Mexico: Another rate hike this week

And the balance of risks is tilted towards more rate hikes than currently expected, during 1H18

Risk of a more frontloaded Fed hiking cycle should keep Banxico on a tightening path, beyond this week's meeting. In fact, given the focus on monetary policy synchronicity with the US, the risk is that Banxico opts for more hikes than currently expected. Policy guidance should turn progressively less hawkish, as inflation comes down, and if FX concerns ease somewhat, amid signs that NAFTA negotiations should be delayed. But an attempt to decouple from the Fed may not happen ahead of the July election.

Banxico should keep the door open for additional rate hikes

Mexico’s central bank (Banxico) should continue to diverge from the other regional central banks and extend the rate hiking cycle with another 25bp hike on Thursday, bringing the policy rate to 7.5%.

This would be in line with the more hawkish policy guidance adopted ahead of the December meeting, which marked the resumption of the hiking cycle and concluded with the dissenting opinion from a board member that voted for a larger 50bp rate increase. Authorities justified their decision by highlighting the persistent inflation challenges resulting from the price shocks seen throughout 2017, along with the highly uncertain backdrop for 2018, marked by NAFTA negotiations and local elections.

| 7.50% |

New rate hike to accentuate divergence with regional peers |

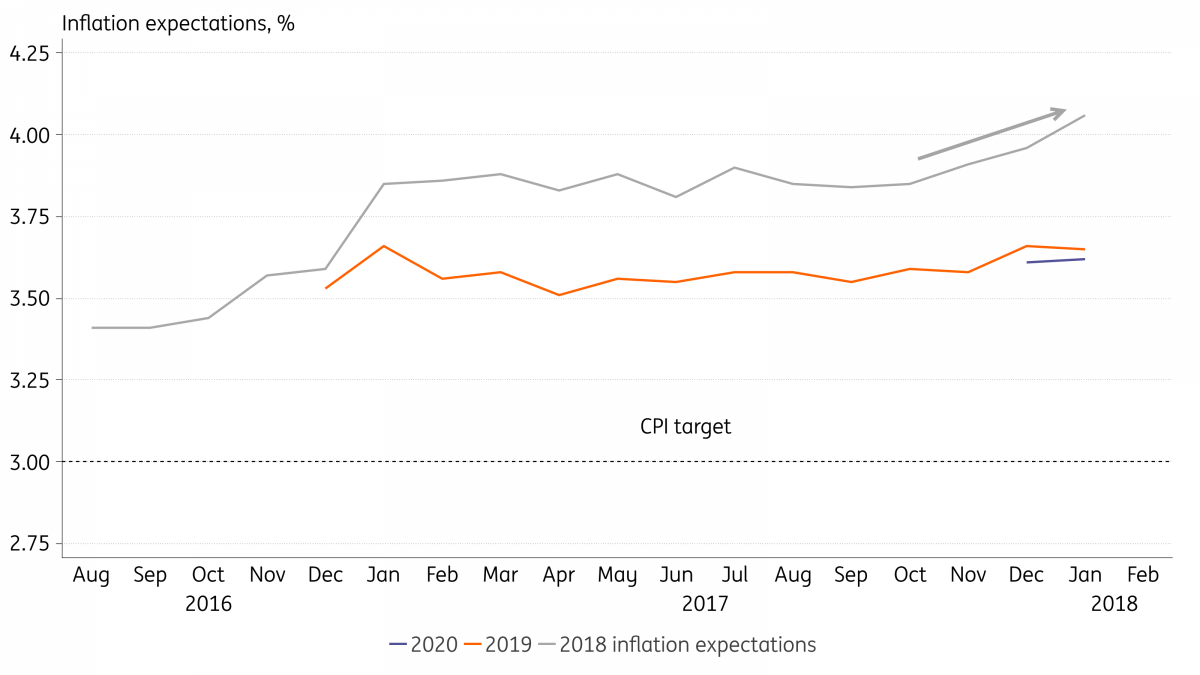

But perhaps the primary reason to follow through with a hike this week, which would be the first time since May that a Banxico hike does not coincide with a Fed hike, is the recent rise in inflation expectations. In particular, Banxico's own survey showed that market expectations for 2018 inflation are no longer anchored, having risen over the past couple of months to 4.1%, ie, above the targeted range. This marks an important contrast with the official central bank view that inflation will end 2018 near 3%; and should leave Banxico no choice but to match market expectations and hike this week.

Inflation expectations surged above the targeted range for 2018

Inflation data for January, to be announced hours before the meeting, is unlikely to impact the central bank's decision this week, but it should help guide market expectations for future policy decisions. The release should confirm a sharp drop in the yearly CPI rate, thanks to the favourable base-effect resulting from the one-off fuel price adjustment in January 2017. As a result, in YoY terms, inflation should fall about 1.2ppts, from 6.8% in December to 5.6% in January.

Confirmation of a low January CPI print should help stabilize inflation expectations especially if the drop is broad-based, including services and core components, ie, beyond the widely expected drop in fuel. But prospects for a quicker convergence to the target should remain limited. As indicated by the consensus survey, the yearly inflation rate should re-enter the targeted range (ie, 2-4%) only next year.

Benign base-effects should help reduce headline inflation by more than 2.5ppts this year but it should remain uncomfortably high due to several factors including stretched labour market conditions, trending around full employment, the unfavourable inertia/indexation pressures, and the inexistence of a clear output gap, as evidenced by the relatively upbeat 4Q GDP report.

FX and the FOMC decisions are key drivers for future rate decisions

Apart from near-term inflation data, FX and US Fed decisions also rank very high in Banxico’s decision-making process, and should remain critical factors that will help determine if the bank will follow through with additional hikes in its upcoming meetings, scheduled for April 12, May 17 and June 21. In particular, the higher risk of a more frontloaded monetary normalization in the US has added material upside risk to the near-term policy-rate trajectory in Mexico.

a more frontloaded monetary normalization in the US would add material upside risk to the near-term policy-rate trajectory in Mexico.

The prevailing view within Banxico regarding the need to maintain monetary policy synchronicity with the US has fluctuated over the past year. After matching a Fed hike in the June 2017 meeting, bank officials indicated a willingness to decouple from the Fed, presumably because the aggressive frontloading in Mexico (400bp in hikes vs 100bp in the US) would provide sufficient room to manoeuvre for Mexico to conduct monetary policy independently from the US. At that meeting, Banxico signalled that change by altering its reaction function guidance, downgrading its sensitivity to US rate hikes from second to third, ranking the FX pass-through and the output gap ahead of Fed moves.

The issue was never settled among board members however, and at the November meeting, Banxico once again altered the ranking order in its reaction function guidance, with US rate decisions being upgraded from third to first. This ranking order was kept in December.

In principle, even though Banxico has hiked much more aggressively than the Fed, the bank's operating assumption is probably that it is still important to match any Fed hikes, in an effort to limit FX market vulnerabilities, given the still-challenging short-term inflation and FX outlook. A preference to err on the side of caution would lead policymakers to postpone the eventual decoupling to 2H18, after election-related risks no longer pose a major threat to the stability of local financial markets.

As a result, if the US Fed hikes twice during the first half of the year, a higher-likelihood scenario following last week’s US labour market data, the April and June meetings would be strong candidates for future rate hikes by Banxico.

potential for decoupling from the Fed may not happen until electoral risks dissipate, after the July 1 election

This would imply a higher risk of more rate hikes than is currently expected for 1H18. Moreover, a substantial fall in yields resulting from a decisive shift in policy guidance, emphasizing the potential for decoupling from the Fed, may not happen until electoral risks dissipate, after the July 1 election.

Outlook for the peso has improved, but is still skewed towards weakness during 1H

Rate hikes could be avoided if the peso surprises, relative to our base-case scenario, and strengthens materially in the coming months. Banxico lists the FX pass-through as the second most important driver for policy decisions, and the likely postponement of the deadline for the conclusion of NAFTA negotiations should be supportive of the MXN as it would show that a negotiated compromise is still seen as viable, sharply reducing the likelihood of an imminent US pull-out from the negotiations.

we still expect the peso to weaken, but it should follow a slightly stronger trajectory than we had previously expected

Overall, the balance of risks still point to a weaker currency in the coming months but, as NAFTA worries move to the backburner, FX catalysts should turn increasingly to politics and economic fundamentals. In particular, investors should focus on the risk of a victory by left-leaning candidate Lopez Obrador (AMLO) on July 1, and what that would mean for the outlook for energy sector policies. Still, assuming NAFTA-related headline risk dissipates, at least for now, we expect the peso to follow a slightly stronger trajectory than we had previously expected (ie, rising towards 20 instead of 21-22), even if AMLO maintains his leadership in the polls.

After the July 1 Presidential election, and assuming a market-friendly result in the presidential race, or the announcement of a market-friendly economic plan by AMLO, the currency could gradually retrace back towards its medium-term fair-value. That value would be closer to 18 if NAFTA survives and closer to 20 if the treaty is abandoned.

The stronger peso, and the more comfortable inflationary path expected for 2H18 should meanwhile pave the way for Banxico to start considering rate cuts, later in the year. But prospects for continued hikes by the Fed should keep Banxico cautious and limit the scope of any monetary easing cycle in the foreseeable future.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).