez Obrador took office, Fitch has announced a two-notch downgrade of PEMEX while S&P announced last Friday a downgrade in Mexico’s outlook to negative, from stable, while keeping the sovereign’s rating unchanged at BBB+. The agency singled out the deterioration in the growth outlook triggered by the policy resistance to private sector involvement in the energy sector and the rise in contingent liabilities resulting from the new policy directives.

S&P’s stance is now closely in line with Fitch’s (BBB+, with a negative outlook) while Moody’s remains the most optimistic of the three agencies, at A3, with a stable outlook.

Although not unexpected exactly, the news confirmed the deep scepticism towards the policy choices by the new administration, especially as it tries to boost the state presence in the economy, particularly in the energy sector, with predictably negative consequences for economic activity and the fiscal outlook.

Even though we believe a credit rating downgrade is likely, we don’t expect it to be immediate. The risk of rupture in market credibility in issues like fiscal prudence should take a bit longer to emerge. This is more a 2020 story, in our view.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).