Metals take a hit but aluminium is clueless on tariffs

Base metals suffered losses last week as a slowdown in Chinese manufacturing deflated expectations and the US dollar rose. Although US premiums have surged on section 232, the LME aluminium price traded sideways with markets confused on the global effects. We lean towards a bullish stance

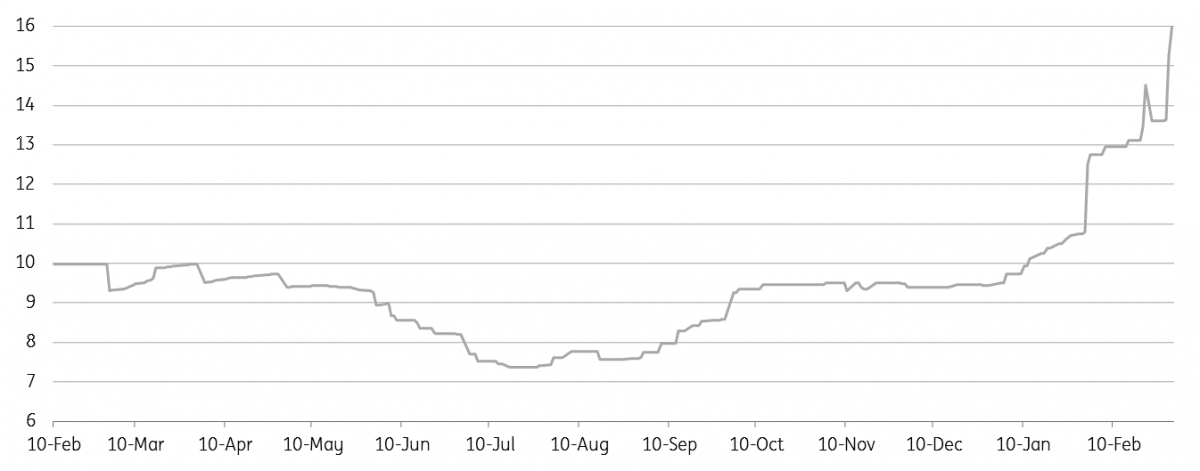

Aluminium premiums surge on section 232

US premiums have surged to 16¢/lb with the CME forward curve pricing in 17¢/lb by the end of the year. On Thursday, President Trump announced he would indeed be imposing a 10% duty on aluminium imports (all types: products and primary). It is worth remembering that prior to the commerce report, the market was largely just expecting duties on fabricated products and perhaps only just those from China. Duties will now clearly be applied more broadly but the all-important details on Canada are still unknown. Canada supplies over 50% of the US imports, with the potential to fill 70%.

Premiums are up 60% year-to-date and whilst a 10% duty supposes around a 10¢/lb premium increase (if Canada is not exempt) it is worth remembering that the market has been pricing in a duty effect for some time. Still, even if we assume around half of the original 7.7% proposed duty was priced as we crossed 13¢/lb, then premiums still have 3-4¢/lb further to run with 20¢/lb in sight.

As the dust settles in months to come, we could well see US premiums come in from these highs. A near-term sell-off could come if Canada gained an exemption but further out it will be important to track developments in freight rates. A bottleneck in trucking drove much of the earlier increase in the premium with Truckstop data showing Midwest rates are up 31% year-on-year. As new rules on electronic logging become commonplace and capacity is added to trucking fleets, premiums can only ease. We also expect more tight backwardations on the LME, which could pressure any customs cleared stockpiles to be sold off into the domestic market. A move which will be all the more tempting at the higher premiums.

CME premiums pricing 16c/lb for March

Knock on to the LME

Whilst premiums rallied, the LME has traded sideways, with the market seemingly confused as to whether the duties are bullish or bearish for the LME price. We see points on both sides but lean towards a bullish stance at least in the near-term.

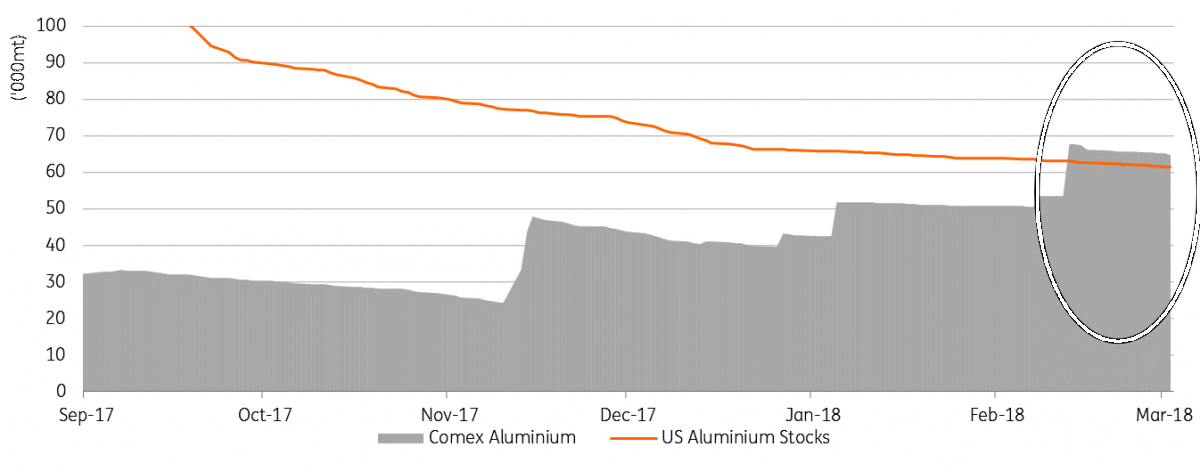

- First, it’s worth remembering that the LME price is a 'duty unpaid' contract with all registered warehouses in free trade zones. Our near-term bullish view is that traders are already racing to move stocks through customs ahead of the duties. We can already see how the Comex (customs cleared) sheds for aluminium have jumped to 65kt, which is now even greater than LME US stocks. Once the stock is customs cleared it's not coming back.The earnable premium renders it extremely unlikely to be delivered on to exchange. The stock flow from Europe and Asia is already leading to a notch up in global premia, which will support LME prices.

- Next, isolating customs cleared stock from the exchange could set the stage for greater LME tightness which is price supportive.

- We also think trade protectionism is likely to keep more of the Chinese surplus stuck behind its borders. Read: For once it’s not all about China.

The race to ship stock has been on for a while but now timing will be everything. We have heard it could take up to 60 days to cancel, ship and customs clear stocks from LME Asian sheds which might prove too risky. Mike Bless of Century had estimated 0.5Mt might already be on the move west from both Europe and Asia. Further shipments will likely await more guidance from the White House but more US free-trade stock is still likely to move.

The bear case is whether high US premiums escalate the unwinding of off-warrant stocks in the US. These could displace imports and loosen the balance outside of the US. We already expected US smelters to begin restarting and forecast a 1.7MT ex-China deficit this year. But this can become a 300kt ex-China & US surplus should an estimated 2Mt off-warrant US stocks offset imports. We can already see that financing profits have been eroded through tighter LME spreads so that high local premiums will prove tempting. We place a lower probability on this right now because financed stocks have proved extremely sticky to date and how much is customs cleared is unknown.

CME aluminium stocks reflect the rush to customs clear stock

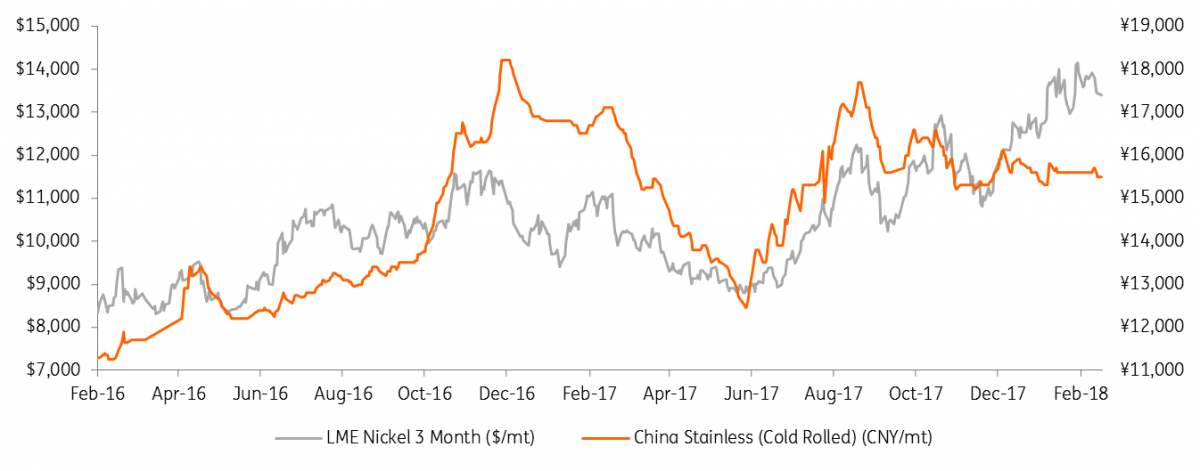

Nickel: Stainless feels the squeeze

Nickel, along with tin, are the only metals that have held on to gains this year but whilst prices are up 24% since December we remain concerned that stainless steel prices in China have barely budged. Producers are failing to pass higher costs on to the consumers who appear well stocked. On Friday, the Shanghai Metals Market reported the first victim, a major stainless steel plant in the south will cut 65% of its 304 series output (2% of China’s total). We would reinforce that for all the EV exuberance, batteries are still a minor part of demand (<5%) and stainless clearly drove the market through last year. Stainless output grew 7.5% in the first nine months last year following a 10% surge the year before and is likely to be considerably slower this year.

Nickel is inherently volatile and especially so since the Shanghai Futures Exchange contract opened the door to retail speculators. High volumes and high open interest pushed prices to their recent highs and could yet be vulnerable to liquidation hence our lower forecasts for the year. At the higher prices, the premium in domestic spot markets has been eroded which we take as evidence that the paper markets are inflated. SMM reports Norilsk cathodes now trade at a discount to the SHFE price.

According to media reports, the Philippines will this month look to publish the review of miners' appeal against suspensions for mining in watershed areas. Delays were common when the bans were proposed last year so we will not hold our breath. The Mines and Geosciences Bureau (MGB) reported that 2017 nickel ore production dropped 6% which is close to the drop in Chinese imports but the USGS estimates a far more severe drop of 34%. According to the MGB, 13 out of 30 mines had no output last year so we see room for output to increase. Given the expected rise in domestic Indonesian NPI production (2018F: 260kt) and export permits (now near 27Mt) we think the Philippines developments will take a back seat to market sentiment.

Stainless yet to pass on higher nickel

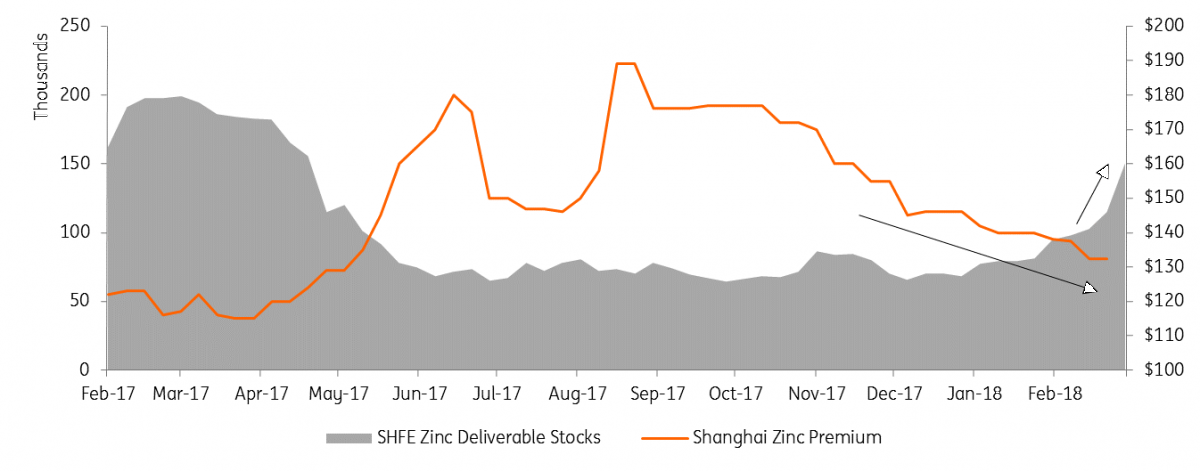

Zinc: LME tightness has been exaggerated

Zinc prices have weakened since Chinese markets re-opened and further evidence showed that markets inside China are considerably less tight than spreads and stocks on the LME had been suggesting. Today’s 77kt delivery into the LME and weaker spreads show the tension within the western bourse might be finally letting up.

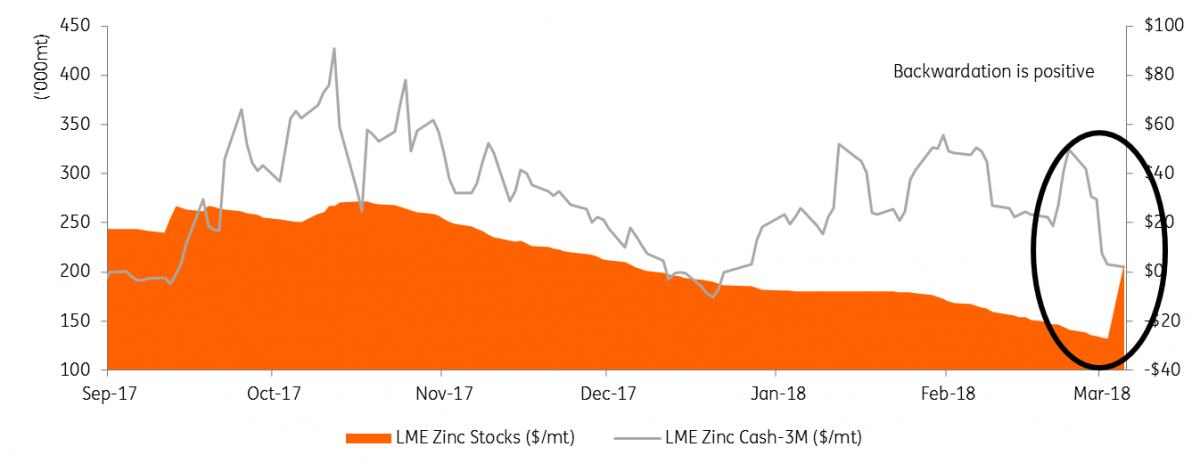

SMM reported that social/exchange stocks rose a hefty 45kt over the new year and SHFE stocks alone are up another 36kt since. January imports were up three-fold YoY, which clearly ran ahead of demand needs even though they were down 34% on December. Metal Bulletin also reports that premiums in China are down 32% since August and the import arbitrage has been closed since December. Meanwhile, LME stocks have drawn another 38kt through February and the Cash-3M averaged a $35 backwardation. We think the tightness on the exchange has been somewhat exaggerated since stable western premia suggest supplies are still flowing and today's delivery demonstrates off-warrant stocks remain high. The sell-off last week saw zinc spreads retreat to just a $3 backwardation which if maintained could encourage fresh shorts.

An easing in concentrate supplies this year forms our view that zinc prices are likely to peak in H1 and tension is high for news of the annual TC/RC benchmarks (treatment and refining charges). The IZA conference in mid-Feb has passed without any deal yet announced. Nyrstar's CEO Hilmar Rode reported that he expects TC’s to rise this year as concentrate supply grows but miners are also pushing for big drops since spot rates were so far below the benchmark last year. MB sees spot TC’s in China at just $20/dmt compared to a 2017 benchmark of $172/dmt.

Potentially easing the concentrate tightness near-term, an indefinite strike has been called at Nexa Resources’ Cajamarquilla zinc smelter (313kt in 2016), the fifth largest outside of China. The company will act to reduce production losses but 2018 will be a key test for looser concentrates ability to impact refined markets and developments here could prove key to watch. The International Lead & Zinc Study Group has reported the 2017 refined deficit at 495kt and in October forecast a more than 220kt shortage for this year, even as mined output increases by c800kt.

China zinc market been looking loose for a while

LME zinc spreads eased even before the sharp delivery

Lead's discount to zinc hit fresh highs

Lead prices continue to underperform sister metal zinc with the ratio last week coming close to 1.4x for the first time since 2007. Lead prices are down 1.5% year-to-date whilst zinc is still in the green. Looser spreads explain the latest divergence with the lead Cash-3M closing at a $5.75 contango on Friday compared to a $7 backwardation just one week before. Driving the shift was a sizeable 22kt increase in LME stocks. Zinc spreads also softened considerably but unlike lead remain in backwardation. Todays LME zinc delivery has seen the ratio fall back to 1.36x.

Chinese lead imports were an insignificant 40kt in January ending the 12 months of volatile imports as SHFE prices are now trading back at a discount to LME. Participants hoping for a pick-up in Chinese activity may yet be disappointed following news that automotive battery producers in Hebei have been required to cut 30% of production as part of pollution controls.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 March 2018

Trade war: What is it good for? This bundle contains 4 Articles