Mexico: FX rally brings relief

A pause in the monetary tightening cycle is likely this week, while rate cuts may be considered later this year, but room for cuts are likely to be limited to about 100bp, over the next couple of years.

The most important development for financial markets in Mexico over the past month has been the considerable rally in the Mexican peso. The rally resulted, mostly, from the positive signs emanating from NAFTA negotiations, but it may also have benefited from investor focus on the highly attractive carry. Mexico’s high interest rate levels stand out particularly in relation to its peers in the region, such as Brazil and Colombia, where dovish monetary policy surprises have prevailed in recent weeks.

The stronger peso, coupled with inflation data that, albeit still high, has been more closely in line with expectations, should give central bankers enough breathing room to pause the hiking cycle at this week’s monetary policy meeting. After hiking the policy rate in each of the past two meetings, Banxico should keep it stable at 7.5% this week.

| 7.5% |

stable rate ... but divergence with regional peers continues to grow |

Looking beyond this week’s meeting, prospects for one additional hike in 2Q remain high, as officials may consider prudent to continue to support the peso by matching an eventual rate hike by the Fed, in June. This would be consistent with the assumption that FX volatility should rise ahead of the July 1 election.

Another rate hike could be avoided, however, if the peso surprises, relative to our base-case scenario, due to (1) the announcement of a preliminary NAFTA agreement in the coming weeks, a real possibility according to news reports citing sources close to the negotiations, while (2) lingering political uncertainties fail to weaken the peso towards the 19-20 range in the run-up to the elections. In that case, an alternative scenario would open up and allow Banxico to keep the policy rate unchanged at 7.5% until later in the year.

Not decoupling from the US Fed just yet

Much has been made about the idea that Banxico would be finally “decoupling” from the Fed if it opts not to hike this week. But that’s not the best way to characterize the decision, in our opinion. Banxico officials still care deeply about Fed decisions and the interest-rate differential between the US and Mexico remains a crucial variable to assess FX risks in Banxico’s policy reaction function.

But, specifically regarding next week’s meeting, the bank has decided to frame its latest hike, in February, as a pre-emptive move that took into account the subsequent Fed hike, in March. In fact, since June 2017, the Fed hiked three times, exactly the same as Banxico so far.

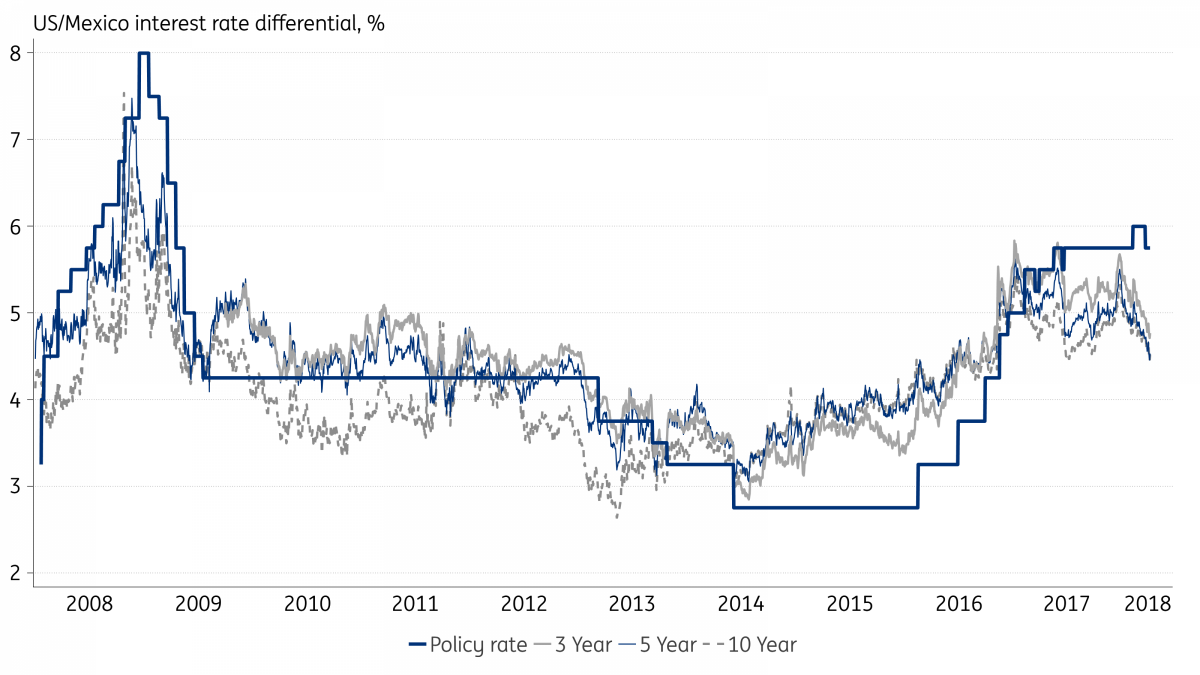

As a result, apart from brief periods in-between meetings, the US/Mexico interest rate differential has remained unchanged, at 5.75%, for almost one year now. Hiking this week would increase that differential to 6.0%, until at least mid-June 2017. And, given how well-behaved FX dynamics have been, an increase in the interest rate differential would be seen as unwarranted.

A rate differential with the US of 5.75% has prevailed for almost one year

Rate cuts are just a matter of time, but room for cuts is limited to about 100bp

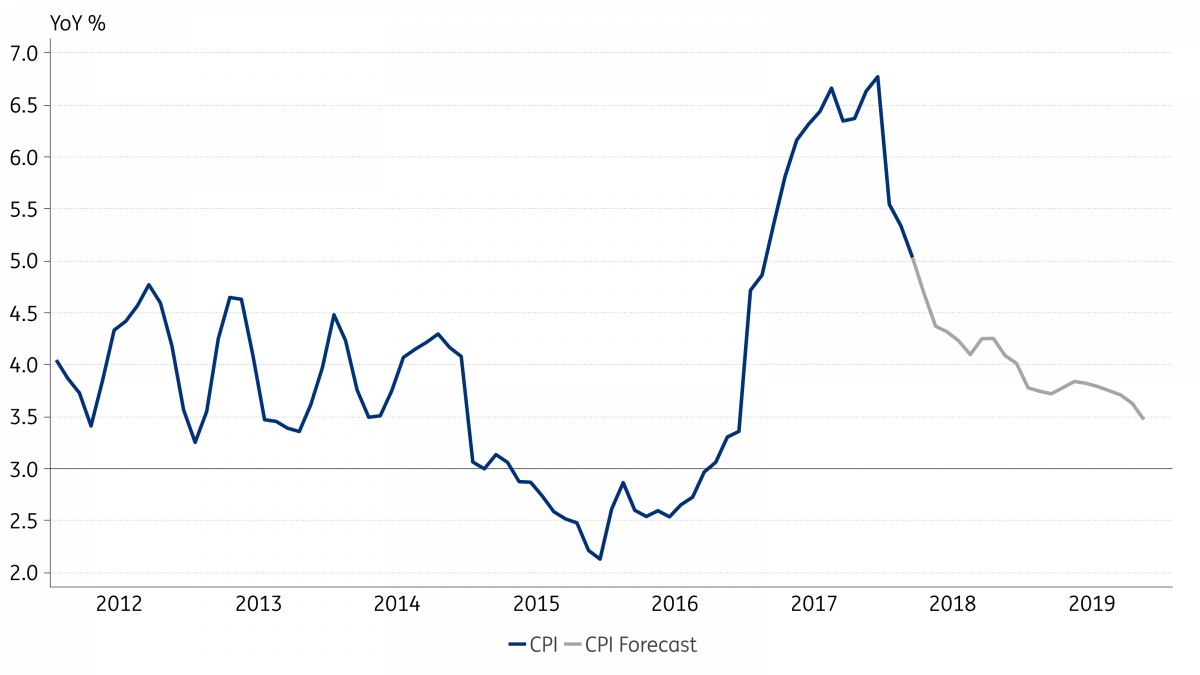

Yearly inflation (5.0%) is unlikely to re-enter the targeted range of 2-4% until early next year. But as the ongoing disinflation process takes hold throughout the second half of the year, the arguments for Banxico to start considering rate cuts should gain traction. The basic assumption would be that, at 7.5%, monetary policy is restrictive and, with inflation concerns easing, monetary policy should shift towards a more neutral stance.

A policy rate at around 6% would be closer to neutral ...

Room for cuts is relatively limited however. As Banxico governor Alejandro Diaz de Leon emphasized recently, Mexico’s real interest rate “isn’t far above” its neutral level. Officials estimate that the neutral range is centred on 2.5% (1.7-3.3% range), which compares with current levels near 3.5% (ex-ante). As a result, assuming that inflation expectations (12-months) converge to 3.5% in coming quarters, down from close to 4% now, the neutral level for the nominal policy rate should be seen as close to 6%, or 150bp lower than current levels.

But apart from inflation and economic cycle considerations, another crucial variable for Banxico to determine how much to cut the policy rate will be its FX outlook assessment. In particular, a stable/strong peso, presumably resulting from a favourable resolution of lingering political/NAFTA-related challenges, would greatly improve prospects for rate cuts.

... but the need to bolster FX stability suggests a policy rate closer to 6.5%

Alternatively, persistent FX risks would call for caution, delaying the easing cycle. And, as usual, a critical element in Banxico’s assessment of FX risks will be the level of Mexico’s interest rate differential with the US. It’s unclear if an “ideal” rate differential level exists. But, looking over the levels that prevailed over the past decade, two levels stand out to us. The first is 4.25%, which prevailed over a long stretch from 2009-13, and coincided with a largely stable peso. The second is 2.75%, which prevailed from mid-2014 to early 2016 and was, arguably, seen is too small a differential, one that left the peso especially vulnerable to the subsequent sell-off that took place.

Other factors, particularly domestic economic cycle considerations, may eventually weigh more heavily on the bank’s reaction function. But, in principle, we would expect officials to prefer to keep that rate differential in the 3.5%-4% range. And assuming that the US Fed should aim to hike its overnight rate towards 3%, we suspect the need to bolster FX stability should prevent Banxico from cutting rates below 6.5%, ie, by more than 100bp from current levels, over the next two years.

The overall conclusion, for us, is that even though rate cuts may be considered later in the year or early in 2019, policymakers should be in no rush to provide monetary stimulus. Moreover, room for cuts are likely to be limited to about 100bp, from current levels, in our view.

This relatively cautious stance would also be consistent with the fact that, despite the relatively lukewarm activity indicators, policymakers estimate the output gap to be close to zero, with “the economy operating near its potential”, while the unemployment rate continues to trend around full-employment levels.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).