Metals: You’ve got to roll with it

Metals have been hit hard by escalating trade wars and the perceived risks to global growth and demand. Amid the macro gloom, it’s hard to see what can provide a firm near-term floor but we do think some over-zealous shorting will be squeezed by sharp backwardations approaching

Impending tightness between July-August

Aluminium and zinc are fast approaching sharp rolls between the July-August prompts on the LME that will be costly for any near-term short positions to roll. Traders should be on the look-out for how this impending tightness could drive outright prices higher by causing shorts to exit. From thereon, however, to entice a return of long allocations will depend on the global trade-war sentiment. ING economists think that at least the direct impacts on growth/metal demand are limited and that a deal is probably going to be sought after the US mid-terms, but it’s increasingly becoming the indirect effects to business sentiment that are most risky.

In LME metals, spreads between the futures dates have the proven ability to direct prices and especially as key expiries approach. It is important to remember that in a backwardation rolling a short position forward position is costly (buying the nearby is higher than selling the further out). Many commentators focus on the Cash-3 month (Cash-3M) LME spread. This is the price difference between historically the most defined closing prices but it actually tells us little about the real cost for traders to roll long/short positions in the market. In actual fact, most positions (over 2/3rds of open interest) sit on the LME’s regular monthly contracts (3rd Wednesdays) and so most positions are rolled between those dates.

With the July month contract soon to expire (18th July with the last full day of trading on Monday 16th), those still short the contract will be facing costs to roll the short position forward. If they choose to instead just square out their position (buy nearby without also selling further out) that is likely to bring some much needed positive momentum to these markets. The 288 kt equivalent shorts of July Zinc, 428kt of July copper are actually fairly in line at this stage ahead of the expiry, but the 1.6Mt of Aluminium July shorts, that are going down to the wire before rolling, are looking very high making it the most tense of rolls with the most short-squeezing potential.

Aluminium: Immense tightness looms

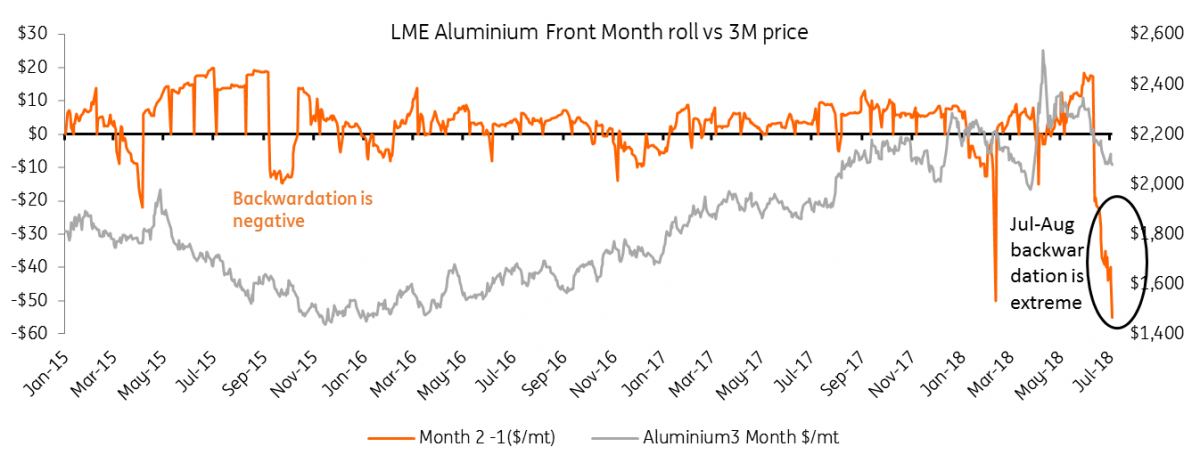

It’s been our conviction for a while that in a world of lower LME stocks (vs off-warrant levels) sharp monthly rolls in Aluminium are becoming more commonplace and are actually responsible for a good deal of the rally since 2015. (Read: It's not all about China).

The situation escalated as premiums get higher and provide the opposite incentive for metal to be bought and sold into the physical market rather than delivered on the LME. US premiums are now at 20c/lb effectively walling off any customs cleared material from being profitably delivered into the exchange. Other regional premiums, such as in Europe, have corrected ($84/mt down from $158/mt peak) and even where the forward curve on CME expects a decrease (assuming Rusal sanctions get lifted) premiums are still likely to remain higher than incentives offered by warehouses for metal to be delivered. These incentives have dropped considerably since queues at the LME warehouse were resolved and so we think its the new normal for the market to trend towards deep pockets of backwardations in an attempt to attract deliveries to the exchange.

For whatever the structural drivers of the sharp rolls, the July-August backwardation is particularly immense: $50b (b=backwardation) and counting. It's now even surpassed the sharp spasm that occurred through February-March. Short holders who have stocks may well find this situation compelling to unwind any stocks in financing and deliver (even against high premiums) into the exchange, but likely we are also due for a substantial amount of shorts to simply buy out their position and exit the market. Given the high amount of July LME Aluminium positions outstanding (1.6 million tonnes= 62k lots) aluminium may well get the most upward support from the roll as shorts feel the squeeze.

Aluminium's erratic rolls hit new extremes for July-August backwardation

Zinc: Spreads eased but still in backwardation

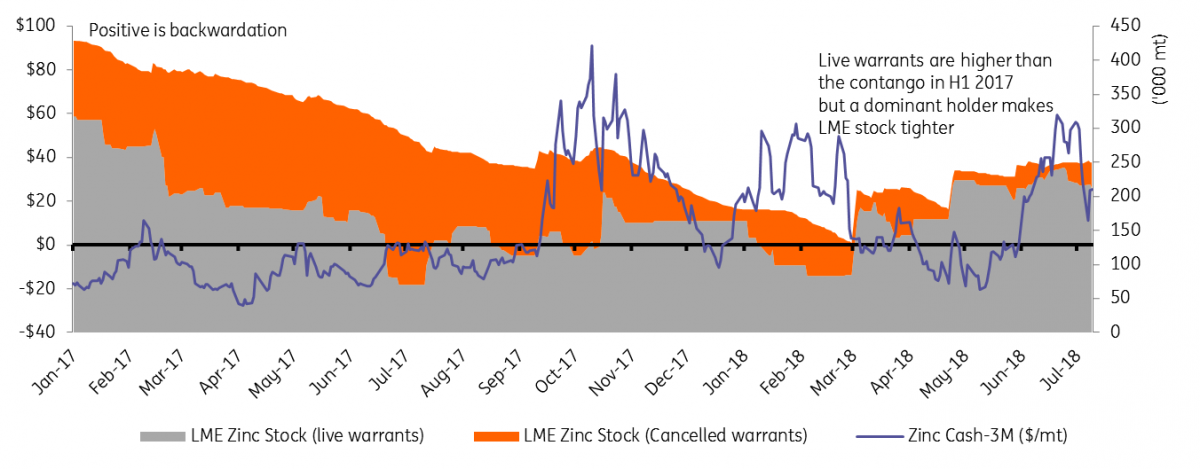

We warned of a short-term bear trap from zinc spreads when the Cash-3M surged in June but it hasn’t deterred the huge sell-off since: (-20% since the G7 summit). Shorts may well have increased confidence as this spread eased from a high of $55b to a low of $11b on Monday 9th. The more significant July-August still remains at a substantial $22.25b, however, which would pose a big sting to the front month shorts still waiting to roll.

We think much of zinc’s downfall this year has been the sheer availability of stocks on the LME. Not just have the stock levels increased but the very high proportion of those stocks on live warrants (only 14% are cancelled) has reflected a situation of high stock churn and associated spread lenders. That eased-zinc tightness certainly prevented what many saw as a last squeeze higher above $3k. Through June though, long positions have expired into stock holdings and a single party now holds 50-79% of the LME stocks, LME data shows. The LME Lending Rules prevent a squeeze at the shortest term rolls (tom/next: 1-day rolls) but the influence to the other monthly dates can certainly be felt. Since June the July contract zinc price is down 0.5% less than the 3-month price as near-term supplies/stocks become centralised.

Zinc open interest is up 7% since June, reflecting a wave of new short positions that are being added to ride the sell-off. Whilst these positions are being made out further than the July-August tightness it is still likely that if the dominant stockholder remains in place this tightness will continue and could eventually catch those positions. Whilst we respect that zinc concentrate supply is easing significantly this year, the refined zinc metal market remains in deficit (ILZSG expect a 263kt shortage). Given this, we see no reason why a sizeable cancellation of LME stock to fill the shortfall could not occur and, in turn, maintain the backwardation. Zinc’s bull run from a shortage of mine supply is surely ending but shorts need to be cautious to navigate around this squeeze.

LME Zinc stocks have been highly available, but it can quickly change

Copper: A short lived backwardation

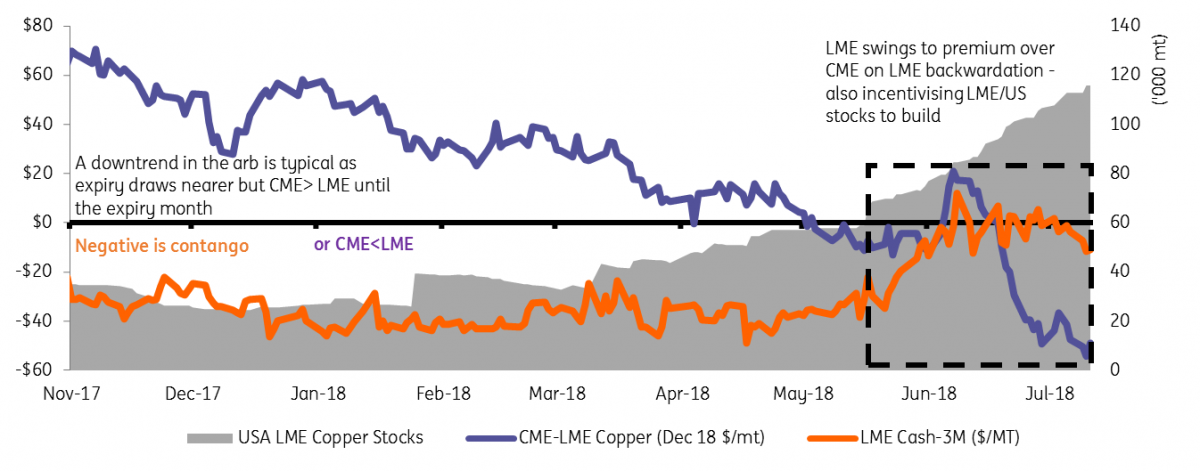

We don’t think Copper’s run to $7,300 was fundamentally justified and put that move down to a technical backwardation in the spreads (read: Copper goes back to a back). Prices had peaked alongside the Cash-3M which hit a backwardation of $12/mt before retreating and has now flipped back to a contango.

Once again looking at the monthly rolls tells us more about the strain on the shorts. June-July had peaked at a sizeable $10.50b and it was as June expired the curve flipped back to contango. It was the roll past June that seemed to set the Cash-3m to flip back to contango. July-August did get as tight as $16b at the beginning of July but that ha retreated considerably since.

Like zinc, in copper we focus on the dominant stockholder to explain. This we believe drove the spreads to tighten through July. The dominant holdings have now retreated from 50-79% of LME (un-cancelled) stock in mid- June to the 40-49% banding currently.

Also amid a considerably lower premium environment than the likes of aluminium (especially as Asian premiums drop) copper spreads need not be so tight to incentivise delivery into the exchange. The spreads haven't yet materialised into any big deliveries in Asia where the premiums are weakest but there has been some previously cancelled stock being put back on warrant. The ratio of cancelled-to-warranted LME Copper stock in Asia has gone from a 9 month high of 0.77:1 at the end of June to 0.43:1 currently.

In fact, the only place the backwardation is visibly drawing stocks into the LME is in the US. Reinforcing our view that the LME’s backwardation has been temporary and technical (vs. fundamental), the CME has actually remained in a wide contango (along with SHFE). The divergent curve structure and the squeeze on the LME shorts have seen LME prices recently outperform CME. The CME copper price for December 18 was at a slight premium to the LME until May when the LME backwardation began to surface. Since the 2nd half of June, however, the LME has gone to having around a $40 premium compared to CME. That LME premium to CME would only normally happen in the expiry month (December).

Some traders have therefore profited from the CME discount by delivering copper into the LME. Comex stocks have only drawn slightly though since most are fairly isolated in Utah and freight costs around the US remain very high. It's those same freight costs that are also supporting US copper premiums and, in turn, provides competition for the copper to be sold physical material vs. the exchange.

LME Copper backwardation drove premium to CME and incentivised US stock build

Download

Download article

11 July 2018

In case you missed it: The trade war is on This bundle contains 6 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).